Company Law

ECB 2 returns for the month of February 2021 to be filed on or before 7 March 2021.

In terms of Companies (Compromises, Arrangements and Amalgamations) Amendment Rules, 2021 dated 1 Feb 21, the scheme of merger or amalgamation between two or more start-up companies or one or more start-up company with one or more small company may be taken up with the approval of Central Government instead of taking the NCLT route.

DIRECT TAX

Circulars/Notifications/Press Release

Extension of last date for completion of Assessments/Re-assessments.

Notification No. 10/2021 in S.O. 966 (E) dated 27/02/2021

• Where, as per CBDT Notification No. 93/2020 dated December 31, 2020, the time limit for completion of assessment/reassessment expires on March 31, 2021, the time limit has been extended to April 30, 2021. For cases not covered by earlier notification, CBDT has extended the time limit to September 30, 2021.

• CBDT has extended the due date for passing of order imposing penalty under Chapter XXI to September 30, 2021.

• CBDT has also extended the deadline for completion of assessment under Prohibition of Benami Property Transaction Act, 1988 to September 30, 2021.

CBDT further extends VsV deadline to March 31, 2021

Notification No. 10/2021 in S.O. 966 (E) dated 27/02/2021

• CBDT has further extended the date of filing declaration under Direct Tax Vivad se Vishwas Act, 2020 (VsV) from February 28, 2021 to March 31, 2021.

• It has also extended the dates of making payment under the third and fourth columns of table under Sec. 3 of VsV to April 30, 2021 and May 1, 2021, respectively

Case Laws

ITAT: No negative working-capital adjustment for captive-service provider

Lam Research (India) Private Limited vs DCIT, Bengaluru IT(TP)A No 2490 of 2017 dated 03 February 2021

• The assessee was engaged in the business of providing IT and ITES service.

• The learned TPO made additions in the IT segment and this was upheld by the DRP.

• Aggrieved by the same, the assessee preferred an appeal to ITAT.

• One of the interesting grounds the assessee raised, was not to provide negative working capital adjustment while computing the NCP.

• The assessee has submitted that he does not bear any expense for meeting working capital requirement. Further, he does not bear any risk related to working capital and market as the services are provided to only one party.

• It was held that negative working capital adjustment shall not be made in case of a captive service provider as there is no risk and it is compensated on a total cost-plus basis.

ITAT: Treats forex-loss operating, considers it part of base for charging markup on cost plus basis

CPA Global Support Services India Private Limited vs ACIT, Delhi ITA No. 1524/Del/2017 dated 03 February 2021

• The assessee is engaged in the business of ITES.

• The TPO recomputed the search and made an addition in his order. Further, he considered foreign exchange fluctuation as ‘non-operating’ while computing the NCP.

• The same was upheld by the DRP too.

• In ITAT, assessee submitted that the invoices were made in USD to its AEs. The forex risk was borne by the company.

• Being a cost-plus company, it also formed part of total base of the taxpayer for the charging a mark up to its AEs.

• ITAT directed DRP/TPO/AO to treat the same as operating item.

ITAT: Quashes re-opening citing reasons recorded by non-jurisdictional AO

G.K. Business Centre (P) Ltd. Vs ITO Ward (14), Delhi, ITA 828/Del/2020 Dated 11 February 2021

• The case was selected for reassessment proceedings. The notice was issued by Jurisdictional AO. But the reason for reopening was recorded by a non-Jurisdictional AO.

• Further the proceedings were done by non-Jurisdictional AO and the final order were passed by the Jurisdictional AO.

• The appeal was made by the assessee to quash such illegal proceedings and set aside the order issued.

• ITAT stated that the notice in this case has been issued without recording of reasons as the same was recorded by the non-Jurisdictional AO.

• Hence the proceedings under section 147/148 is void ab initio and without jurisdiction and the same is quashed.

Section 50C can-not be invocable in the case of letter of intent

Raminder Singh vs ITAT Chandigarh [ITA No. 1270/Chd/2019]

• The Assessee had purchased a land which was compulsorily acquired by GMADA.

• The assessee received letter of intent allocating three residential plots in lieu of the acquisit ion.

• Assessee sold the same in AY 2015-16 and computed Long term capital gain and also, claimed exemption u/s 54F.

• AO invoked Section 50C (comparing the sale amount with stamp duty) and recomputed the long -term capital gain.

• Aggrieved with this, Assessee went to ITAT. ITAT held that ‘ LOIs only confer a right to own development land of specific area, to be developed and also to be identified at a future point in time, not in present.’

• LOI can not be equated to land or building, hence Section 50C cannot be invoked.

Overriding effect of Land- Acquisition Act

The ACIT vs SV Global Mill Limited [ITA No. 2684/CHNY/2019]

• The assessee is a real estate developer who had received interest on delayed compensation received from compulsory acquisition of land and claimed the same as exempt from income tax in accordance with Section 96 of RFCTLARR Act, 2013.

• Revenue made an addition of the same considering it as an income under other sources.

• Aggrieved assessee appealed before CIT(A) and held that interest received falls under the definition of compensation of acquisition for land , which is specifically exempted u/s 96 of the said act and hence cannot be brought to tax under income tax laws.

• Aggrieved Revenue filed an appeal before ITAT. ITAT observes that Cost of acquisition under the said act includes any enhanced compensation or interest thereon. Also, refers CBDT Circular where it has been clearly explained that compensation received in respect of award or agreement which has been exempted from income tax vide Section 96 of the said act, cannot be taxed under income tax.

ITAT: Confirms levy of fees u/s 234E on belated TDS returns pertaining to pre-Jun'15 period

Special Judge Court SC/ST Vs ITO (TDS) ITA No.1086/JP/2019

• Jaipur ITAT upholds levying fee u/s. 234E for belated filing of TDS return for AY 2014-15 filed on October 2017

• The machinery provision for Sec. 234E coming into effect June 1, 2015

• However, restricts levy only from June 1, 2015 to the date of actual filing of TDS return

• Explains that ‘where the TDS statements have been filed after 01.6.2015 and processing thereof happens and intimation issued thereafter, the Assessing officer is well within his jurisdiction to levy fees under section 234E of the Act.’

ITAT: Flat booking equivalent to construction of house; Applies extended 3 years timeline to grant Sec.54 benefit

Smt. Harminder Kaur V.ITO ITA No.2656/Del./2017

• Delhi ITAT holds that booking of flat is equivalent to construction of house and deduction u/s 54 is available if such investment is made within three years;

• Revenue denied assessee’s deduction claim u/s 54 on following grounds:

• Flat booking is not construction

• Assessee had not obtained possession of the flat within 3 years

• Capital gain has neither been invested in purchase or construction of residential house within the stipulated period, nor deposited in capital gain scheme account within limit provided Sec.139(1);

• ITAT remarks that ‘The prime requirement is investment in new residential house within the prescribed period.’ Relies on plethora of rulings including Karnataka HC ruling in Fathima Bai and Punjab and Haryana HC in Jagtar Singh Chawla wherein it was held that exemption u/s 54 can be availed if the full amount of capital gain is utilized within time limit u/s 139(4)

ITAT: Confirms Sec.69A addition for cash deposits during demonetization, rejects ‘matrimonial dispute settlement’ plea

Leela Devi Vs ITO ITA No.1423/Del.2020 dated 01/02/2021

• Delhi ITAT upholds addition made u/s 69A in case of assessee-individual for AY 2017-18 with respect to cash deposits made during demonetization period;

• Assessee contended that the cash so deposited included savings, cash withdrawal from bank account and withdrawal from loan account during FY 2014-15 in anticipation of settling the matrimonial dispute between her son and daughter-in-law, which was not settled until after demonetization and thus, the unutilised amount was deposited into the bank account;

• As regards the contention of settling matrimonial dispute, ITAT observes that the assessee had no reason to keep the cash at home when the dispute was settled in 2019, remarks that ‘it is a story created by the assessee which has no connection whatsoever with the money withdrawn from the Bank.’

No Sec. 40A(2) disallowances on payment made to sister-in-law as she isn’t 'relative' as per Sec. 2(41): ITAT

Rajesh Bajaj Vs.DCIT IT Appeal Nos.249 & 261 (ALL) of 2018

• Assessing Officer (AO) noted that assessee had paid rent for various godowns and shops to persons specified under Section 40A(2) and disallowed the excess rent paid

• Assessee contended that the person to whom rent was paid, i.e., his sister-in-law, does not fall within the definition of relative as provided under Section 2(41). Thus, the provision of section 40A(2) couldn’t be invoked.

• On appeal, Allahabad ITAT held that the definition of the term ‘relative’ provided under section 2(41) does not cover the sister-in-law of assessee. However, sister-in-law of assessee is covered within the definition of the term ‘relative’ as provided under section 56(2).

• Since the definition provided under 56(2) is only for the relevant clause provided under section 56(2), therefore, the same couldn’t be applied in respect of provisions of section 40A(2) when a general definition of the term ‘relative’ is provided under section 2(41).

ITAT: Allows exemption u/s 54F on purchase of residential house for dependent widowed daughter

Shri Krishnappa Jayaramaiah Vs Income Tax Officer ITA No.405/Bang/2020 dated 22/02/2021

• This appeal by the assessee is directed against the order of CIT(A)

• Assessee’s submission: 54F deduction must be allowed despite investing the entire sale consideration of a property received by inheritance in the name of his daughter

• Brief facts: The assessee invested the sale consideration received on the sale of Capital Assets in purchase of residential property in the name of his married widow daughter. She along with her children are staying with the assessee and she is having no independent source of income. The residential site purchased in her name and constructed residential house.

• The assessee and other family members are the sole owners of the property which is sold and the Capital Gain arising out of the sale of the said property was declared in individual name using their PAN.

• The assessee claimed deduction u/s 54F of the Act on the capital gains in his return.

• However, the ld. DR submitted that the sale consideration received by the assessee was invested in his married widowed daughter on which the assessee claimed exemption u/s. 54F of the Act which is not permitted. According to ld. DR, the investment shall be made in the name of assessee himself, not in the name of his married widowed daughter. The ld. DR argued that the assessee is not eligible for exemption u/s. 54F of the Act.

• Being so, the ITAT held that the statute should be construed liberally; since the provisions that permit economic growth have to be interpreted liberally, to advance the objective of the provisions not to frustrate it.

• ITAT directed the AO to grant exemption u/s. 54F of the Act on the amount invested in purchase of residential house in his daughter’s name.

Gujarat HC: Sums paid under IDS, 2016 neither adjustable nor refundable

Yogesh Roshanlal Gupta V. Central Board of Direct Taxes, R/Special Civil Application No. 2148 of 2019 dated February 4, 2021

• Assessee’s writ petition praying to adjust the sums paid in earlier instalments to third instalments was dismissed by HC.

• HC notes that the assessee defaulted in paying third instalments and the declarants under IDS Scheme are expected to strictly adhere to the prescribed time limits.

• Accepts Revenue’s contention of paying the delayed amount along with 12% interest.

Other Updates

India to file appeal against Cairn's $1.2 billion arbitration award

• The case pertains to the ₹ 24,500-crore tax demand on capital gains made by the oil major in reorganising its India business in 2006-07.

• It also includes reversing dividend as well as tax refund that the government had seized, and shares that the I-T department had sold to recover part of the demand.

• India had argued, during the Cairn arbitration, that non-compliance with the tax demand was not covered under international treaties.

• In discussions between finance ministry officials and Cairn Energy CEO Simon Thomson – and his team, appears the government wants Cairn to settle the dispute using the Vivad se Vishwas scheme; under the scheme, the company will have to pay around half the amount due sans interest and penalties.

• Cairn moves US District Court to confirm, recognize, enforce arbitral award. In the US, the Foreign Sovereign Immunities Act of 1976 provides that a foreign state is immune to suit in any court in the US except for certain statutory exceptions and grants the US District Courts jurisdiction over foreign states in cases where the foreign state has waived its immunity either explicitly or by implication; Cairn argues that India has waived its immunity from suit and from an action to enforce an award and raises various grounds for enforcement of the award.

Croatia, Malaysia finalize multilateral tax treaty

• Croatia and Malaysia have deposited their instrument of ratification for the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI).

• The MLI will enter into force for those countries on June 1, 2021.

• The ratifications now bring to 63 the number of jurisdictions that have ratified, accepted, or approved it.

OECD renews Action 5 peer review process to improve transparency on tax rulings

• The OECD Forum on Harmful Tax Practices (FHTP) has been conducting reviews of preferential regimes in order to determine if the regimes could be harmful to the tax base of other jurisdictions.

• Action 5 is among the four BEPS minimum standards others being countering tax treaty abuse (Action 6), transfer pricing documentation and country-by-country (CbC) reporting (Action 13) and improving dispute resolution mechanisms (Action 14).

• Action 5 comprises three key areas – firstly, the assessment of preferential tax regimes to identify features of such regimes that can facilitate BEPS, and therefore have the potential to unfairly impact the tax base of other jurisdictions.

• Secondly, the peer review and monitoring of the Action 5 transparency framework through the compulsory spontaneous exchange of relevant information on taxpayer-specific rulings which, in the absence of such information exchange, could give rise to BEPS concerns.

• Thirdly, the review of substantial activities requirements in no or only nominal tax jurisdictions to ensure a level playing field.

Dominica is added to the EU list of non-cooperative jurisdictions; Barbados removed

• The list includes jurisdictions worldwide that either have not engaged in a constructive dialogue with the EU on tax governance or have failed to deliver on their commitments to implement the reforms necessary to comply with a set of objective tax good governance criteria.

• The criteria relates to tax transparency, fair taxation and implementation of international standards designed to prevent tax BEPS.

CBDT releases MLI synthesised text for India-Norway DTAA

• The synthesised text for India-Norway DTAA released by CBDT incorporates the changes made by the MLI on the basis of respective positions taken by both countries. The MLI provisions that are applicable are included in boxes in the relevant provisions of convention.

I-T Dept conducts searches on group running multi-specialty hospital in Srinagar

• The group runs the biggest private multi-specialty in Jammu & Kashmir’s Srinagar.

• It allegedly has unaccounted asset transactions of more than ₹100 crore in cash since 2013-14.

• Seven locations were searched during the operation.

• During the searches, the agency seized ₹82.75 lakh in cash and jewellery/bullion worth ₹35.7 lakh. One bank locker has been sealed.

• The alleged suppression of receipts from the hospital operations is being probed.

• Besides, there is a substantial default of tax-detected at source on almost all the purchases and sales.

I-T Dept detects over ₹ 450 Crores black income after raids on MP-based soya group

• Undisclosed income of over ₹ 450 crore after its raided a Madhya Pradesh-based Soya products manufacturing group.

• The group has introduced unaccounted income to the tune of ₹ 259 crore by way of introduction of share capital at huge premium from Kolkata-based shell companies.

• CBDT alleged that the group has also introduced undisclosed income of ₹ 90 crore in its books of accounts by way of sale of paper investments in shell companies to another set of shell companies of Kolkata.

• Alleged bogus loss to the tune of Rs 52 crore has been claimed by the group to suppress their profits.

• The CBDT said various companies were formed in the name of employees to carry out these transactions, while there was no actual business carried out between them.

• The group has also allegedly claimed incorrect Long Term Capital Gains (LTCG) exemption of over ₹ 27 crore on sale of shares of a group entity.

Income tax dept detects ₹ 335-Crores black money after raids on Pune tobacco group

• Profit on un-recorded transactions of sale of real estate amounting to ₹ 9 crore has been accepted by the assessee.

• Total undisclosed income amounting to ₹ 335 crore has been detected so far, CBDT alleged.

Karnataka HC to hear Flipkart's petition on taxability of employees' secondment as FTS

• Flipkart entered into a Master Service Agreement with Walmart under which Walmart seconded its employees to Flipkart.

• Walmart paid salaries to its seconded employees and the same have been reimbursed by Flipkart by deducting TDS u/s 192 on cost-to-cost basis.

• On the same ground, Flipkart made an Application to AO u/s 195(2) and this was rejected on the basis that the payment made to Walmart were of the nature of FTS amenable to withholding obligation u/s 195.

• Given the payment is on cost-to-cost basis and has no income component, it should not be liable for any TDS obligation.

Income Tax Department conducts searches in Tamil Nadu

• During the search, it was found that about 50% of the transactions were out of the Books.

• A total of 220 crores representing 100 crores of suppressed income and the remaining undisclosed income – share premium through shell companies.

Engineering Analysis Centre of Excellence Pvt Ltd. v. CIT (CA 8733-8734 of 2018)

Introduction:

The prolonged controversy with respect to the taxability of sale of software licenses and/or sale of copies of software is finally put to rest by the Apex Court in its decision in this case. This ruling has provided respite and certainty to the scope of the meaning of the word ‘copyright’ and the consequent characterization of consideration as ‘royalty’.

• This appeal by the assessee is directed against the order of CIT(A)

• Assessee’s submission: 54F deduction must be allowed despite investing the entire sale consideration of a property received by inheritance in the name of his daughter

• Brief facts: The assessee invested the sale consideration received on the sale of Capital Assets in purchase of residential property in the name of his married widow daughter. She along with her children are staying with the assessee and she is having no independent source of income. The residential site purchased in her name and constructed residential house.

• The assessee and other family members are the sole owners of the property which is sold and the Capital Gain arising out of the sale of the said property was declared in individual name using their PAN.

• The assessee claimed deduction u/s 54F of the Act on the capital gains in his return.

• However, the ld. DR submitted that the sale consideration received by the assessee was invested in his married widowed daughter on which the assessee claimed exemption u/s. 54F of the Act which is not permitted. According to ld. DR, the investment shall be made in the name of assessee himself, not in the name of his married widowed daughter. The ld. DR argued that the assessee is not eligible for exemption u/s. 54F of the Act.

• Being so, the ITAT held that the statute should be construed liberally; since the provisions that permit economic growth have to be interpreted liberally, to advance the objective of the provisions not to frustrate it.

• ITAT directed the AO to grant exemption u/s. 54F of the Act on the amount invested in purchase of residential house in his daughter’s name.

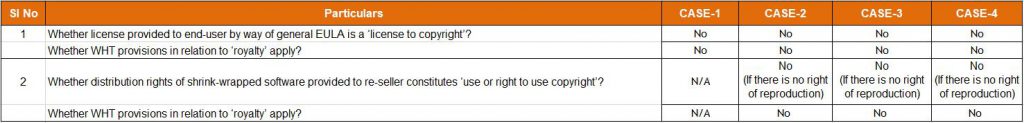

Decision Summary:

a) The Court held that ‘use or right to use’ a software is distinct from acquiring a ‘copyright’ or ‘license to copyright’ per se. Any acquisition of distribution rights (by re-sellers of software) or usage rights by virtue of the End User License Agreement (EULA) would in no manner constitute acquisition of copyrights or license to use such copyrights. Consequently, the Court held that payment made by the re-sellers of software or by end-users would not constitute royalty and thus withholding tax provisions in relation to such payment would not arise.

b) Further, the provisions of the domestic tax law which have a broader reach to deem a transfer as transfer of copyright do not over-ride the narrower definition envisaged in the DTAA and wherever applicable, the articles of DTAA should be accepted.

Cases covered by the Ruling:

The Court has provided the ruling to cover 4 broad scenarios as could be summarized from the spate of appeals covered by it:

CASE-1: Software purchased by end-user from a non-resident supplier (usage rights transferred by EULA).

CASE-2: Indian distributors acquiring software from non-resident suppliers (under a re-marketer agreement) and selling the same to end-users (usage rights transferred by EULA).

CASE-3: Non-resident distributors acquiring software from non-resident suppliers (under a re-marketer agreement) and selling the same to resident Indian distributors/end-users.

CASE-4: Software which is a part of an overall package of hardware and software components (forming a single equipment) sold to resident Indian distributors/end-users by non-resident suppliers.

Application of the Ruling in the given cases (where DTAA is applicable):

What constitutes ‘copyrights’ as far as Computer Software is concerned:

Following acts are held to be copyrights and have to be carefully looked into when considering granting an EULA or drafting a distribution agreement

a) Right of reproduction and storage of software (except for the limited purpose of using a legally obtained copy for maintaining a temporary back-up to guard against losses/corruption of data).

b) Right to issue copies to the public, except those copies which are not in circulation (excluding the right of a legal distributor of such software in shrink wrapped format to distribute the copies held by him vide the distribution agreement).

c) Right to perform/communicate the work in public.

e) Making a film / recording in respect of the work (excluding reviews / criticism of the product).

f) Right to translate / adapt the software.

g) Right to sell / offer to sell or commercially rent / offer to commercially rent software (except the right of a legal distributor of such software in shrink wrapped format to distribute the copies held by him vide the distribution agreement).

Goods and Services Tax

GST litigation update

Karnataka Appellate AAR overrules AAR ruling - liaison office not liable to pay GST on reimbursement received from head office

Earlier the Karnataka Authority for Advance Rulings (AAR) in the case of M/s Fraunhofer-Gessellschaft Zur Forderung der angewwandten Forschung e.V, Germany – Liaison Office had ruled that liaison office is required to obtain GST registration and would be liable to pay GST. This Ruling conflicted with the decisions of Rajasthan and Tamil Nadu AAR who had held that liaison office is not liable to pay GST. The Applicant in this case approached Appellate Authority for Advance Rulings (AAAR) against the decision of AAR. Appellate AAR in this case noted that the liaison office is not allowed to undertake any business activity in India or enter into any business contracts in its name. It is allowed to undertake only liaison activities, that is to say, act as a channel of communication between the Head Office in Germany and parties in India. It also cannot earn any income in India either by way of commission/fee or any renumeration. Thus, the inward remittance in foreign exchange received by the liaison office from its head office for maintaining the office in India cannot be termed as a consideration for the liaison activity. AAAR also noted that the liaison office is registered with the Registrar of Companies in the same name as the parent foreign company and it does not have a separate legal existence in law. Thus, the liaison activity performed for the parent company is in the nature of a self-service and hence, cannot not come within the purview of ‘supply’ under GST. Based on these grounds, AAAR set aside the AAR order.

Input tax credit required to be reversed on inputs consumed in manufacture of intermediate/finished product destroyed in fire

The facts in this case are that a fire broke out at the warehouse of the Applicant viz. M/s Jay Chemical Industries Ltd. The Applicant sought clarification whether they are required to reverse input tax credit on inputs consumed in intermediate/finished products which are destroyed in fire. The Applicant contended that Section 17(5)(h) of the CGST Act, 2017 which deals with reversal of input tax credits in respect of goods lost, stolen, destroyed etc., has no application in their case. According to the Applicant, the said Section provides for reversal of input tax credits availed on finished goods and not on inputs contained in finished goods. AAR however rejected this contention of the Applicant and held that registered person can avail credit of tax paid on the inward supply of goods or services or both, which are used or intended to be used in the course or furtherance of business. According to AAR, since the said inputs and capital goods have been used in manufacture of finished goods that have been destroyed, the same are not used in course or furtherance of business. Thus, the AAR ruled that the Applicant is required to reverse input tax credit on inputs consumed in manufacture of intermediate/finished product destroyed in fire.

Customs update

Compulsory to update Importer Exporter Code (IEC) details every year

Directorate General of Foreign Trade (DGFT) has issued Notification 58 to provide that application for amendment in IEC registration is required to be made online on DGFT website. Further, it has been made mandatory to update IEC details online every year during April-June period. Even in case there are no changes in IEC details, IEC holders are required to confirm the same online. IEC may be deactivated temporarily if it is not updated in a timely manner.

Government extends interim solution for pending IGST refunds in case of mismatch between GSTR-1 and GSTR-3B for shipping bills filed up to 31 March 2021

Vide Circular 12/2018-Customs, Central Board of Indirect Taxes and Customs (CBIC) had provided a solution to exporters to clear their pending IGST refunds due to mismatch between GSTR-1 and GSTR-3B returns. This solution was limited to shipping bills filed up to 31 March 2019. Considering that the mismatch still persists for the shipping bills filed for the subsequent period, CBIC has decided to further extend the interim solution for shipping bills filed from 1 April 2019 up to 31 March 2021. Exporters are required to submit the corresponding CA certificate for the financial years 2019-20 and 2020-21 by 31 March 2021 and 30th October 2021 respectively.

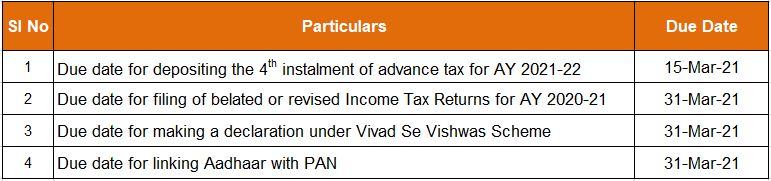

Due Dates

Important Due Dates, March 2021

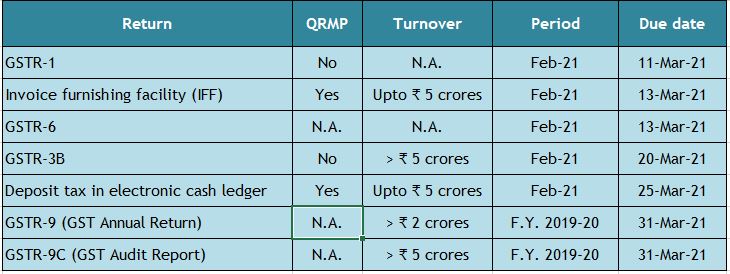

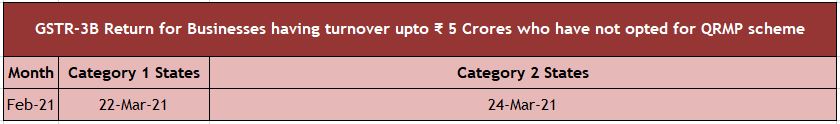

GST Compliance Calendar

Category 1 States: Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep

Category 2 States: Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi

SINGAPORE UPDATES

Accounting and Corporate Regulatory Authority (ACRA) Latest Updates

1) ACRA issues the revised Code of Professional Conduct and Ethics for Public Accountants and Accounting Entities.

Accounting and Corporate Regulatory Authority (ACRA) has issued the revised Code of Professional Conduct and Ethics (the Revised ACRA Code) for public accountants and accounting entities to adopt the Final Pronouncements relating to the Restructured Code and Revisions to the Code pertaining to the Offering and Accepting of Inducements, issued by the International Ethics Standards Board for Accountants (or IESBA)1. The Revised ACRA Code is set out in the Accountants (Public Accountants) (Amendment) Rules 2021 and will take effect from 1 March 2021.

The Restructured Code retains a principles-based approach and is a complete rewrite of the extant Code under a new structure and drafting convention that makes it easier to navigate and use.

The Revised ACRA Code incorporates amendments made to the definition of a financial institution which is a public interest entity for purposes of the Code. The amendments:

1. Clarify existing terms in the definition referring to “licensed” entities;

2. Update existing terms in the definition to take into account revised regulatory regimes; and

3. Include certain entities that are or will be regulated by Monetary Authority of Singapore (MAS).

2) Cessation of Deposit Service Accounts service from 1 Oct 2021

The Deposit Service Accounts (DSA) service, which is one of the payment options available for customers transacting with BizFile+ and ACRA iShop, will be ceased from 1-October-2021.

Customers can continue to use the wide range of payment options including credit and debit card, PayPal, Google Pay and Apple Pay for their transactions on BizFile+ and ACRA iShop.

BizFile+ users who have set up an account to use the DSA service are encouraged to make arrangements to onboard the available e-payment options and terminate their DSA before 1 Oct 2021, to minimize any inconvenience to their transactions with ACRA.