DIRECT TAX

Circulars/Notifications/Press Release

Press release: Roll out of Annual Information Statement (AIS) for the year 2021-22

- CBDT notifies New Annual Information Statement (AIS) which includes additional information relating to interest, dividend, securities transactions, mutual fund transactions, foreign remittance information, etc.

Notification: CBDT prescribes new form in respect of Production of Cinematography Films

- CBDT prescribes a new form (Form No. 52 A) for submission by a person carrying on production of cinematography films.

Update by ICAI’S UDIN Directorate

- CBDT has extended the last date for updating UDIN’s for all IT Forms at e-filing portal to January 31, 2022

Circular: CBDT clarifies on TDS on sale of goods , TDS on e-Commerce and TCS on sale of goods.

- TDS on E-commerce not applicable on sale / purchase of goods through e-Auction subject to certain conditions. However, other TDS provision like TDS on purchase of goods / TCS on sale of goods will be applicable.

- TDS on purchase of goods has to be calculated only on the value of goods excluding taxes ( like VAT/Sales tax/Excise duty/CST etc.) However, the same has to be shown separately on the invoice.

- CBDT further clarifies that TDS on purchase of goods would be applicable in case any goods are exempted under Tax collected at source.

- CBDT clarifies that Central or State government would not be considered as seller for the purpose of TDS on purchase of goods. However, any other person like public sector undertaking, body, authority owned or established under a Central or State Act will be required to withhold taxes.

Case Laws

A Raymond Fasteners India Private Limited

- In this case, the ITAT held that, for computing arm’s length price for international transaction, foreign Associated Enterprise can be taken as a tested party only if the data/nature of the said entity is not complex, and for which verifiable and reliable information is available. ITAT rejects Foreign AE as a tested party being they were very complex entities in terms of data/nature.

Atlas Copco (India) Limited

- In this case, the ITAT deleted the addition on Royalty, as the payment of royalty was in accordance with the policy of the Government of India under the Foreign Technology Collaboration Agreement.

Bright Enterprise (P.) ltd

- In this case, the ITAT held that while disallowing any expenditure which is excessive or unreasonable over fair market value, it is the duty of the Assessing officer to bring the justifiable market value on record in the assessment order.

Subex Ltd

- In this case, ITAT held that the cost incurred in acquiring companies by purchasing 100% shares cannot be said as to purchase of a Fixed asset. Thus, deduction cannot be claimed as preliminary expenditure.

- Further, it was also held that the share premium collected by the company on the issuance of fresh/additional share capital cannot be taken as a part of the capital employed and cannot be claimed as a deduction.

Synamedia Limited

- In this case, ITAT held that, the company has supplied Set Top Box and other connected components along with embedded software. Receipts from supply of Set Top Box with embedded software cannot be taxed as royalty as end-user only gets the right to use computer software under a non-exclusive license.

L.G. Electronics Inc Ltd

- In this case, ITAT held that it is mandatory for the Assessing officer to complete the assessment in conformity with the DRP directions, failing which the assessment would become non-existent. ITAT also held that the department cannot go for revision of such assessment order.

Sulzer Pumps India Private Limited

- In this case, the assessee failed to an intimate the assessing officer about the appeal filed before Dispute Resolution Panel. AO not knowing this fact passed the final order. High Court set aside final assessment order passed by AO where appeal before Dispute Resolution Panel is still pending.

Parag Kishorchandra Shah

- In this case, the assessee was asked to submit a response to Show cause notice within 24 hours in response to which assessee asked for an adjournment of 10 days. The assessing officer ignored the request and passed an assessment order. Assessee filed writ petition before High court and HC ruled in favor of assessee.

Bharat Petroleum Corporation Ltd

- Adjustment of a refund with outstanding income tax demand without issuance of intimation under section 245 of the Income Tax Act is bad in law, HC directs refund of entire amount along with interest.

Rajeev Suresh Ghai

- Mumbai ITAT observes and states that unexplained investment under section 69 is not taxable as per India – UAE DTAA. ITAT opines that unexplained investment is not an income to be taxed under the DTAA.

Corporate laws

Due Dates under the legislation in Dec 2021 or Jan 2022

- Filing of Form AOC 4, AOC 4 XBRL MGT 7 and MGT 7A to be completed on or before December 31, 2021. For Annual General Meeting conducted as on November 30, 2021 – MGT 7 and MGT 7A to be filed on or before January 29, 2022.

- Filing of Form 8 LLP (Statement of Account and Solvency) to be completed on or before December 30, 2021.

Notifications / Circulars / Amendment issued during Nov 2021

Insolvency and Bankruptcy Board of India has vide Circular No. IBBI/LIQ/45/2021 dated November 15, 2021 clarified that an Insolvency Professional handling voluntary liquidation process is not required to seek any NOC/NDC from the Income Tax Department. This shall speed up the process for Voluntary Liquidation of entities.

Reserve Bank of India vide RBI/2021-22/120 A.P. (DIR Series) Circular No. 16 dated November 8, 2021 permitted Foreign Portfolio Investors (FPIs) to invest in debt securities issued by Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs) under the Medium-Term Framework (MTF) or the Voluntary Retention Route (VRR). Such investments shall be reckoned within the limits and shall be subject to the terms and conditions for investments by FPIs in debt securities under the respective regulations of MTF and VRR.

Goods and Services Tax

Settlement fees payment to foreign entity under Deed of Settlement and Release, liable to IGST under reverse charge – Gujarat AAR

The applicant in this case M/s GSPC (JPDA) Ltd along with other concessionaries entered into a production sharing contract (PSC) for undertaking the exploration activities in the Joint Petroleum Development Area. Due to the applicant-contractor’s material breach of the terms of PSC by reason of failure to meet its Exploration Work Program for the initial period, the applicant was served a notice of termination of PSC with a demand for payment of the estimated cost of exploration not carried out and damages for breach of its local content obligations. Subsequently, the arbitration proceedings were initiated against the applicant which culminated into Deed of Settlement and Release in terms of which the applicant was liable to pay a settlement sum. The applicant sought an advance ruling on whether the payment of settlement fees would qualify as a supply under GST and thereby attract GST levy under the reverse charge mechanism. The applicant argued before AAR that the termination of PSC has arisen due to an unintended event and has not originated from any obligation on the part of any of the parties to tolerate an act and therefore, settlement amount cannot be considered as payment for any kind of supply of services.

The Gujarat AAR on careful consideration of the facts and submissions by the applicant held that the payment of subject settlement amount has not arisen due to a breach of contract of PSC but the same is dependent on the Deed of Settlement and Release which is essentially (i) an agreement to do an act viz. to release the performance guarantee of the applicant, (ii) to tolerate an act or a situation viz. to tolerate non-payment of exploration cost by the applicant. Finally, the Gujarat AAR has held that the applicant is liable to pay GST under reverse charge mechanism on settlement amount paid under the Deed of Settlement and Release.

No separate GST registration required in the State of Import for further sale in same State or different State: Karnataka AAR

The Karnataka AAR in the case of M/s Pine Subsidiary Industry has held that the applicant can issue a Tax Invoice from Karnataka (the State in which he is registered) for the supply of goods imported at Chennai Sea Port and directly sold to customers located in the State of Tamil Nadu, Andhra Pradesh, etc.

The AAR noted that in the present case, though the applicant imports the goods at the port of Chennai, the imported goods are deemed to have been supplied from the location of the importer which is Karnataka State in this case. Since the applicant does not have any place of business in Tamil Nadu and does not maintain any office / fixed establishment in Tamil Nadu or any other state in India other than Karnataka, the AAR held that the applicant is not required to take any separate registration at the place of importation and the applicant can issue Tax Invoice from Karnataka.

No GST on top-up and parental insurance premium recovered from the employees – Maharashtra AAR

The Maharashtra AAR in the case of M/s The Tata Power Company Limited has held that recovery of an amount towards top-up and parental insurance premium from the employees does not amount to supply of any service under the GST law and hence, the same is not liable to GST.

In support of its ruling, the AAR noted that the applicant is not in the business of providing insurance coverage, and secondly, providing employee insurance or parental insurance cover is not a mandatory requirement under any law and therefore, non- providing employee insurance or parental insurance coverage would not affect its business in any manner. Therefore, recovery of the cost of insurance premium cannot be treated as an activity done in the course of business or for the furtherance of business, and therefore, GST is not leviable in this case.

Madhya Pradesh AAR rules on taxability of various employee recoveries

The Madhya Pradesh AAR in the case of M/s Bharat Oman Refineries Limited has ruled on the taxability of various employee recoveries as follows.

Notice pay recovery

At this point, the AAR has held that the recovery of notice pay is a supply of service liable to GST. The AAR in support of its conclusion stated that there can be no dispute about the fact that the applicant as an employer is tolerating the act or situation whereby the employee is not giving the notice for the agreed period before leaving the service of the applicant-company. Thus, by relieving an employee without notice period or by accepting a shorter notice period, the applicant tolerates an act, or a situation created by such action of the employee, which is a taxable activity under GST law.

Recovery of medical insurance premium at actuals from non-dependent parents of employees and retired employees

On this point, the AAR rejected the contention of the applicant that this activity is not in the course or furtherance of the business of the applicant and also does not fall under the definition of “business”. AAR further stated that the applicant, in this case, does not act as a pure agent of the insurance company. Considering this, the AAR has held that the said recovery of medical insurance premium is liable to GST.

Recovery of nominal amount towards canteen facility

The AAR in this regard has held that the applicant is liable to pay GST on the amount recovered from the employees for the canteen facility. Further, according to AAR, the valuation for levy of GST ought to be done in terms of GST valuation Rules since this transaction is between two related parties and nominal value cannot be taken as a basis for discharging GST liability.

The AAR has further held that even if there is no recovery from employees towards the canteen facility, the applicant would still be liable to pay GST. This is considering that the supply between related parties without consideration is covered under Schedule I of the Central GST Act, 2017 and hence liable to GST.

Telephone charges recovered from the employees

At this point, the AAR has held that GST is payable on the recovery of telephone charges from employees since this activity is incidental or ancillary to the business of the applicant.

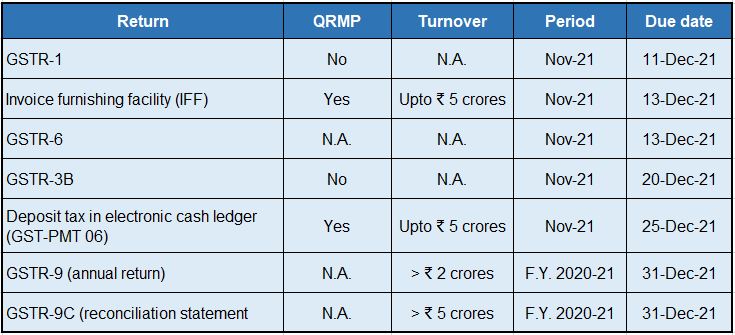

Due Dates

GST Compliance calendar for November 2021

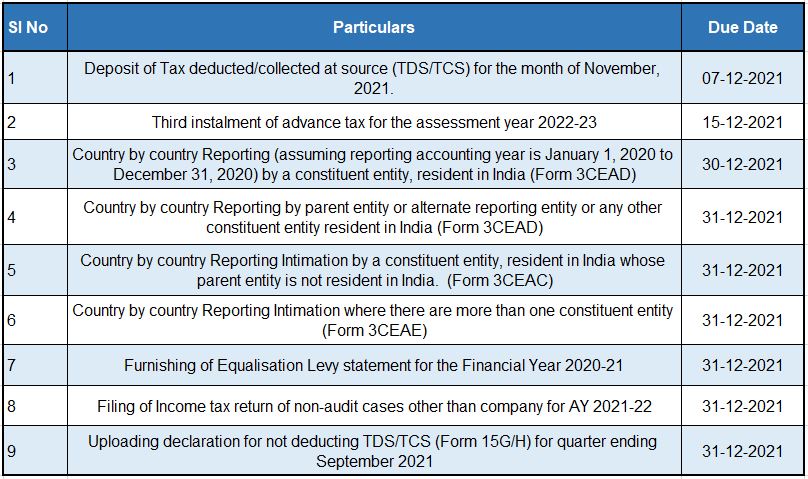

Important Due Dates December 2021

SINGAPORE UPDATES

Accounting and Corporate Regulatory Authority (ACRA)

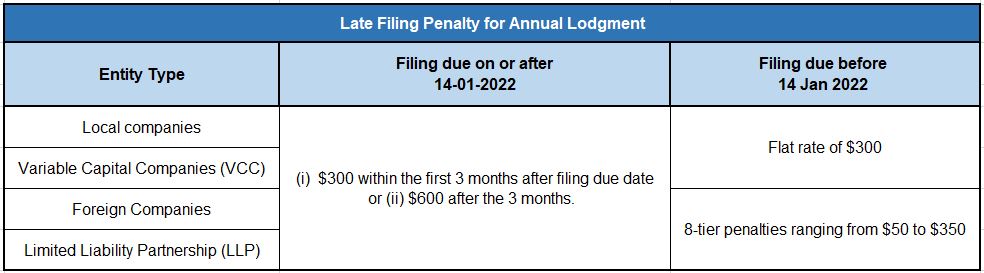

1) Penalty for late filing beyond 3 months to go up to $600 takes effect from 14 Jan 2022

With effect from January 14 2022, there will be higher penalties for late filing of the annual lodgements by Singapore-incorporated companies, Variable Capital Companies (VCCs), and Limited Liability Partnerships (LLPs).

Under the 2-tier penalty framework, first announced in December 2020, the penalty for late filing of the annual lodgements will be $300 within the first 3 months after the due date or $600 if the lodgement is filed more than 3 months after the filing due date. This applies to annual lodgements that are due on or after January 14, 2022. For annual lodgements due before January 14, 2022 the existing penalty framework continues to apply.

Singapore-incorporated companies and VCCs are required to file Annual Returns (AR) within 5 or 7 months after the financial year-end for listed and non-listed companies respectively. LLPs are required to file Annual Declarations (AD) within 15 months of registration and subsequently, once in every calendar year within 15 months of the last lodgement.

The changes to the penalty framework are set out below:

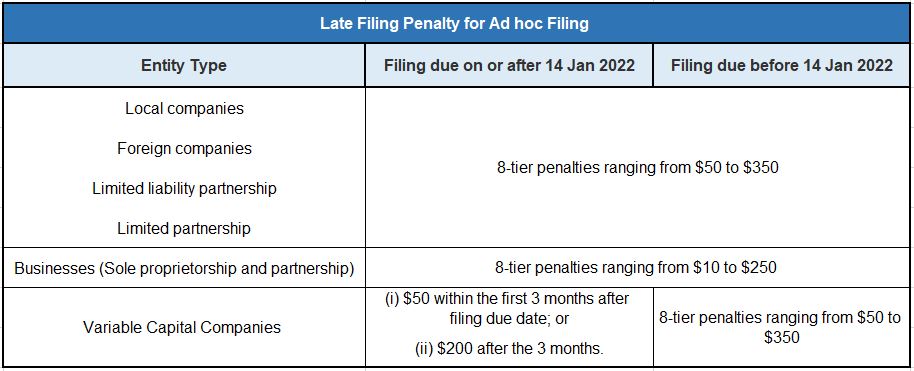

Penalty for late ad hoc filings

For all ad hoc filings for companies, LLPs, and businesses such as a change in entity information or personal particulars of the officers or business owners, the existing penalty framework will continue to apply for late filing of such lodgments.

For ad hoc filings by VCCs, the 2-tier penalty framework will apply for all late filings with effect from January 14, 2022.

Monetary Authority of Singapore and Inland Revenue Authority of Singapore Updates

1) MAS Proposes Changes to Classification of Investment Products for Retail Investors

On November 3 2021, The Monetary Authority of Singapore (MAS) issued a consultation paper on the classification of certain investment products as complex products entailing enhanced safeguards when distributed to retail investors. The paper also proposes changes to increase retail investors’ access to diversified investment funds. The consultation closes on December 15 2021.

The complex products regime was introduced to help retail investors better understand the features and risks of complex products before transacting in them. Under the regime, MAS prescribes a list of products that are well established in the market and have terms and conditions generally understandable by the market, termed Excluded Investment Products (“EIPs”). Products that do not fall within the prescribed list of EIPs are regarded as more complex products. These are termed as Specific Investment Product (“SIP”) and must be sold with enhanced distribution safeguards, such as requiring intermediaries to assess a customer’s investment knowledge and experience before the customer invests in a SIP.

MAS is seeking to enhance and update the complex products regime as financial innovation has led to an increasing number of investment products with more complex risk-return profiles being manufactured and marketed to retail investors, the features of which they may not fully understand. The proposals relate to the EIP/SIP classification of collective investment schemes (“CIS”), debentures, perpetual securities, and preference shares, and the distribution safeguards that apply to the sale of SIPs.

2) MAS issues Revised Guidelines on Corporate Governance for Designated Financial Holding Companies, Banks, Direct Insurers, Reinsurers and Captive Insurers

On November 9 2021, The Monetary Authority of Singapore (MAS) issued revised guidelines on Corporate Governance for Designated Financial Holding Companies, Banks, Direct Insurers, Reinsurers and Captive Insurers which are incorporated in Singapore (“CG Guidelines”)

Proposed Revisions to the Code of Corporate Governance

Greater responsibilities for board of directors

There is a greater emphasis on expected roles and responsibilities of the Board of Directors as set out in the Basel Committee of the Banking Supervision Core Principles for Effective Banking Supervision and the International Association of Insurance Supervisors Core Principles. The Board is expected to review financial institutions’ corporate governance framework, culture and conduct framework, business objectives, and strategies on an annual basis. There is a requirement to have an appropriate risk management system and adequate internal controls to support the financial institution’s risk appetite.

Recommendations for oversight of remuneration practices

The Guidelines on Corporate Governance sets out recommendations for remuneration practices. It is expected that financial institutions design and implement appropriate remuneration policies for employees with active oversight and monitoring of the effectiveness of policies by senior management. Effective oversight includes ensuring performance evaluation and conducting independent annual reviews which must take into account both financial and non-financial factors.

Extended remuneration practices for executive officers

Where remuneration is variable, it should be aligned with long-term value-creation and subject to deferral arrangements to ensure they are consistent with the financial institution’s long-term objectives and financial soundness. MAS proposes to extend the remuneration requirements for executive officers to material risk-takers given that their decisions or actions could impact the financial institution’s risk profile.

Documentation for unresolved concerns of independent directors

As part of the Guidelines on Corporate Governance, MAS requires unresolved concerns for independent directors, particularly those on the running of the company, to be documented in the minutes of the board meetings. MAS proposes to include this expectation as a new additional guideline under the Guidelines on Corporate Governance.

Experts may be appointed as a member of the Board Risk Committee

The Board Risk Committee of a financial institution has statutory responsibilities under the Corporate Governance regulations overseeing the establishment and operation of an independent risk management system for the financial institution, as well as ensuring the adequacy of the risk management function of the financial institution. To achieve this, the financial institutions, as part of Guidelines on Corporate Governance, is expected to appoint independent directors with skills and competency relevant to their business strategies and objectives. Given the limited pool of resources, some financial institutions have resorted to utilizing subject matter experts in their place. MAS proposes that an expert, who is not a director, may be appointed as a member of the Board Risk Committee. Appropriate notifications must be provided to MAS and the individuals must commit to appropriate undertakings for proper accountability.

3) Corporate Registers (Miscellaneous Amendments) Bill

On November 1 2021, the Corporate Registers (Miscellaneous Amendments) Bill (“Bill”) was tabled for the first reading in Parliament. The Bill aims to enhance Singapore’s regime on the transparency and beneficial ownership of Companies and Limited Liability Partnerships (LLPs). The amendments serve to reduce opportunities for the misuse of corporate entities for illicit purposes and are in line with international standards set by the Financial Action Task Force (“FATF”) for combating money laundering, terrorism financing, and other threats to the integrity of the international financial system.

4) Business Partner and Company Convicted for Preparing False Records to Claim Fictitious Expenses to Evade Tax

Quek Lip Ngee (“Quek”) and his company, Fanco Fan Marketing Pte Ltd, have been convicted for serious fraudulent tax evasion. The Court sentenced Quek to 10 months and 2 weeks in jail and ordered to pay a penalty of $508,969, which is four times the amount of tax undercharged, on the two proceeded charges under Section 96A(1)(a) of the Income Tax Act for serious fraudulent tax evasion.

Quek had, wilfully with intent to evade tax, prepared and authorised the preparation of false books of accounts and records, for purpose of claiming fictitious expenses. He created false invoices and expense records to support the claims of fictitious expenses in order to reduce the profits of his partnership business, Fanco Fan Marketing, in his Income Tax returns. By reducing the profits of the partnership and under-declaring his partnership income, he was seeking to pay less personal income tax. Consequently, Quek under-declared his share of his partnership income by $659,355 for the Years of Assessment (YAs) 2012 and 2014, resulting in a tax undercharged of $127,242.

Fanco Fan Marketing Pte Ltd was sentenced by the Court to pay a fine of $7,500 and a penalty of $50,252, which is four times the amount of tax undercharged, in July 2021. Fanco Fan Marketing Pte Ltd had, wilfully with intent to evade tax, prepared false records to support the claiming of deductions of fictitious expenses of $72,840 in its tax returns for YA 2016, resulting in tax undercharged of $12,563.

Enhanced Sentencing Framework for Tax Evasion

With the endorsement of the enhanced sentencing framework for tax evasions by the High Court on June 9 2021, offenders will face a stiffer imprisonment sentence that takes into account the harm caused by the offender and his or her culpability, such as the quantum of tax evaded and modus operandi. The imprisonment term imposed for serious tax evasion under Section 96A(1) of the Income Tax Act may span the full range of up to five years.

Penalties for Non-Compliance

IRAS Warns Against Tax Evasion

IRAS takes a serious view of non-compliance and fraudulent tax evasion. There will be severe penalties for those who wilfully evade tax. The authority will not hesitate to bring offenders to court. Offenders may face a penalty of up to four times the amount of tax evaded for serious fraudulent tax evasion. Jail terms may also be imposed.

5) Former Director to pay $124,058 in fines and penalties for multiple tax offences and failure to keep business records

Li Longyi (“Li”), 46, former director of Wooleejeep Pte Ltd (“Wooleejeep”), has been ordered by the Court to pay fines and penalties totaling $124,058 after being convicted of omitting a total income of $348,276 in Wooleejeep’s Form C Income Tax Return for Year of Assessment (YA) 2011, failing to register Wooleejeep for Goods and Services Tax (GST) in 2009, and failing to keep business records between 2009 and 2012. Wooleejeep operated food stalls at food courts.

Court Sentences

Li faced one charge of omitting Wooleejeep’s actual income earned in its Form C Income Tax Return, resulting in a total of $49,207 in taxes undercharged for YA 2011. The Court imposed a fine of $3,000 and a penalty of $98,414 which is two times the amount of tax undercharged.

For failing to register Wooleejeep for GST when the company’s revenue had exceeded the $1 million thresholds by the end of the quarter ending 30 September 2009, the Court ordered Li to pay a penalty of $1,500, which is 10% of the GST due, and a fine of $17,644.

Li also faced one charge of failing to properly maintain records, including business and accounting records, food court statements and invoices from Wooleejeep’s suppliers or vendors, for a period of not less than 5 years. The Court ordered him to pay a total fine of $3,500.

IRAS’ audit program uncovered the offense

IRAS runs audit programs across various industries to ensure tax compliance among individuals, businesses, and the self-employed. Using data analytics and advanced statistical tools, IRAS is able to cross-check data and detect anomalies. This case was uncovered through one such audit program.

Penalties for Non-Compliance

GST Registration

All businesses, including individuals deriving income from their trade, profession or vocation, should closely monitor their income on a calendar year basis to assess if they need to register for GST.

If their 12-month taxable turnover has exceeded $1 million at the end of the calendar year, they will be required to apply for GST registration within 30 days.

Any business that fails to register for GST is still required to pay GST on all their past transactions from the date the business became liable for GST registration. GST is payable even if the amount was not collected from customers. In addition, failure to register for GST is an offense and businesses may be required to pay 10% of GST due as a penalty and fined up to $10,000.

Keeping Proper Records

IRAS would like to remind all taxable persons to keep proper records and accounts of all their taxable transactions. Records pertaining to income tax must be retained for a period of 5 years from the relevant YA, while records pertaining to GST must be retained for a period of not less than 5 years from the prescribed accounting period. Those who fail to do so may be liable on conviction to a fine and/or a jail term.

6) Singapore and Cabo Verde sign Avoidance of Double Taxation Agreement

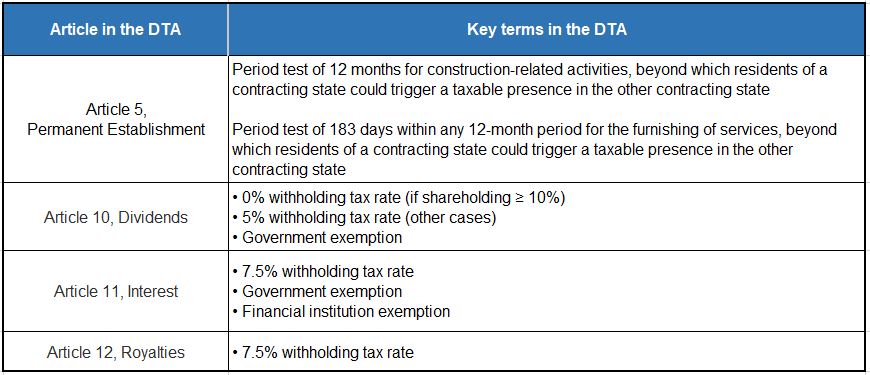

Singapore and Cabo Verde have signed the Agreement between the Government of the Republic of Singapore and the Government of the Republic of Cabo Verde for the Elimination of Double Taxation with respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance (“DTA”).

The DTA clarifies the taxing rights of both countries on all forms of income flows arising from cross-border business activities and minimizes the double taxation of such income. This will lower barriers to cross-border investment and boost trade and economic flows between the two countries

For dividends, the treaty establishes a general withholding tax rate of 5%. However, a 0% rate applies to beneficiaries holding at least 10% of the capital of the paying company. An exemption also applies for payments to governments.

For interest, the treaty establishes a 7.5% withholding tax rate, with exemptions for government and financial institutions.

For royalties, the treaty also sets a 7.5% withholding tax rate.

Annex: Summary of key terms in the DTA

IRAS- Due Dates

- Estimated Chargeable Income (ECI) (Sep year-end) – 31-Dec-2021

- GST Return: (October 2021 – December 2021) – 31 January 2022