Company Law

ECB 2 Returns for the month of April 2021 to be filed on or before 7 May 2021.

1. RBI vide notification dated 7 April 2021, has announced a one-time measure that un-utilised ECB proceeds drawn down before 1 March 2020, may be parked in term deposits with banks up to 1 March 2022 in order to provide relief to borrowers who could not utilise the proceeds due to the impact of COVID-19.

2. MCA, vide Companies (Accounts) Second Amendment Rules, 2021 dated 1 April 2021, has changed the effective date for usage of software having feature of audit trail for each and every transaction and which will create an edit log of each change made in the books of accounts along with the date to reflect when changes were made. Companies will now have additional one year to identity and procure the necessary software to comply with these provisions.

DIRECT TAX

Circulars/Notifications/Press Release

CBDT notifies IT Rules for revision of tax audit report over disallowance u/s 40, 43B; Amends Form 3CD

Notification 28/2021 dated 1 April 2021

• CBDT notifies IT (8th Amendment) Rules: this 2021 to insert Rule 6G(3), provides for revision of tax audit report u/s 44AB for recalculation of disallowance under Sections 40 or 43B;

• The Rules come into effect on 1 April 2021.

• They also amend Form 3CD:

(i) clause 8A, to include Sections 115BAC, 115BAD,

ii) clause 17 , to include details of transfer of land or building for consideration less than the value referred to in Sections 43CA/50C and whether such transfer falls under fourth proviso to Sec. 56(2)(x) or second proviso to Sec. 43CA (both inserted by Finance Act, 2021) allowing 20% variation in consideration for transfer,

(iii) clause 18, to include details of adjustments made to WDV u/s 115BAC/115BAD (special provision for individuals, HUFs/ Cooperative Societies) and intangible asset due to exclusion of the value of goodwill, and

iv) clause 32, to include details of brought forward losses/ depreciation allowance having regard to special provisions u/s 115BAC/115BAD in addition to Sec. 115BAA;

Omits clause 36 (applicable to Dividend Distribution Tax)x

Finance Ministry notifies India-Iran DTAA

Notification 29/2021 dated 1 April 2021

Ministry of Finance notifies India-Iran DTAA by exercising powers u/s 90(1);

DTAA applies in India with respect to income-tax arising in FY 2021-22 onwards

CBDT authorizes DIT(CPC) & CIT(E) for Trust related procedure, w.e.f. 1 April 2021

Notification 30/2021 dated 1 April 2021

CBDT authorizes Director of Income-tax (CPC), and Commissioner of Income-tax (Exemption), Bengaluru, for:

(a) receiving applications for provisional registration or registration or approval or intimation in Form 10A

(b) for passing order granting provisional registration or registration or provisional approval or approval in Form 10AC

(c) for issuing Unique Registration Number (URN)

(d) for cancelling the approval granted in Form 10AC and URN, under IT Rules;The notification shall be effective from 1 April 2021.

CBDT introduces changes in Master file and CbCR rules effective 1 April 2021

Notification 31/2021 dated 05 April 2021

- CBDT introduces the Income-tax (9th Amendment) Rules, 2021 effective from 1 April 2021;

- Amends Rules 10DA and 10DB of the Income-tax Rules dealing with Master file and CbCR reporting for specified transactions of constituent entities of an international group;

- Increases consolidated group revenue threshold to determine reporting eligibility from INR 5,500 crores to INR 6,400 crores

CBDT notifies format, procedure & guidelines for submission of Statement of Financial Transactions for interest and dividend income

Notification 1 & 2 of 2021 dated 20 April 2021 issued by Directorate of Income Tax (Systems)

- CBDT vide notification no. 16/2021, dated 12 March 2021 has enhanced the scope of the nature of transactions to be reported under SFT as per Rule 114E.

- Capital gains on transfer of listed securities or units of Mutual Funds, dividend income from company and interest income earned a taxpayer become part of SFT.

- The newly inserted sub-rule 5A of Rule 114E specifies that the new information shall be furnished in such form, at such frequency, and in such manner, as may be specified by the Director-General of Income Tax (Systems), with the approval of the Board.

- Now the Board has prescribed the guidelines for the preparation and submission of SFT for information related to interest and dividend income.

- The statement should be furnished on or before 31 May immediately following the financial year in which the transaction is registered or recorded.

IT Dept. introduces JSON utility for AY 2021-22 ITRs, discontinues Excel/Java

- IT Dept. discontinues Excel and Java version of ITR utilities from AY 2021-22;

- Appraises that for AY 2021-22, ITR-1 to 4 can be filled using single JSON Utility;

- Releases step-by-step guide for using the new utility, states “Import of Prefill file is mandatory in utility.”;

- Notifies that utilities for ITR-1 and ITR-4 are available to users for download and the utility for other ITRs will be enabled shortly.

CBDT clarifies, Faceless Appeals Scheme applies only to appeals under Income-tax Act

Letter dated 7 April 2021

- CBDT clarifies that no direction has been issued for finalization of appeals under any Direct Tax Law other than Income-tax Act, 1961 under the Faceless Appeals Scheme, 2020;

- CBDT received communications seeking clarification of jurisdiction over appeals under various Direct Tax Laws after implementation of Faceless Appeals Scheme, 2020 from the field formations;

- CBDT notifies CIT(A)s to exercise jurisdiction over appeals in cases pertaining to other Direct Tax Acts i.e., Wealth tax Act, 1957, Interest tax Act, 1974, Gift tax Act, 1958, Expenditure tax Act, 1987, Securities Transaction Tax in Chapter VII of Finance (No. 2) Act, 2004, Commodities Transaction Tax in Chapter VII of Finance Act, 2013, and Equalization Levy in Chapter VIII of Finance Act, 2016;

- Notifies, with retrospective effect from 25 September 2020, that regional CIT(A)s would exercise jurisdiction over the appeals pertaining to Direct Tax Laws other than Income tax Act, 1961 for which necessary notifications shall be issued by the regional Pr. Chief CIT.

CBDT releases synthesised texts of MLIs and India's DTAAs with 9 more jurisdictions including Norway, Netherlands, Russia

Notification No. 17/ 2021 [F. No. 225/40/2021] / ITA-II Dated 15 March 2021

- On 5 April 2021 CBDT publishes synthesised texts of MLIs and India’s DTAAs with:

♦ Cyprus

♦ Czech Republic

♦ France

♦ Italy

♦ the Netherlands

♦ Norway

♦ Portugal

♦ Russia and

♦ Ukraine

CBDT passes order to substitute NeAC by NaFAC in all correspondences, w.e.f. 1 April 2021

Order u/s 119 dated 8 April 2021 F No 187/3/2020-ITA-I

- With the introduction of The Faceless Assessment Scheme 2019, Section 144B pertaining to the scheme of faceless assessment has been inserted in the Income Tax Act with effect from 1 April 2021.

- In this regard, CBDT passes order u/s 119 directing that all the orders/notices/letters/instructions/any other communication issued by National Faceless Assessment Centre (NaFAC) on or after 1 April 2021 bearing logo of National e-Assessment Centre (NeAC) shall be deemed to have been issued by NaFAC; Also directs that in communications or orders issued by NaFAC, Sec. 143(3A)/(3B) shall be read as Sec. 144B.

The Order comes into effect from 1 April 2021.

Govt. extends various Income-tax Act timelines till 30 June in wake of raging Pandemic

CBDT Press Release dated 24 April 2021

Time limits have been extended to 30 June 2021 in the following cases:

♦ Passing an order for assessment, reassessment or recomputation u/s 153 or search and seizure u/s 153B

♦ Passing an order consequent to direction of DRP u/s 144C(13)

♦ Issuance of notice where income has escaped assessment u/s 148

♦ Sending intimation of processing of Equalisation Levy u/s 168(1) of the Finance Act 2016

♦ Payment of amount payable under the Direct Tax Vivad se Vishwas Act, 2020, without an additional amount.

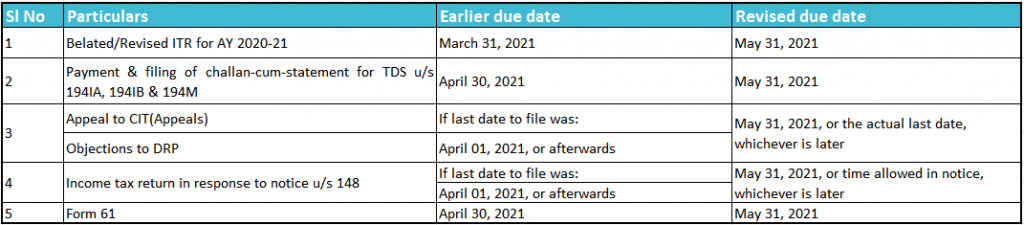

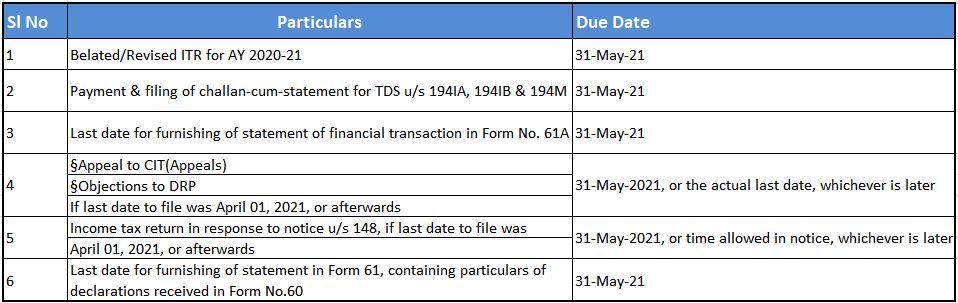

Extension of various due dates due to the Covid-19 pandemic wave 2

CBDT Circular No 8 of 2021 30 April 2021

The CBDT vide its Circular No.8 of 2021 dated 30 April 2021, gave relief to taxpayers extending various time limits of compliances due to the Covid-19 pandemic. As per the circular, the new various tax compliance dates are as follows-

Case Laws

Delhi HC issues notice on writ against faceless assessment order suffering from procedural irregularities

- An assessee has filed a writ petition challenging the assessment order for AY 2018-19 passed under the faceless assessment scheme and the matter is pending before the division bench of Delhi HC.

- On 25 March 2021, notice seeking certain details was issued, against which assessee moved an online adjournment on the same day. Although, the request for adjournment was accepted as the portal reflected that the case was adjourned to 8 April 2021, Revenue passed assessment order raising a demand on 31 March 2021, the date of limitation being 30 April 2021.

- HC considers assessee’s submission that the assessment order was passed

♦ in a complete denial of opportunity of being heard

♦ without rejecting the adjournment application filed by the assessee

♦ in violation of principle of natural justice

♦ without issuing any show cause notice

♦ without providing any draft order which is clearly prescribed in the Faceless Assessment Scheme

CIT(A) not entitled to enhance income on issues outside the scope of assessment order

Trimurty Buildcon Pvt. Lt Vs ITO dated 6 April 2021.

- Assessee company is engaged in business of construction, purchase and sale of immovable properties.

- The AO completed the assessment U/s 143(3) of the Act by making addition on account of disallowance u/s 14A read with Rule 8D.

- Aggrieved, the assessee filed an appeal with the CIT(A) where the CIT(A) deleted the disallowance u/s 14A however, it enhanced the income of by making disallowance of Rs. 53,78,282, u/s 36(1)(iii) of the Act on account of interest expenses incurred on loan taken.

- ITAT observes that CIT(A) cannot touch upon issues which do not arise from the order of assessment and outside the scope of order of assessment.

- Even otherwise, the interest expense was an allowable expense and not to be added back to the income.

ITAT: Deletes AO's Sec.40A(2) disallowance given ALP of international transaction accepted by TPO

ACIT Vs Lifestyle International (P) Limited Dated 19 April 2021

- Lifestyle paid sums to its AE for professional services received and declared it as international transactions.

- AO referred the case to TPO to determine ALP. TPO concluded that no adjustment is required as the impugned transaction is at ALP, however, the AO without relying on TPO’s order, has gone ahead and disallowed the professional fees paid, u/s 40A(2) as unreasonable and excessive without specifying what is excess or unreasonable in the payments made.

- Accordingly, ITAT noted that “the A.O. has erred in invoking the provisions of section 40A(2) of the Income Tax Act to disallow the claim of expense as excessive and not legitimate to the business needs, especially in view of the fact that the TPO, in its transfer pricing orders for assessment years 2008-2009 and 2010-2011, had held the impugned transaction at arm’s length.”

- ITAT also noted that “The A.O. cannot take a place of the management of the company and decide from its own point of view, whether an expense has to be incurred or not. Merely because there is expert management and team and resources, it cannot be contended that the expenditure was not at all required.”

- And “that the A.O. is not correct in disallowing the expenditure also u/s 37 of the Income Tax Act.“

ITAT: Consultancy Fee to Harvard Professor outside 'make available' clause, not liable to TDS

Hero Motocorp Ltd Vs Addl CIT, Dated 13 January 2021

- Hero Motocorp had remitted a sum to a Harvard Professor (US) in respect of scenario planning exercise, aimed at identifying key variables impacting two-wheeler industry and establishing early warning signal without deducting TDS

- The professor was engaged merely for providing services in the scenario planning exercise and in no case or circumstance did he reveal or provide the details of research to the assessee.

- This enables the professor to carry out and undertake such services in future on its own accord without availing services from him

- ITAT held that since there is no make availability, the same cannot be categorized as FTS/FIS as per Art. 12(4) of India – US DTAA, the transaction is not chargeable to tax in India u/s 195.

- Thus, ITAT deletes the disallowance u/s 40(a)(i).

No TDS on sales commission paid to non-residents in respect of sale services rendered outside India

Modern Threads India Ltd. v. ACIT - [2021]

- Assessee paid a certain sum as sales commission to foreign agents without deduction of tax at source as per the provisions of Section 195.

- Assessing Officer (AO) held that the commission paid by assessee was a fee that was paid for technical services rendered by a non-resident and disallowed by applying the provisions of Section 40(a)(i).

- CIT(A) upheld the order of AO.

- Jaipur ITAT held that where the commission had been paid to various non-resident entities in respect of sales affected by assessee outside of India, the services had been rendered by these entities outside of India, and the payments had been made outside India.

- The said commission will not fall in the category of the income received or deemed to be received in India as well as accrues or arises or is deemed to accrue or arise in India

- Therefore, the said commission is not chargeable to tax in India and hence not liable for TDS. Accordingly, the provisions of section 40(a)(i) couldn’t be invoked.

HC: Disallows refund adjustment sans Sec 245 intimation; Directs Rs. 227 Cr refund to Tata Comm

Tata Communications Ltd VS Union of India, WRIT PETITION, Dated 6 April 2021

- Assessee(Tata Communications) claimed refund of taxes paid amounting to Rs. 205 Cr. and subsequently, filed a writ petition due to delay in processing the said refunds.

- Revenue issued intimation dated 17 January 2021 u/s 143(1) calculating refund (along with interest) at 227 Cr. and stating that intimation u/s 245 has been issued proposing to adjust the refunds against outstanding demand of earlier assessment years.

- HC notes that no intimation u/s 245 was issued and Revenue had not responded to Assessee’s submissions that earlier years’ demand was stayed by orders of HC and ITAT and were still in force on the date of adjustment.

- Accordingly, Hon’ble HC allowed the writ petition and directed the revenue to refund the amount to assessee for as determined u/s 143(1) with interest within a period of four weeks

Delhi HC: MFN clause in India -Netherlands applicable from date of OECD membership; Approves lower dividend WHT

Concentrix Services Netherlands BV Vs Income Tax Officer (TDS)

- Issue: what should be the withholding rate of tax in respect of dividend?

- Background

♦ Concentrix Netherlands had applied to the concerned statutory authority u/s 197 seeking issuance of a certificate that would authorize Concentrix India to deduct withholding tax at a lower rate of 5% in consonance with the India-Dutch DTAA read with the protocol appended thereto.

♦ The officer issued the certificate wherein the stipulated withholding tax rate was shown as 10%. - Rival submissions

♦ Per Assessee: DTAA requires 10% withholding. However, per MFN clause read with DTAA with Slovenia, Lithuania and Colombia, applicable rate should be 5%.♦ Per Revenue: Above countries became members of the OECD post signing of the Indo-Dutch DTAA. Hence, MFN clause and 5% rate both inapplicable.

- Held: Accept Assessee’s arguments and re-issue certificate u/s 197

Mumbai ITAT: Allows Goldman Sachs to carry-forward STCL 'exempt' under India-Singapore DTAA

Goldman Sachs India Investments (Singapore) PTE Limited Vs DCIT (IT)

Issue: were the DRP and AO right in denying the carry forward of short-term capital loss?

- Background

♦ Goldman Sachs India Investments (Singapore) Pte Ltd incorporated in Singapore & registered with the SEBI as a FII, incurred STCL in AY 12-13 & the same was disallowed by the AO.

♦ The DRP also confirmed the action of the AO. Aggrieved, Goldman Sachs appealed before Tribunal. - Rival Submissions:

♦ Since Capital Gains are exempt, carry forward of capital losses also not applicable.

♦ Treatment valid as per 90(2) - Held: Accepted Assessee’s arguments and allowed carry forward of losses

Other Updates

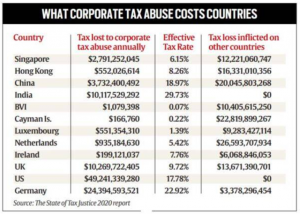

News of the hour

- President Joe Biden has proposed hiking the US corporate tax rate to 28% from 21% to help pay for his plan to build up the country’s infrastructure.

- Delhi HC turns to Virtual Hearings till 23 April, due to surge in Covid-19 cases.

- Fees for non-maintenance of minimum balance in Post Office Saving A/c reduced from Rs. 100 to Rs. 50.

- Provisional Direct Tax collections for the Financial Year 2020-21 show growth of approx. 5%.

- CBDT files caveat before Bombay HC anticipating challenge against Faceless schemes.

- IT refunds worth Rs.5,649 crore issued during April 1-19

UN Committee of Experts approves new digital tax article for model treaty

- The new article(Article 12B) would grant additional taxing rights to countries where an automated digital services provider’s customers are located.

- The new taxing right would apply to income from automated services, namely, income received with little human involvement from the service provider. It would apply to income derived from online advertising services, the supply of user data, online search engines, online intermediation platform services, social media platforms, digital content services, online gaming, cloud computing services, or standardized online teaching services.

- The model treaty provisions allow source countries to apply a withholding tax on gross payments made in exchange for the specified automated digital service. Alternatively, companies can elect for the withheld amount to be based on profits earned in the source country from the automated digital service.

UN releases third edition of UN Practical Manual on TP for developing countries

- This edition (600+ pages) intends to reflect developments in the area of transfer pricing analysis & administration since the second edition(2017).

- The Manual highlights the key country practices of some developing countries such as China, India, Brazil, Kenya, Mexico, South Africa.

- Manual intends to improve content pertaining to financial transactions, profit splits, centralized procurement functions and comparability issues.

Goods and Services Tax

Interest on delay in vendor payment towards goods imported liable to GST as import of services

The Gujarat Authority for Advance Rulings (AAR) recently had an occasion to determine the reverse charge implications on interest charged for delay in vendor payment towards goods imported.

In the present case, the applicant M/s. Enpay Transformer Components India Private Limited, imported certain goods from its holding company located outside India. Against such import of goods, there was delay in payment to foreign supplier. For this delay, foreign supplier charged interest to the applicant. The applicant posed a question before AAR whether such interest paid on delay in payment of consideration to foreign supplier would be regarded as supply liable to GST under reverse charge.

The AAR observed that “tolerating an act or a situation” is deemed to be a service in terms of Entry No. 5(e) of the Schedule-II to the CGST Act, 2017. When applicant delays vendor payment, the foreign supplier tolerates such delay and interest charged is the consideration for such act of tolerance. So, AAR held that applicant is liable to pay GST under reverse charge mechanism on such interest payment. It is worthwhile to note that Section 15 of the CGST Act, 2017, which deals with the value of taxable supply, treats interest on delayed payment as an additional consideration of the original supply. So, it appears that the observation of the AAR in this ruling that the interest for delayed payment is a consideration for separate supply of service requires reconsideration

AAR opens pandora’s box – Rules one-to-one correlation necessary for availing input tax credit under GST

Unsettling the jurisprudence in catena of judgements related to the pre-GST regime, the Gujarat Authority for Advance Rulings (AAR) in the case of M/s Aristo Bullion Private Limited introduced a new requirement of establishing one-to-one correlation between the inward supplies and the outward supplies for availing input tax credit.

Facts of the case are that the applicant was engaged in two business activities, viz. (i) supply of bullion, and (ii) trading in castor oil seeds. The applicant requested for an advance ruling on whether the input tax credit accumulated in respect of its bullion business can be utilized against its GST liability towards outward supply of castor oil seeds.

The AAR in its ruling surprisingly introduced a new and onerous condition for availing input tax credit that Section 16(1) of the CGST Act, 2017, mandates applicant to prove the nexus/connection between the inward supplies and the outward supplies. Since inward supplies of bullion business do not have any nexus to the business of supply of castor oil seeds, the AAR ruled that the applicant cannot utilize the input tax credit balance available for payment of GST liability on outward supply of castor oil seeds. It appears that the AAR has not properly appreciated the scope of Section 16 which basically deals with fundamental conditions for availing input tax credit; once the input tax credit is eligible in terms of Section 16(1) it forms part of the common pool of credit which can be used for payment of output GST liability without having to establish one-to-one correlation.

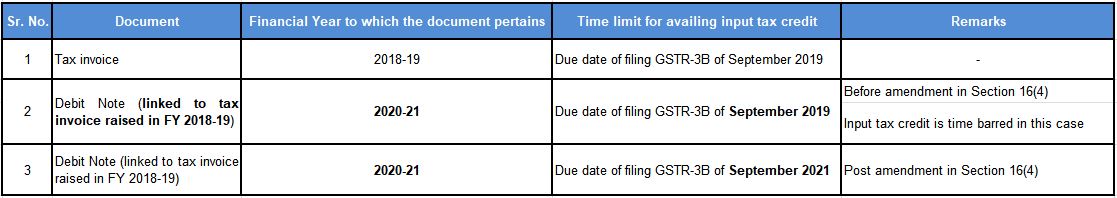

Time limit to avail input tax credit on debit note - AAR rules debit note still ‘not independent’ of original invoice

The Gujarat Authority for Advance Rulings (AAR) in the case of M/s. I-tech Plast India Private Limited disregarded a recent amendment made in Section 16(4) of the CGST Act, 2017 and ruled that the applicant cannot claim input tax credit of GST charged in debit notes issued by the supplier in the financial year 2020-21, towards the original supply transaction pertaining to the year 2018-19.

Before discussing this Ruling, it would be apposite to first understand the legal background around the issue related to input tax credit on debit note. Section 16(4) of the CGST Act, 2017 deals with time limit to avail input tax credit on tax invoice and debit note as the earliest of (i) due date for furnishing GSTR-3B return for the month of September following the end of financial year to which such tax invoice or debit note pertains, or (ii) furnishing of the annual return. For the easy understanding, we have explained in the below table the time limit to avail input tax credit in different scenarios:

Before amendment in Section 16(4), time limit to avail input tax credit on debit note was linked to original tax invoice date. Due to this, taxpayers were not able to claim input tax credit on debit note due to time limit restriction under Section 16(4) in the pre-amendment period. See scenario explained at serial number 2 in above table. From 1 January 2021, the amendment in Section 16(4) de-links debit note from the original tax invoice for determining time limit to avail input tax credit. It appears that the amendment is aimed at enabling taxpayers to avail input tax credit on debit notes as can be seen from the third scenario in the above table.

The AAR, however, squarely took a divergent view in the present case where it observed that the aforesaid amendment to Section 16(4) had not resulted in any drastic or far-reaching change in the operation of Section 16(4). Even after the amendment, it observed that debit note is essentially linked to original invoice and is not an independent document in itself. Thus, even if a debit note is issued in a different financial year than that of the original invoice, it would still be linked to the year in which the original invoice was issued for determining the time limit under Section 16(4). Thus, the AAR rejected the input tax credit of GST paid on debit note on the ground that it is barred by time prescribed under Section 16(4).

Input tax credit not eligible on promotional goods/materials

The Karnataka Appellate Authority for Advance Rulings (AAAR) in the case of M/s. Page Industries Limited ruled that promotional goods/materials used by appellant in its brand promotion and product marketing can be considered as ‘inputs’ within the meaning of Section 2(59) of the CGST Act, 2017. However, it also ruled that input tax credit on such promotional goods/materials would not be eligible in terms of the provisions of Section 17(2) read with Section 17(5)(h) of the CGST Act, 2017.

The appellant in this case is engaged in the manufacture, distribution and marketing of knitted and woven garments under the brand name “JOCKEY” and swimwear and swimming equipment under the brand name “SPEEDO”. In terms of agreements with franchisees/ exclusive brand outlets the appellant is under a contractual obligation to provide promotional materials such as gondola racks, wall shelves, storage units, etc. On this point, on a perusal of the various provisions of the GST law, including scope of the term ‘supply’, Schedule I transactions and various other definitions etc., the AAAR noted that supply of the said promotional items is without consideration and thus, in the nature of non-taxable supply/ exempt supply. Therefore, the AAAR held that GST paid on procurement of the aforesaid promotional items is not eligible for input tax credit.

Further in this case, the appellant also provides other promotional items such as carry bags, calendars, diaries, pens etc., embossed/engraved with the brand name to its franchisees, distributors and retailers for the purpose of giving away to the customers. On this point, the AAAR noted that this is also in the nature of non-taxable supply and the appellant is not eligible for input tax credit on the said promotional items. AAAR also noted that there is an additional disentitlement under Section 17(5)(h) which provides that goods which are disposed by way of gift are not eligible for input tax credit.

CENVAT Credit reversal not required on profit earned on redemption of mutual funds

At the outset we state that this judgement is under the erstwhile service tax law. In an interesting case, the Hon’ble CESTAT Bangalore in the case of M/s. Ace Creative Learning Private Limited, had an opportunity to decide eligibility to CENVAT Credit in case of profit earned from redemption of mutual fund investments.

Under the erstwhile service tax law, CENVAT Credit was restricted when the assessee derives its income from taxable as well as exempt supplies. Interestingly, trading in goods (including mutual funds) was treated as exempt supply. The department in this case demanded proportionate reversal of CENVAT Credit on common input services in proportion to the quantum of profit earned from redemption of mutual funds. The Hon’ble CESTAT observed that ‘trading’ in mutual fund, which is treated as exempt service, is different from ‘investment and redemption’ of mutual fund. In the absence of a license from the SEBI, the appellant was not permitted to trade in mutual fund units. Thus, the appellant could not transfer mutual fund units to any third party and could only get the mutual fund units redeemed from the mutual fund. Thus, the Hon’ble CESTAT held that CENVAT Credit reversal is not required because redemption of mutual funds is different from trading in mutual funds.

As regards invocation of extended period of limitation and allegation of suppression of facts in this case, the Hon’ble CESTAT also observed that, when the appellant had appropriately reflected the profit on redemption of mutual fund units as “other income” in its financial statements, extended period of limitation cannot be invoked.

It will be interesting to see how the ratio of this judgement will apply under the GST regime because GST law treats transactions in securities (including mutual fund units) as exempt supply for the purpose of computing input tax credit reversal.

Credit card expenses reimbursable to foreign holding company not liable to GST under reverse charge mechanism

In this case, the appellant viz. M/s ICU Medical India LLP is engaged in the business of software development for its ultimate holding company in USA. The appellant followed a practice of raising its invoice for software development on ‘cost plus markup’ basis, meaning all the costs which it incurred essentially formed a part of its billing. Appellant’s employees inter alia incurred travel related expenses in the course of their employment. Towards such travel related expenses, foreign holding company had issued credit cards to appellant’s employees. The settlement of such credit card bills was initially done by the foreign holding company with the card issuing bank and later claimed reimbursement at actuals from the appellant by raising an invoice. The Tamil Nadu AAR had earlier held that such reimbursement to foreign holding company is liable to GST as import of services at the rate of 18%. Being aggrieved, the appellant appealed against the AAR order.

The AAAR modified the order of the AAR and held that GST is not payable on the reimbursement of credit card expenses to foreign holding company. While arriving at its conclusion, the AAAR observed that the fact of reimbursement does not result in any transaction on its own. Such reimbursement is only for the purpose of restoring the appellant company’s accounts to previous position for operational convenience so that the same could be later included in the software development charges invoiced by the appellant to the overseas holding company. AAAR finally held that such reimbursements are nothing but part of software development billing and consequently part of the taxable value of services of the appellant.

Customs update

Government notifies new regulations for verification of identity of Importers and Exporters

The Government has notified the new regulations viz. the Customs (Verification of Identity and Compliance) Regulations, 2021 for verification of identity of the importer or the exporter. These new regulations would apply to the following class of persons:

- Persons who are newly engaged in import or export activity after the commencement of these regulations (it may be noted that these regulations are not yet effective, and the Government would notify the date from when they would come into force);

- Customs broker; and

- Existing importer or exporter who has availed refunds, duty drawbacks, exemptions, licenses etc. and who have been selected by the Commissioner of Customs for the purpose of verification of identity under the aforesaid regulations.

Verification process involves (i) verification of entity level documents, (ii) verification of PAN and Aadhar of authorized person/signatory, and (iii) physical verification of business premises. Failure to comply with these regulations may attract penalty as well as temporary suspension of import/export clearances, other benefits such as refunds, duty drawback, exemption etc.

Due Dates

Important Due Dates - May 2021

GST due dates in the month of May 2021

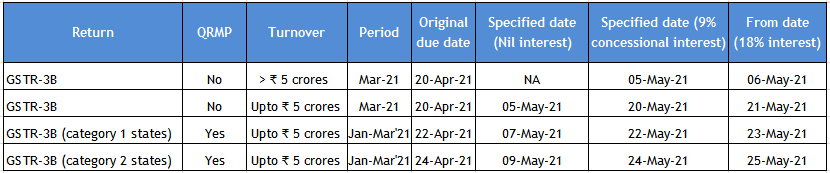

Due dates with relaxation in interest rates for delay in payment of GST

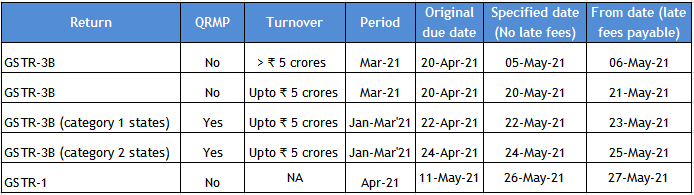

Due dates with relaxation in late fees for delay in filing of GST compliance returns

Category 1 States: Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep

Category 2 States: Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi

SINGAPORE UPDATES

Accounting and Corporate Regulatory Authority (ACRA) Latest Updates

1) Further Extension of Duration of Alternative Arrangements for Conduct of Meetings

On 6 April 2021, the Ministry of Law announced the extension of the duration of the COVID-19 (Temporary Measures) (Alternative Arrangements for Meetings for Companies, Variable Capital Companies, Business Trusts and Debenture Holders) Order 2020 (the “Meetings Order”) beyond 30 June 2021. This will provide entities with greater legal certainty to plan their meetings, and the option to hold virtual meetings to minimise physical interactions, amid the continuing COVID-19 situation.

The Ministry of Law had earlier announced that the Meetings Orders would apply for the period starting on 27 March 2020 and ending on 30 June 2021. The Meetings Order will now extend beyond 30 June 2021, until it is revoked or amended by the Ministry of Law. Accordingly, until such time, issuers may continue to utilise the Checklist issued by ACRA, MAS and SGX RegCo to guide entities on the conduct of their general meetings.

To provide certainty to entities organising meetings, the Ministry of Law will give at least 6 months’ advance notice before the alternative arrangements cease to be available. This is to cater to entities who have relied on the Meetings Order to make early preparations for meetings before the end date is announced.

Other Updates

1) Singapore IP Strategy 2030 launched

On 26 April 2021, the Singapore IP Strategy (SIPS) 2030 (“SIPS 2030) was launched at the virtual World IP Day 2021 event hosted by the Intellectual Property Office of Singapore (“IPOS”), led by an inter-agency committee comprising over 10 government agencies. The 10-year blueprint builds on the 2013 IP Hub Master Plan and comprises the following three interlinked thrusts:

- Strengthen Singapore’s position as a global hub for intangible assets (“IA”) and intellectual property (“IP”)

- Attract and grow innovative enterprises using IA/IP.

- Develop good jobs and valuable skills in IA/IP.

Below is the summary of the SIPS 2030 recommendations highlighted in the media release jointly issued by the Ministry of Law, Ministry of Finance, Ministry of Trade, and Industry and IPOS:

- Develop a next generation IP filing system to support innovators and enterprises by mid-2022.

- Establish Singapore as an IP dispute resolution hub by continuing to strengthen IP dispute resolution capabilities through working with law schools and professional training providers, building a pool of technical experts and promoting Singapore’s IP dispute resolution offerings globally.

- Strengthen ASEAN and global linkages to support enterprises internationalisation efforts better.

- Build a pool of IA/IP valuation professionals in Singapore.

- Provide an IA/IP disclosure framework and guidelines to help enterprises better communicate the value of their IA/IP.

- Promote IA/IP skills and competencies in job roles involved in innovation.

- Work with stakeholders to develop a set of nationally recognised standards and certification programmes that can be adopted by the industry.

2) Strengthening AML/CFT controls of digital payment token service providers

The Monetary Authority of Singapore (MAS) has published a guidance infographic setting out an overview of MAS’ anti-money laundering requirements, and related supervisory expectations for the Digital Payment Token (DPT) sector (Infographic). The Infographic is intended to raise industry awareness among DPT service providers of money laundering and terrorism financing (ML/TF) risks in the sector, and to provide additional information to such service providers to support their implementation of effective controls.

This update highlights key elements in the Infographic pertaining to: (a) Financial Action Task Force (FATF) standards and recent developments; (b) ML/TF risks in the DPT sector; and (c) an overview of MAS’ AML/CFT requirements and expectations for the DPT sector.

3) MAS report on critical infrastructure for an inclusive digital economy

The Monetary Authority of Singapore (‘MAS’) released, on 26 April 2021, its report on the foundational digital infrastructure necessary for an inclusive digital economy and seamless cross-border transactions. In particular, the report highlights the importance of systems that allow different users and digital devices to interact with one another and aims to assist both public sector agencies and organisations in the financial and technology sectors to better understand the key value drivers of strong digital infrastructures.

Specifically, the report outlines the following four key pillars needed for an effective foundational digital infrastructure:

- digital identity to ensure authentication and validation of an individual’s identity, while protecting privacy and security of information;

- authorisation and consent to ensure transparent and secure digital transactions through authorised use of data and mechanisms for obtaining users’ consent;

- payments interoperability; and

- data exchange to enable users to make their data accessible to third parties for the benefit of the users.

IRAS- Due dates

Form C-S/C for the FY 2020 -30 – November 2021

Estimated Chargeable Income (ECI) (Mar year-end)- 30 – Jun 2021

GST Return: April 2021 – Jun 2021- 31 – July 2021