DIRECT TAX

Circulars/Notifications/Press Release

CBDT exempts certain classes of Non-Residents from filing their Income Tax Return

CBDT exempts the following classes of Non-Residents from filing tax returns from the financial year 2020-21

i. Any non-resident not earning any income in India other than Income from Alternative Investment Fund- Category III and is not liable to obtain a PAN.

ii. An eligible foreign investor not earning any income in India other than capital gain from transfer of government security and is not liable to obtain a PAN. An eligible foreign investor means a non-resident who operates in accordance with the Securities and Exchange Board of India.

The above exemption will not be available if a notice has been issued for filing a return of income for a specified financial year.

CBDT notifes criteria for claiming exemption under Section 10(23FE)

- The Finance Act, 2021, inserted a new exemption on income earned by specified sovereign funds investing in Indian Infrastructure without undertaking any loans or borrowings, directly or indirectly.

- Addressing the ongoing concerns CBDT clarifies that borrowings undertaken with an intention other than investment in India shall not discontinue the exemption, while borrowings from group concerns will make the fund ineligible for claiming exemption, on account of indirect borrowings

Case Laws

M/s Hitachi Metglas (India) Pvt. Ltd

- In this case, the ITAT held that standard automated services received through broadband network from foreign entities shall not be classified as fees for technical services.

- The assessing officer had disallowed amount paid towards admin and network charges by the Assessee to its associated enterprises for not deducting TDS. The same was challenged by the Assessee before the CIT(A) wherein the CIT(A) upheld the assessing officer’s order stating that the services availed are liable to TDS. Subsequently, the Delhi ITAT held that services received by the assessee are classified as standard internet services used to send or receive data and to remotely access the company’s network which shall not be classified as fees for technical services and hence TDS not applicable.

India Power Corporation Ltd

- In this case, the ITAT held that the education cess paid by the Assessee is not income tax and same is allowable as deduction under section 37(1).

Natural Biochemicals and Foods Ltd

- In this case the ITAT held that that depreciation is to be claimed when asset is actually put to use for business or profession and once an asset is included in the block of asset, it remains in the block for its entire life. Therefore, assessee was entitled to depreciation even during suspended operations as the business was only temporarily shut down not was closed permanently.

Underwater Services Company Limited

- In this case, the Assessee is engaged in providing marine repair services was served a notice for search under section 153A without any material evidence in possession of the income tax department. The Assessee filed a writ petition against such notice stating that nothing was mentioned in the notice that the petitioner could comply with.

- Hon’ble Bombay High Court observed that the issuance of a show cause notice is the preliminary step which is required to be undertaken and its purpose is to enable the assessee to effectively deal with the case and held that the income tax department should indicate in its notice the details of material seized. The High Court quashed the notice and directed to issue a fresh notice with sufficient information.

American Chemical Society

- The Assessee, a non-resident through its Publications Division from USA, received subscription charges which was undisputedly treated as royalty by Assessee in the preceding years, but discontinued to treat the same as royalty in the year under consideration, which was argued by the income tax department.

- The Mumbai ITAT favoured the Assessee by holding subscription charges not to be treated as royalty in the given case as the subscribers did not have the right to make any copies, amend, replicate or reproduce the content of the journals granted by the subscription division.

Goods and Services Tax

SEZ developer eligible to claim refund of unutilized input tax credit – Madras High Court

The Madras High Court in the case of M/s Platinum Holdings Private Limited has held that SEZ developer is eligible to claim refund of unutilized input tax credit under Section 54 of the Central GST Act read with Rule 89 of the Central GST Rules. Revenue in this case had argued that, in terms of Rule 89 only a supplier to SEZ can file refund application and the said Rule does not explicitly permit recipient SEZ to claim refund. The High Court on perusal of provisions of Section 54 and Rule 89 observed that though the Rule 89 refers to a ‘supplier’ to file refund application, that by itself will not exclude, by virtue of such reference, recipient SEZ to file refund application. Section 54 allows “any person” to seek refund of taxes or other amounts paid under the provisions of the Act. Thus, on the legal issue of entitlement to refund, the High Court has held in favour of the assessee. However, the High Court remanded back the matter to verify that the suppliers have not filed refund claim in this case, and the Suppliers have indeed paid GST to the government treasury on supply to SEZ.

Supply of goods at a nominal price under promotional scheme not an arm’s length transaction, valuation to be done with reference to GST valuation Rules – West Bengal AAR

The Applicant in this case M/s Kanahiya Realty Private Limited is engaged in the business of supply of hosiery goods. The Applicant proposed to implement a promotional scheme to incentivize sale of hosiery goods amongst the retailers whereby it would offer unconnected goods (such as gold coins, refrigerators, coolers, split air conditioner etc.) for sale at a discounted price based on the targets achieved by the retailers. The retailers have the liberty not to purchase the goods offered under the said promotional schemes. The Applicant in this case raised two questions before AAR: First, whether supply of hosiery goods and promotional items would be considered as a mixed supply attracting highest rate of tax, and second, whether the Applicant would be entitled to claim input tax credit on promotional items which would be sold to retailers at a nominal price.

As regards the first question, the AAR has held that since the hosiery goods and promotional items will be sold under different invoices at different point in time at different price, the supply would not be considered as mixed supply. The supply of promotional items would qualify as individual supply taxable at the rate applicable to each such promotional item. However, AAR has held that the nominal/discounted price is not the sole consideration for supply of promotional items. According to AAR, the supply of the promotional items would be contingent upon the supply of hosiery goods, as the supply of promotional goods would take place only when the retailers meet the prescribed criteria stipulated under the promotional scheme. Should the retailers fail to achieve the target or do not opt for the scheme, there would be no supply of promotional items. Thus, the AAR observed that the nominal price is not the sole consideration for supply of promotional items. The value of promotional items is required to be determined in terms of Section 15 of the Central GST Act read with Rule 27 of the Central GST Rules.

As regards the second question on input tax credit, the AAR has held that the supply of promotional items is in the course or furtherance of business of the Applicant. Further, the Appellant would be charging nominal price to retailers for supply of promotional items and that too upon fulfilment of targets under the promotional scheme. Thus, the same cannot be considered as ‘gift’ and thus restriction under Section 17(5)(h) of the Central GST Act would not be applicable in this case. Therefore, the AAR has held that the Applicant would be eligible for input tax credit on promotional items.

No Input tax credit on procurement of inputs/input services under promotional scheme ‘Buy n Fly’– Tamil Nadu AAR

The Applicant in this case M/s GRB Dairy Foods Private Limited are engaged in manufacture and supply of ghee and other products viz. masalas, instant mixes and sweets. With the objective of enhancing the market share, the Applicant launched promotional offer under the name “Buy n Fly’. Under this scheme, once the participating retailers achieve the targets, they would be eligible for rewards in the form of Trip to Dubai, Gold Voucher, Television, Air Cooler. The Applicant pays GST on procurement of these goods/services from Vendors. The Applicant claimed that they are eligible for input tax credit and restriction under Section 17(5)(h) of the Central GST Act would not be applicable in this case because they are not offering any gifts to retailers in this case. Rewards under the promotional offer cannot be equated with ‘gifts’. The AAR in this case noted that Section 17(5)(g) of the Central GST Act restricts input tax credit on goods/services used for personal consumption. In the instant case according to AAR, the promotional items are distributed to retailers for personal consumption. Further the fact that the cost of such promotional items is considered to arrive at the cost of the product is immaterial as credit on goods/services used for personal consumption is specifically restricted. Further, the AAR rejected the contention of the Applicant that the promotional items cannot be regarded as “gifts”. The AAR finally concluded that the Applicant is not eligible for input tax credit on procurement of inputs/input services under the promotional scheme “Buy n Fly’.

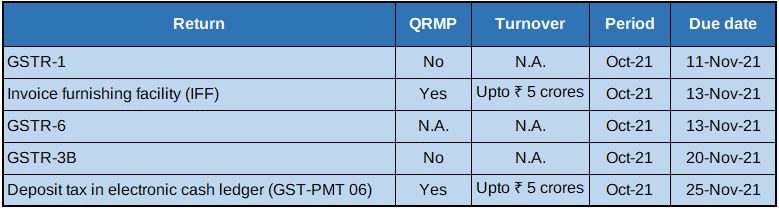

Due Dates

GST Compliance calendar for November 2021

SINGAPORE UPDATES

Monetary Authority of Singapore and Inland Revenue Authority of Singapore Updates

1) MAS proposes methods to strengthen cybersecurity in financial institutions

The Monetary Authority of Singapore (‘MAS’) announced, on 29 October 2021, that its Cyber Security Advisory Panel had issued a number of proposals to strengthen cyber defences in financial institutions, following its fifth annual meeting. In particular, the panel advocated for the adoption of ‘zero trust’ security principles and architecture to tackle advanced cyber threats and IT supply chain attacks. Furthermore, the panel outlined various cyber risks and mitigating actions in emerging technologies such as blockchain and digital currencies.

As such, the panel recommended financial institutions to consider the following, among other things:

- improving the adoption of cybersecurity standards across IT supply chains and incorporating security considerations throughout the system life cycle;

- establishing effective system monitoring and regular log reviews to facilitate prompt detection of suspicious activities;

- enhancing multi-factor authentication; and

- implementing immutable data storage technologies.

2) MAS Implements contractual recognition requirement for certain financial institutions

The Monetary Authority of Singapore (Resolution of Financial Institutions) Regulation 2018 (“Regulations”) have been amended from November 1, 2021 to provide for the contractual recognition requirement for qualifying pertinent financial institutions (“QPFI”) and their related entities to include enforceable provisions in their financial contracts which contain early termination rights where such contracts are governed by foreign law. The effect of the provisions is to have all parties to the contract agree that their exercise of termination rights will be subject to MAS temporary stay powers in the event of a resolution.

QPFIs will have three years from November 1, 2021 to make the necessary preparations to implement the contractual recognition requirement.

MAS will also be engaging the International Swaps and Derivatives Association (“ISDA”) to explore the possibilities of putting in place an ISDA Jurisdictional Module for Singapore, to support industry efforts.

https://sso.agc.gov.sg/SL-Supp/S802-2021/Published/20211029?DocDate=20211029

3) Bank Indonesia and Monetary Authority of Singapore Further Extend Bilateral Financial Arrangement

Bank Indonesia (BI) and the Monetary Authority of Singapore (MAS) today announced the extension of the USD10 billion bilateral financial arrangement to 4 November 2022. This arrangement has been endorsed by Indonesian President Joko Widodo and Singapore Prime Minister Lee Hsien Loong, and will continue to support monetary and financial stability in both countries amid the on-going recovery from the COVID-19 pandemic.

The arrangement comprises two agreements:

- A local currency bilateral swap agreement that allows for the exchange of local currencies between the two central banks of up to SGD9.5 billion or IDR100 trillion (about USD7 billion equivalent); and

- A bilateral repo agreement of USD3 billion that allows for repurchase transactions between the two central banks to obtain USD cash using G3 Government Bonds [1] as collateral.

The bilateral financing arrangement was established between BI and MAS in November 2018 to build confidence in each other’s economies, following the Singapore-Indonesia Leaders’ Retreat. The arrangement has been extended annually since.

4) IRAS’ Partnership Efforts Simplify Corporate Income Tax Filing 2021

The Inland Revenue Authority of Singapore (IRAS) partnered with the tax community and government agencies to simplify Corporate Income Tax (CIT) Filing 2021 for companies. With the new initiatives, companies and tax agents can further reduce the time they take to file CIT this year. Companies are to e-File their CIT Returns (Form C-S/ Form C-S (Lite)/ Form C) by 30 November 2021.

- Up to 40% time-savings for companies and tax agents with simplified tax treatment for qualifying telecommuting assets under COVID-19 concession

- Extended seamless filing solution to more tax professionals

- Syncing of financial year end details

- Pre-filled companies’ email addresses for digitised notices

IRAS- Due Dates

- Form C-S/C for the FY 2020 -30-November-2021

- Estimated Chargeable Income (ECI) (Sep year-end)- 31-December-2021

- GST Return: October 2021 – December 2021- 31 January 2022