DIRECT TAX

Circulars/Notifications/Press Release

CBDT notifies "specified bank" u/s 194P for TDS on "specified senior citizen"

A new provision was introduced in Finance Act 2021, in which, the exemption to file income tax return is provided to senior citizens having attained the age of 75 years or more and having income from pension and interest from the same bank. Accordingly, CBDT has notified specified Bank to mean a banking company which is a scheduled bank and has been appointed as agents of Reserve Bank of India under section 45 of the Reserve Bank of India Act, 1934.

CBDT issues clarification with regard to setoff and carry forward of losses on account of strategic disivestment

To make disinvestment schemes more attractive CBDT clarified that as a part of strategic disinvestment, where a Public Sector Undertaking (PSU) ceases to be a PSU as a result of amalgamation with one or more other companies then, subject to conditions specified, the accumulated loss and the unabsorbed depreciation of amalgamating company shall be deemed to be that of amalgamated company for the previous year in which amalgamation was effected.

CBDT extends time limit to Intimate PAN – Aadhar Linkage

Time limit for intimation of PAN-Aadhaar linkage from 30 September 2021 to 31 March 2022.

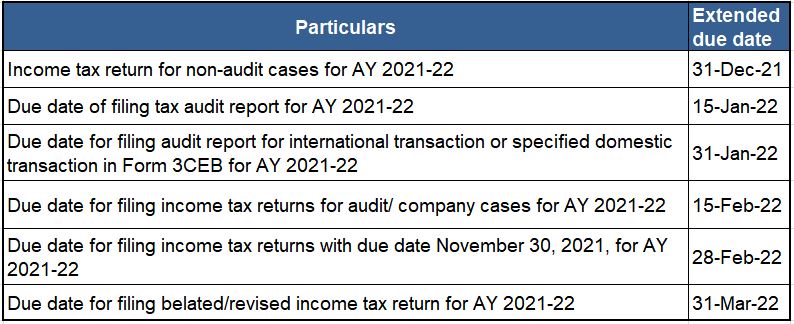

CBDT extends various the due dates for the assessment year (AY) 2021-22

CBDT has extended the due dates for the assessment year (AY) 2021-22 as below:

Further CBDT also clarified that the taxpayers having self assessment tax liability exceeding INR 1 lakh, the whole of the self assessment tax shall be paid by the due dates specified in the Income Tax Act, 1961 (“the Act” )and delayed amount would attract interest under Section 234A of the Act.

Furthermore, the tax paid by the senior citizen who is resident in India and not having any income chargeable under the head “ profit and gains of business or profession” within the original due dates shall be deemed to be considered as Advance tax.

Case Laws

Tamil Nadu Road Development Co. Ltd

- In a recent judgement, the Madras High Court held that an Assessee who was engaged in improvement and development of roads can claim depreciation on roads at rate applicable to building.

- The Appellant in this case was engaged in improvement and development of roads and had claimed deprecation on the roads developed at the rate applicable to plant and machinery. The Assessing Officer disallowed the claim of depreciation on the ground that the Appellant was not eligible to claim deprecation. The Madras HC placing reliance on the other judgements held that as the Assessee had invested in the project of construction and maintenance of highways and shall be eligible to claim depreciation at the rate applicable to building as building includes roads as per the appendix prescribing rate of deprecation.

Tata Securities Limited

- In this case, the ITAT held that an Assessee can be given the benefit of allowance of the provision for payment of gratuity even if it is unapproved.

- During the verification of Tax audit report, the Assessing Officer had disallowed provision for payment of gratuity on the grounds that the fund was unapproved. The Assessee contented that a prior application was filed before the Commissioner of Income tax (CIT) for the approval of gratuity scheme, but no intimation was received form CIT till date and the Assessee also alleged that the Assessing Officer while assessing the income of previous years had not raised any objection on the said grounds. ITAT placing its reliance on other judgements held that since the fund was created for the exclusive benefit of employees and also, Assessee is not having any control over it being an irrevocable trust, no disallowance can be made even if application seeking approval is pending before the Competent Authority.

Michael E Desa

- In this case, the Assessee has reported Long Term Capital Gains (LTCG) on sale of property and reported Long Term Capital Loss (LTCL) on sale of shares. However, the Assessing officer had rejected the set off of LTCL against LTCG alleging that the loss was prima facie fictitious and premeditated and was created to avoid the tax liability on LTCG on sale of property.

- Mumbai ITAT has held that “It is not for the Assessing Officer to take a call on how should an Assessee organize his fiscal affairs so as to serve the interests of the revenue authorities and concluded that this transaction may be tax-motivated, but that factor does not, by itself, render the transaction a sham transaction or a colourable device”.

Mitsubishi Corporation & Others

- Assessee is a non-resident and revenue had held that a portion of the Assessee’ s income was attributable to its activities in India and thus, held it liable to tax in India along with the interest u/s 234B.

- Supreme Court holds , “The liability for payment of interest as provided in Section 234B is for default in payment of advance tax. While the definition of “assessed tax” under Section 234B pertains to tax deducted or collected at source, the pre-conditions of Section 234B, viz. liability to pay advance tax and non-payment or short payment of such tax, have to be satisfied, after which interest can be levied taking into account the assessed tax. Therefore, Section 209 of the Act which relates to the computation of advance tax payable by the Assessee cannot be ignored while construing the contents of Section 234B.”; Also holds that Revenue is not remediless and can proceed against the payer who has defaulted in deducting tax at source.

Rajat Bhandari

- In this case, the Assessee sold long-term asset and purchased a farm-house. The Assessee availed capital gains exemption under 54F which was rejected by the Assessing Officer based on the allegation that assessee had bought and sold 2 residential properties in between the sale of the long-term asset and purchase of farm-house. The Assessing Officer further held that farm-house was akin to a ‘farm’ and could not be construed as ‘residential’ in nature.

- ITAT dismissed the Assessing Officer’s allegation of purchase of 2 interim properties sans material evidence. Further held that burden of proof of nature of property lies on Assessing Officer and accepted farm-house as residential in nature. Also ruled on nature of expenses incurred by Assessee through credit card on behalf of the employer as ‘reimbursement’ and not income of the Assessee.

Chander Arjandas Manwani

- In this case, Assessee filed tax-return and the same was selected for scrutiny. Assessee then received first show-cause notice which was responded to with a plea for a personal hearing. Second show-cause notice was received, and the Assessee again responded to the same with another plea for a personal hearing.

- However, assessment order was passed without grant of personal hearing and without going into Assessee’ s submission. Aggrieved, assessee filed writ before Mumbai HC.

- HC held that SCNs calling for further evidence and clarifications cannot be termed as draft assessment order by any stretch of imagination and accordingly quashed the assessment and related penalty assessment.

CbCR Reporting- India

If the group turnover is more than INR 6,400 Crores then Country by Country report (CbC Report) will have to be filed by the parent entity or the alternate reporting entity in Form 3CEAD. The limit of INR 6,400 Crores needs to be checked for the financial year preceding the year under consideration of the parent entity.

If it is filed by the parent entity or any other group entity in India or in any other country, then the same need not be filed by your company in India. However, your company will have to intimate the same to Indian tax authorities in Form 3CEAC.

The due date for CbC Report in Form 3CEAD shall be 12 months from the end of the reporting accounting year i.e. the financial year as applicable by law in the country of parent entity.

The due date for filing intimation in Form 3CEAC shall be at least 2 months prior to the 12 months from the end of the reporting accounting year.

For example, if the reporting accounting year of the parent entity is ending on 31st December 2020, then the due date of filing Form 3CEAC will be 31 October 2021 and for filing Form 3CEAD will be 31 December 2021.

Should you require any other clarifications, please do not hesitate to contact us.

Goods and Services Tax

45th GST Council meeting was held on 17 September 2021. Some important changes/amendments proposed are as follows:

Beneficial amendment:

Interest on ineligible input tax credit would be payable only if such credit is actually utilised for tax payment. Further rate of interest in this case would be 18% p.a. instead of 24% p.a. This amendment would be notified retrospectively from 1 July 2017

GST rate related amendments:

GST exemption on transportation of goods for export out of India will be extended up to 30 September 2022

GST rate on licensing services/the right to broadcast original films, sound recordings, Radio and Television programs has been proposed to be increased from 12% to 18%. This rate increase would bring parity between distribution and licensing services

UPS System/Inverter when sold along with external batteries to attract GST at 18% while the batteries (other than lithium-ion battery) would attract GST at 28%. This amendment would address the issue of higher rate of 28% on UPS Systems/Inverter when sold along with external batteries due to concept of ‘mixed supply’

Relaxations in compliances:

- Job work compliance return in Form ITC-04 will now be required to be filed on half yearly basis (if aggregate turnover above Rs. 5 crores) and on yearly basis (if aggregate turnover is up to Rs. 5 crores)

- Cash ledger balance in CGST and IGST account can now be transferred among different GST registrations of same legal entity

Procedural amendments:

- Late fee for delay in filing Form GSTR-1 will now be auto-populated and collected in next GSTR-3B return

- Aadhar authentication of Managing Director or any whole time Director and authorised signatory has been made mandatory to claim GST refund

- GST refund will be disbursed in that bank account only which is linked with the same PAN on which GST registration has been obtained.

Amendment with respect to refund of wrong type of tax paid

It is an oft-repeated statement that GST is a destination based consumption tax. This destination based principle can be found in the provisions of the Integrated GST Act which deal with ‘place of supply’. The ‘location of supplier’ and ‘place of supply’ determines the type of tax payable either ‘CGST-SGST’ or ‘IGST’ in a given transaction. The ‘place of supply’ being legal prescription is subject to varied interpretations. So, there is a possibility that ‘CGST-SGST’ is paid presuming the supply to be an intra-state supply only to discover later that the correct tax that should have been paid is ‘IGST’, and vice versa. Now in such cases the law requires the taxpayers to pay correct tax again and claim refund of wrong tax paid earlier. However, the law as it stands hitherto posed a rider here that the refund must be claimed within two years from the date of payment of wrong tax. If the two year period is over, then the taxpayer would suffer double tax (both the wrong one paid earlier and right one paid later). To address this injustice to the taxpayers, the Government has made amendments in Central GST Rules as follows:

- Period of two years to claim refund will be computed from the date of payment of correct tax

- For past cases where correct tax is already paid on or before 23 September 2021 (the date of amendment) then period of two years to claim refund will be computed from 23 September 2021

- Further it has been also clarified that the refund can be claimed irrespective of the fact that the correct tax has been paid by the taxpayer on his own or as on outcome of the adjudication or the appellate proceedings.

Non-filing of GSTR-3B would result in blocking of GSTR-1 return

From 1 January 2022, taxpayer would not be able to file his GSTR-1 return if he has not filed GSTR-3B for the preceding month. This would prevent defaulting supplier from passing on input tax credit if he has not paid GST liability.

Clarifications issued by CBIC based on the recommendations of GST council

Clarification on scope of intermediary services

- In our July month’s newsletter, we discussed three judgments on taxability of cross border intermediary services. Readers may be aware that, export of intermediary services from India is not eligible for zero-rated benefit and is liable to tax under GST law. This GST is a cost in the transaction generally borne by the Indian intermediaries. What constitutes intermediary services is predominantly a questions of fact and we have seen a lot of litigation hovering around this issue. CBIC has issued a Circular number 159 clarifying the scope of intermediary services. As per the Circular, the primary requirements in case of intermediary services are involvement of three parties and two supplies: one is the main supply between two parties and the second is ancillary supply of intermediary services. Further the Circular also clarifies that the customer care services and sub-contracting for a service are not intermediary services.

Clarification on meaning ‘deemed distinct persons’ to claim refund on export of services

- Definition of ‘export of services’ as per Section 2(6) of the Integrated GST Act contains five conditions. One of the conditions is that the supplier of service and recipient of service are not merely establishments of a distinct persons as per Explanation 1 in Section 8. Basically, the objective of the Government has been to debar the GST refund on export transactions between head office and branch office or between agency or representational office and its Principal. However, there were instances where GST authorities had denied export refund even in case of transactions between Holding and Subsidiary / group companies interpreting the said Explanation 1 erroneously. Realising this, it has been clarified that export of services transactions between Holding company and Subsidiary or between group companies who are separate legal entities, is eligible for GST refund. This clarification is indeed welcome for smooth processing of refund claims in case of export of services between group companies.

Clarification on various issues

Time limit to avail input tax credit on debit note

In case of availment of input tax credit on debit note, the date of issuance of debit note (and not the date of underlying tax invoice) would determine the relevant financial year for the purpose of claiming input tax credit. For instance, if the date of debit note dated 1 March 2021 is issued in respect of tax invoice is 1 February 2020, then input tax credit on such debit note can be claimed up to September 2021 basis the date of debit note. It may be noted that, with effect from 1 January 2021, Section 16(4) of the Central GST Act, 2017 has been amended to delink the debit note from its corresponding tax invoice to enable the recipient to claim input tax credit. However, in spite of this amendment, AAR in few cases had ruled that even after the said amendment it is the date of tax invoice only that would determine the relevant financial year for claiming credit. This clarification is expected to put an end to such unfavourable interpretation by the department.

QR code sufficient for verification of goods in-transit

It is further clarified that it would not be necessary to carry physical copy of tax invoice if e-invoice has been generated. Production of QR code for verification by the proper officer would suffice.

Supreme Court recalls extension of limitation period from 3 October 2021

In view of the COVID-19 pandemic, the Supreme Court took the suo motu cognisance of the difficulties likely to be faced by the litigants in filing appeals, suits, petitions etc. and directed that in computing the period of limitation prescribed under the general law or under any special laws (both Central and/or State), the period from 15 March 2020 shall extended till further orders. Now considering that the present situation is near normal, the Supreme Court has decided to recall this extension with following directions:

- In computing the period of limitation for filing any suit, appeal, application or proceeding, the period from 15 March 2020 till 02 October 2021 would stand excluded. Consequently, the balance period of limitation remaining as on 15 March 2021 would become available to the litigants with effect from 03 October 2021;

- In cases where the limitation period would have expired during the period between 15 March 2020 till 02 October 2021, notwithstanding the actual balance period of limitation remaining, a limitation period of 90 days from 03 October 2021 would be available to the litigants. In the event the actual balance period of limitation remaining, with effect from 03 October 2021, is greater than 90 days, that longer period would apply.

Indirect Taxes

Government extends validity of Foreign Trade Policy by six months

Foreign Trade Policy 2015-2020 was originally valid for five years up to 31 March 2020 which was subsequently extended up to 30 September 2021. Now, the Government has further extended the validity of Foreign Trade Policy 2015-2020 and the Handbook of Procedures by another six months till 31 March 2022.

Government notifies SEIS rates for FY 2019-20

Government has notified benefit rates under Service Exports from India (SEIS) Scheme for financial year 2019-20 in Appendix 3X. Further the total entitlement has been capped at INR 5 crores per IEC. The last date to file SEIS application is 31 December 2021 and the provision of late cut would not be applicable. Therefore applications filed post 31 December 2021 would be time barred.

Government notifies electronic duty credit ledger regulations

To implement issuance of duty credit scrips in electronic form, the Government has notified Electronic Duty Credit Ledger Regulations. The Regulations inter alia specify the manner of generation of scroll for duty credit in the customs automated system, creation of e-scrip in the ledger, registration of e-scrip, use and validity of e-scrip, transfer of duty credit in e-scrip, suspension or cancellation of duty credit. The validity of e-scrip would be one year from the date of its creation after which any duty credit remaining unutilized would lapse. Further, the duty credit in an e-scrip can be transferred at a time for an entire amount only and partial transfer would not be possible.

Government notifies the manner to issue duty credit for goods exported under RoDTEP scheme

Recently the Government notified the scheme for Remission of Duties and Taxes on Exported Products (RoDTEP) under Foreign Trade Policy. The RoDTEP scheme grants the eligible exporters of notified products specified duty credit which can either be used for payment of basic customs duty or can be transferred to other persons. Now the Government has notified vide Notification number 76/2021- Customs (N.T.) the manner in which this duty credit would be issued to exporters. The notification inter alia mandates the exporters to make a declaration in the shipping bill or bill of export at the item level, timely realisation of export proceeds so as to be eligible for duty credit.

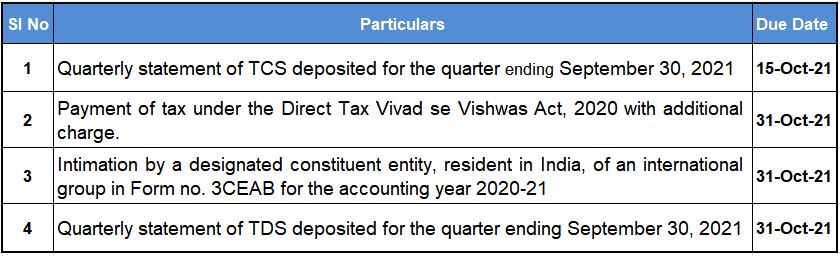

Due Dates

Important Due Dates October 2021

CBDT extends various the due dates for the assessment year (AY) 2021-22

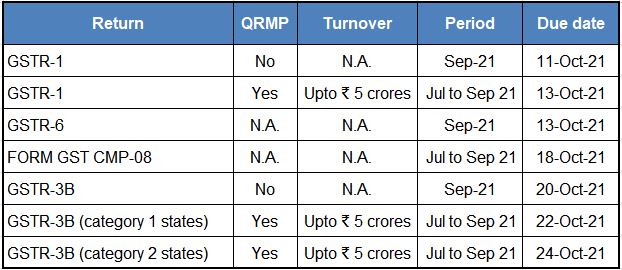

GST Compliance calendar for due dates falling in the month of October 2021

SINGAPORE UPDATES

Accounting and Corporate Regulatory Authority (ACRA)

1) ACRA Bars Registered Filing Agent MEA Business Consultancy Pte Ltd for Multiple AML/CFT Breaches

The Accounting and Corporate Regulatory Authority (ACRA) had cancelled the registration of a filing agent, MEA Business Consultancy Pte Ltd (MBC), and barred it for a period of two years from 8 March 2021 to 7 March 2023. Cancellation is the most severe measure in the Registered Filing Agent (RFA) framework introduced in 2015. This is first time ACRA has cancelled the registration of a filing agent for anti-money laundering and countering the financing of terrorism (AML/CFT) breaches.

A business entity that provides corporate secretarial services, such as helping clients to incorporate a company, file annual returns or meet the requirements of the Companies Act must first be registered with ACRA as an RFA. RFAs play an important role as gatekeepers to prevent illicit activities in the business ecosystem. RFAs must exercise due diligence and ensure internal policies, practices and controls are in place to guard against money laundering and financing of terrorism. 29 severe AML/CFT breaches found

MEA Business Consultancy Pte Ltd (MBC), a registered filing agent, was engaged by MEA Business Solutions Pte Ltd (MEA) to set up 14 local companies and to provide corporate secretarial services. Among other regulatory requirements, MBC was required by law to conduct due diligence to establish the identities of the beneficial owners of the registered entities, but ACRA’s inspection found that MBC had failed to do so. Some of these local companies were subsequently used by MEA for cheating offences which were investigated by the Corrupt Practices Investigation Bureau (CPIB).

In all, MBC had committed 29 severe AML/CFT breaches, including: Failure to inquire on the existence of any beneficial owner; Failure to document the details of risk assessment when performing diligence measures; Failure to conduct on-going monitoring of every business relationship with a customer; and Failure to establish and maintain appropriate and risk-sensitive internal policies, procedures and controls to prevent activities related to money laundering and the financing of terrorism.

In view of the multiple severe AML/CFT breaches, ACRA has cancelled MBC’s registration as an RFA, and barred it from acting as an RFA, for a period of two years from 8 March 2021 to 7 March 2023.

Monetary Authority of Singapore and Ministry of Manpower Updates

1) Boosting Equity Financing for High-Growth Enterprises

Singapore has announced a package of initiatives to support high-growth enterprises to raise capital in Singapore’s public equity market and broaden Singapore’s proposition as a financing hub.

The package comprises four initiatives:

- Establishment of a co-investment fund named Anchor Fund @ 65that will help promising high-growth enterprises raise capital through public listings in Singapore

- Establishment of the Growth IPO Fund that will help late-stage private enterprises at about two or more funding rounds away from a public listing to grow and prepare for an eventual public listing in Singapore

- Enhancements to the Grant for Equity Market Singapore (GEMS) scheme to support enterprises seeking to list in Singapore, and to help develop Singapore’s equity research ecosystem; and

- Singapore Exchange’s Strategic Partnership Model, which will develop bespoke solutions ranging from private market fundraising to liquidity building and global investor outreach for high-growth companies.

https://www.mas.gov.sg/-/media/MAS/News/Media-Releases/2021/Annex-A-Factsheet-on-the-Initiatives.pdf

https://www.mas.gov.sg/-/media/MAS/News/Media-Releases/2021/Annex-B-Infographic-on-GEMS.pdf

2) MAS and Financial Industry to Use New Digital Platform to Fight Money Laundering

The Monetary Authority of Singapore (MAS), which regulates one of the most trusted and secure financial hubs, announced on October 1, 2021 that it will launch a data-and information-sharing platform named Cosmic “Collaborative Sharing of ML/TF Information & Cases”, to prevent money laundering, terrorism funding and proliferation financing.

The COSMIC platform is co-created by MAS and six major commercial banks in Singapore, namely, DBS, OCBC, UOB, SCB, Citibank and HSBC. It will have strong security features to prevent unauthorised access to information, and will be operated by MAS. MAS will provide in legislation that this information sharing by FIs is permitted only for the purpose of combating ML, TF and PF. MAS will also require all COSMIC participants to implement robust measures to safeguard against unauthorised use and disclosure of COSMIC information. MAS will supervise FIs for compliance with these requirements and take action against errant FIs.

MAS plans to launch the COSMIC platform in the first half of 2023. COSMIC will initially focus on three key financial crime risks in commercial banking, namely, abuse of shell companies, misuse of trade finance for illicit purposes, and PF. The six banks involved in COSMIC’s development, which are leading players in commercial banking, will participate and be permitted to share information in COSMIC during this initial phase. MAS plans to progressively extend COSMIC’s coverage to more FIs and focus areas and make some aspects of sharing mandatory.

3) SGX introduces SPAC listing framework

On September 2, 2021 Singapore Exchange (“SGX’) announced new rules that enable special purpose acquisition companies (“SPACs”) to list on the Mainboard of Singapore Exchange Securities Trading Limited (“Mainboard”) effective September 3, 2021.

SGX’S SPAC framework offers companies an alternative capital fund raising route with greater certainty on price and execution and further diversifies the investment products available to investors in local capital markets, giving access to investments which would otherwise have been only available in the private equity space.

The framework takes into consideration the extensive feedback and interest of market participants. The framework also takes into account market practice and rules on SPACs in the United States (“US”), which is the most popular and established SPAC market.

An SGX listing under the SPAC framework must have the following key features:

- Minimum market capitalisation of S$150 million

- De-SPAC must take place within 24 months of IPO with an extension of up to 12 months subject to fulfilment of prescribed conditions

- Moratorium on Sponsors’ shares from IPO to de-SPAC, a 6-month moratorium after de-SPAC and for applicable resulting issuers, a further 6-month moratorium thereafter on 50% of shareholdings.

- Sponsors must subscribe to at least 2.5% to 3.5% of the IPO shares/units/warrants depending on the market capitalisation of the SPAC

- De-SPAC can proceed if more than 50% of independent directors approve the transaction and more than 50% of shareholders vote in support of the transaction

- Warrants issued to shareholders will be detachable and maximum percentage dilution to shareholders arising from the conversion of warrants issued at IPO is capped at 50%

- All independent shareholders are entitled to redemption rights

- Sponsor’s promote limit of up to 20% of issued shares at IPO

https://www.sgx.com/media-centre/20210902-sgx-introduces-spac-listing-framework

4) Copyright Bill introduced in Parliament to strengthen Singapore’s copyright regime.

The Ministry of Law has proposed a repeal of the current Copyright Act with the new Copyright Bill to strengthen the copyright laws in Singapore in an attempt to “stay abreast of changes in how content is created, distributed, and used”. It seeks to make the law more accessible by simplifying the language and key features of the new bill include introducing new rights and remedies for creators, as well as creating new exceptions to copyright owners’ rights (known as permitted uses).

This is to ensure that copyright continues to reward the creation of works and incentivise creativity and that copyright works are reasonably available for the benefit of society and to support innovation respectively,

The new bill revises some of the clauses in the Copyright Act. The proposed revisions are:

- Granting creators and performers the right to be identified

- Granting creators default ownership of certain commissioned works

- Deterring people from profiting off products or services which stream audiovisual content from unauthorised sources

- New equitable remuneration rights when sound recordings are broadcasted or publicly performed

- New permitted use of works for computational data analysis

- New permitted use of online materials for educational purposes by nonprofit schools

- Setting an expiry date for the protection of unpublished works

- Strengthening general “fair use” permitted use

- Facilitating the work of galleries, libraries, archives, and museums

- Adjusting existing provisions for users with print disabilities

- Facilitating the dissemination of information/materials by the government to the public

- Protecting certain exceptions from being restricted by contracts

- New class licensing scheme for collective management organisations

https://www.ipos.gov.sg/docs/default-source/resources-library/copyright/copyright-bill-factsheet.pdf

5) Sole Proprietor to pay $977,898 in Penalties for Submitting Incorrect GST and Income Tax Returns

Ong Chee Keong (“Ong”), 51, the sole proprietor of Hup Seng Lee Metal and Glamorzon Hair & Beauty Salon, has been convicted for reporting incorrect net Goods and Services Tax (GST) payable in his GST returns between 2010 and 2015 and making incorrect Income Tax returns for Year of Assessment (YA) 2013. The Court has ordered Ong to pay a total of $991,398 in penalties and fines for these tax offences.

Court Sentences

The Court ordered Ong to pay a fine of $10,500 and a penalty of $387,720, which is two times the amount of tax undercharged, for the 7 proceeded charges under Section 59(2)(b) of the Goods and Services Tax Act of giving the incorrect information in his GST returns through negligence. The remaining 14 charges were taken into consideration for the purpose of sentencing.

Ong was also ordered to pay a fine of $3,000 and a penalty of $590,178 which is two times the amount of tax undercharged, for the 1 proceeded charge under Section 95(2)(a) of the Income Tax Act of making incorrect returns in his personal Income Tax returns through negligence. The remaining 4 charges were taken into consideration for the purpose of sentencing.

Penalties for Non-Compliance

Giving Incorrect Information in GST Registration Form or Return Affecting Liability to Tax

Any business which without reasonable excuse or through negligence, gives any incorrect information in relation to any matter affecting his own liability to tax, or the liability of any other person or of a partnership, will be liable to a penalty that is twice the amount of tax undercharged. A fine and/ or a jail term may also be imposed.

Incorrect Information in Income Tax Returns

Any person who gives incorrect information in their Income Tax returns without reasonable excuse or through negligence will be liable to a penalty that is twice the amount of tax undercharged. A fine and/or a jail term may also be imposed.