CORPORATE LAWS

ECB 2 returns for the month of July 2021 to be filed on or before 7 August 2021.

- MCA, vide General Circular No. 11/2021 dated 30 June 2021, has granted additional time till 31 August 2021 to companies and LLPs to file forms (excluding Charge related forms), due for filing between 1 April 2021 to 31 July 2021, without any additional filing fees.

- MCA, vide General Circular No. 12/2021 dated 30 June 2021, has further extended the time for filing Charge related forms. If the due date for filing these forms had not expired as on 1 April 2021, the period from 1 April 2021 to 31 July 2021 shall be omitted when considering the due date for filing such forms. . Further, where the due date falls between 1 April 2021 and 31 July 2021, the first day for such forms shall be reckoned as 1 August 2021.

- MCA, vide notification dated 22 July 2021, effective from 1 September 2021, has added a new Rule 33A to the Companies (Incorporation) Rules, 2014. With this amendment, the name of a Company shall automatically stand amended if the Company fails to comply with the order of the Regional Director changing the name of the Company within three months from date of the order.

DIRECT TAX

Circulars/Notifications/Press Release

CBDT notifies Rules on capital gains for Firms u/s 45(4)

Notification No. 76/2021 dated 2 July 2021

- The Finance Act, 2021 revamped the entire scheme of taxation of reconstitution of firm/association of person (AOP)/body of individuals (BOI) (“specified entity”) by introducing a new section 9B in the Act and substituting the existing section 45(4) of the Act. Thus, upon dissolution or reconstitution of a firm, association of persons or body of individuals, any capital asset/money/other assets given to a partner as a consequence of such dissolution or reconstitution, will be taxed in the said financial year as Capital Gains.

- Pursuant to the revamped scheme of taxation, the Central Board of Direct Taxes (“CBDT”) has issued a Notification prescribing rules for attributing capital gains chargeable in hands of the specified entity to the remaining capital assets of specified entity.

- As per these rules, character of capital gains chargeable under section 45(4) shall be determined on the basis of character of remaining capital assets of the specified entity to which such capital gains get attributed. A sub-rule (5) to Rule 8AA and new rule 8AB is inserted to prescribe the manner of calculating the income chargeable to tax under section 45(4) of the Act and also the manner in which such income shall be attributed to remaining assets with the specified entity under clause (iii) of section 48 of the Act.

CBDT extends time for processing refunds in non-scrutiny cases for AY 2017-18 up to 30 Sep

CBDT order dated 05 July 2021

- CBDT passes order u/s 119 to address taxpayers’ refund claim grievances for AY 2017-18 where the returns were not picked up for scrutiny and time limit of processing of return u/s 143(1) has expired ;

- Extends time to process returns for AY 2017-18 up to 30 Sep 2021;

- Earlier, the time limit for processing refunds was extended up to 31 Oct 2020 but after considering taxpayers’ grievances, the time-limit has been further extended subject to exceptions and administrative approval of Pr. Chief CIT/ Chief CIT;

- Exceptions are: (i) returns selected for scrutiny, (ii) unprocessed returns with demand payable or likely to arise, (iii) non-processing of return attributable to Assessee.

CBDT grants further relaxation in E-filing of IT Forms 15CA/15CB to 15 August 2021

Press release dated 20 July 2021

- The income tax department has granted further relaxation in the electronic filing of forms 15CA and 15CB in view of difficulties reported by taxpayers in the filing of forms online on the new e-filing portal http://incometax.gov.in.

- Taxpayers can now file Form 15 CA and Form 15 CB manually till 15 August 2021. The decision was taken in view of rampant glitches on the new income tax filing online portal.

- Authorized dealers were advised to accept such Forms for the purpose of foreign remittances.

- A facility will be provided on the new e-filing portal to upload these forms at a later date for the purpose of generation of the Document Identification Number

Case Laws

Delhi ITAT: Retrospective amendment of Sec.195 cannot be pressed to disallow expenditure retrospectively u/s 40(a)(i)

McCANN Erickson (India) Pvt. Ltd vs ACIT dated 2 July 2021

- Delhi ITAT allows Assessee’s appeal, deletes disallowance made for non-deduction of tax for AY 2008-09

- Assessee-Company (McCann Erickson (India) Pvt. Ltd.) was reassessed and an addition of ₹57.38 lacs was made in respect disallowance of Global Account Co-ordination Cost

- Revenue rejected Assessee’s contention that withholding tax provisions of section 195 were not applicable in his case; this contention was also dismissed by CIT(A)

- ITAT referred to Mumbai ITAT ruling in Ashapura Minichem, wherein it was held that “A retrospective amendment in law does change the tax liability in respect of an income, with retrospective effect, but it cannot change the tax withholding liability, with retrospective effect”;

- ITAT further notes that withholding tax obligations are to be discharged at the point of time when payment is made or credited, whichever is earlier, and such obligations can be discharged only in the light of law as it stands that point of time

Hyderabad ITAT: amendments on due date for depositing ESI, PF apply prospectively

Crescent Roadways Private Limited vs DCIT dated 1 July 2021

- ITAT Hyderabad allows Assessee’s appeal, deletes disallowance on account of alleged delay in deposit of employees’ contribution towards Provident Fund, ESI;

- Assessee company had remitted employees contribution towards PF, ESI before the due date of filing return u/s 139(1) but after the due date prescribed in the corresponding PF, ESI statutes; Revenue disallowed the amounts on the grounds that they had been remitted after the due date prescribed in the corresponding statute;

- ITAT holds that the legislative amendments incorporated in sections 36(1)(va) and 43B by Finance Act 2021, are prospective in application i.e., with effect from 1 April 2021;

- Thus, holds that the disallowance of employees’ contributions towards PF, ESI as not sustainable.

Kolkata ITAT: Onus of proving non-payment of tax by payee on AO for invoking Sec.201

Special Land Acquisition Officer Vs ITO, dated 7 July 2021

Facts of the case :

- The Special Land Acquisition Officer (SLAO) of a department in West Bengal, made payments amounting to ₹ 1,14,61,007 to various people for acquiring immovable property, without deduction of tax u/s 194LA. AO issued a SCN u/s 201(1) and 201(1A). AO also stated that as PANdetails were not furnished, tax was to be deducted @ 20%.

- Penalty u/s 271C also invoked.

- Order was passed against the Assessee and was appealed to CIT(A). CIT(A) passed order in favor of revenue. Further, appeal was filed before ITAT.

Assessee’s contentions:

- SLAO was discharging duty as an officer of the Government and following a SOP, which did not mention for deduction of TDS. Thus, the non-deduction was not intentional.

- Substantial part of the acquisition was of agricultural land and only a small portion (valued at ₹ 1,02,944) was residential land. This was below limit of TDS u/s 194LA. (Furnished as additional evidence)

- SLAO was not assessee in default unless it was proved that the compensation was not offered to tax by the recipients as income in their ITR.

- For this, the Assessee has relied on the decision of Allahabad High Court stating that “Once this finding about the non-payment of taxes by the recipient is held to a condition precedent to invoking Section 201(1) (reference to non offering of the same to tax by the recipient) , the onus is on the Assessing Officer to demonstrate that the condition is satisfied.”

Judgement:

- Directs the Assessee to submit all relevant information of the parties to whom payments were made.

- It is the onus of the AO to utilize his position to ascertain whether the corresponding incomes have been offered to tax by the recipient and pass orders accordingly.

Delhi ITAT: Allows interest on borrowing for trial run period as revenue expenditure

ACIT Vs Nilkanth Concast Pvt Ltd, dated 06/07/2021

- In the present case, the assessee had 2 major grounds in its appeal to CIT(A) against the Assessment order passed by the AO.

i. Addition on account of sundry creditors.

ii. Disallowance of interest incurred on borrowed funds from date of installation of plant to the date of starting of commercial production. - The Assessee produced sufficient evidence to the CIT with respect the first ground and the same was also upheld by the ITAT.

In regard to the disallowance of interest, the following were considered:

- The Assessee paid interest of ₹ 28,84,000 attributable from the date of installation to the date of commercial operation of the Power Plant. AO capitalized this amount and stated that it shall be added to cost of asset as per accounting standards on borrowing cost.

- The Assessee argued that the trial run was also actual use and expenditure for the period is deductible.

- Reference was made to the judgement in the case of PCIT v.Larsen & Toubro Ltd, wherein it was held that “once the plant commenced operations and a reasonable quantity of product is produced, the business is set up even if product was sub-standard and not marketable”.

- Section 37(1) of the Act which provides that “expenses laid out or expended wholly and exclusively for purposes of business shall be allowed in computing Profits and Gains from Business and Profession.

- Proviso to section 36(1)(iii) of the Act provides for “capitalization of interest paid for acquisition of an asset from the date on which funds were borrowed till the date such asset is put to use”.

- As per Explanation 8 to section 43(1), interest paid shall be added in the actual cost of the asset till the asset is first “put to use” for claiming depreciation.

- The Hon’ble Bombay High Court in the case of Western India Vegetable Products Ltd v. CIT held that setting up means ready to commence while actual commencement is when the business activity actually commences and expenses incurred during the gap between set up and commencement are allowable deductions.

- Further based on similar understanding of “put to use” in ICDS IX, AS-16, the judicial pronouncements, and above provisions of the Act, the disallowance of interest was deleted.

Delhi HC: directs ITAT to expedite system for uploading daily order-sheets, revised cause-list on website

Ankit Kapoor Vs ITO, dated 23 Jul 2021

Facts of the case:

- The Assessee states that the ITAT passed an Impugned (false) order without mentioning the matter in the cause list because of which Mr. Ankit Kapoor, the assessee was unable to present his case.

- The Assessee stated that his Miscellaneous Application were heard on 14 February 2020, and it was listed for further hearing on 28 Feb 2020, but on 28 February 2020, the Assessee did not find his matter in the cause list and was informed by the Registry that his matter had already been heard on 21 February 2020 and was dismissed on 27 February 2020.

- The ITAT intimated that due to a clerical error, the matter was not reflected in the cause list of 21 February 2020 , but since the case was noted by the counsel before the Bench, the matter was taken up by the bench on 21 February 2020 as per the adjournment given on 7 February 2020 and since none appeared to represent the Assessee the matter was heard, and judgement was given on 27 February 2020.

- The Assessee stated that the Impugned Order deserved to be quashed as the he did not get adequate and fair opportunity to represent his case since, he was under a bonafide belief that his case will be taken up for hearing on 28 Feb 2020.

Conclusion:

- Even though the matter had been adjourned to 21 February 2020 on 07 February 2020, the Court is of the view that the Assessee did not have adequate notice or fair opportunity to represent his case as neither the daily order-sheets nor the revised cause list had been uploaded on the website of the ITAT.

- Consequently, the impugned order dated 27 February 2020 passed by the ITAT is considered invalid and the ITAT was directed to hear the said Application afresh

Delhi HC: directs PCIT to pass reasoned revisionary order on treaty-rate versus DDT controversy

Riso India Private Limited Vs Pr CIT, dated 22 Jul 2021

Facts of the case:

- A wholly owned subsidiary of Riso Corporation Japan, had remitted dividend to its holding company on which tax was deducted @ 20.35% u/s 115-O of the Act, against the beneficial provisions of India-Japan DTAA, which provides the rate of 10%. Later in a revision petition seeking refund of excess tax to rectify the said error was filed.

- The respondent states that this matter relates to the period where DDT regime u/s 115-O was prevalent, and the rate of tax used for this purpose is the one prescribed therein and not as per DTAA as it is more beneficial to shareholders. It relied on the Supreme Court judgement in the case of Godrej & Boyce Manufacturing Co. Ltd. (2017)

Conclusion:

- Court finds that the assesse’s revised petition was dismissed without giving any reasons on merit and that the commissioner had passed the order without applying his mind to the controversy

- Accordingly, the impugned order dated 31 March 2021 is set aside and the matter to be re-assessed for passing reasonable order within 6 weeks after giving an opportunity of hearing to the assessee.

Delhi HC dismisses writ for refund of excess advance tax paid in 2001 as stale claim

Harbux Singh Sidhu Vs Department of Income Tax, dated 19 Jul 2021

- The petitioner claimed a refund of ₹6,50,000 of excess advance tax deposited with an interest of 12%. In addition to this he also claimed ₹5,00,000 towards mental harassment caused to him and litigation costs.

- The assessee had deposited excess advance tax during AY 2000-01 and misplaced the challan for the same.

- Upon finding the challan, he filed for a refund in 2003 with a certificate issued by Syndicate Bank as proof that the payment had been made.

- Upon cross verifying with the bank, the bank stated that the records pertaining to the year 2001 had been destroyed as per bank policy and the same could not be found.

- Since there was no proof, the claim was denied, and writ dismissed.

Karnataka HC allows fresh claims by the Assessee under 148 proceedings

The Karnataka State Co-Operative Apex Bank Limited Vs DCIT, dated 06 Jul 2021

Facts of the case:

- For AY 2007-08, the Assessee filed ROI declaring income of ₹ 40.77 Cr which was not assessed u/s 143 but only an intimation under 143(1) was received. On issue of notice u/s 148, ROI declaring income of ₹ 32.57 Cr was filed, additionally claiming loss on sale of securities ₹ 8.29 Cr which was disallowed by AO in his order u/s 147 r/w Section 143.

- CIT & ITAT rejected the loss as it was not made in the original assessment proceedings. It relied on judgement in case of Sun Engineering Works (P) Ltd that Section 148 is a remedy for the revenue, not the Assessee and 148 proceedings can be initiated only for escaped incomes and no fresh claims can be made.

Conclusion:

- Assessee argued before 1999, the explanation to section 143 deemed any intimation under 143(1) and 143(1B) as order. However, this was deleted with effect from 1999. Thus, the intimation u/s 143(1) cannot be an order passed and so the issue had not reached finality. Further, the loss is an actual loss and is allowable u/s 37.

- The Hight Court thus held that as no earlier assessment was made in this case, AO’s order u/s 148 was to be considered as first Assessment and all claims to be considered. The intimation order u/s 143(1), was held to be overlapped by the fresh assessment made.

Karnataka HC holds that IISc employees not in par with Govt employees for valuation of perquisites

Indian Institute of Science Vs DCIT, dated 28 Jul 2021

Facts of the case:

- In the AY 2010-11, the Assessee, IISc treated its employees at par with employees of Central and State Government for valuation of perquisites, deduction of TDS u/s 192 and e-TDS returns filed in Form 24Q.

- The Assessee contended that it is a charitable trust and functioned under the control of the Central Government; thus it was an agency of the government. Further, employees were governed by the service principles applicable to the employees of Central Government.

Conclusion:

- The HC has however held that the wordings of the explanation to section 17(2(ii) and Sl No. 2 of Table 1 of Rule 3 specifies that the perquisite shall be “provided by the State or the Central government to employees either holding office or post in connection with affairs of Union or of State or serving with any body undertaking under the control of such government from deputation”.

Thus there is no ambiguity that the Assessee is not the Central Government and thus the employees shall not be treated as employees of government for perquisite valuation.

HC Quashes and set asides final assessment order in violation of Section 144C(1)

Judgment-WPL 11293-21.odt dated 28 Jul 2021

Facts of the case:

- Assessee had declared total income of ₹1.01 crores in its return of income for AY 2017-18. The assessee had filed form 3CEB for the same assessment year on account of transactions entered with its associated enterprise.

- The case was referred to TPO whereby a TP adjustment of ₹10.74 crore was proposed thereby enhancing the total income to ₹11.70 Crores. Subsequent to TPO order final assessment order was passed u/s 143(3) r.w.s 143(3A) and 143(3B). Along with final order a demand notice of Rs.1.17 crore and penalty notice was issued u/s 274 r,w,s 270A.

- Aggrieved by the order, the assessee filed a writ petition before the High Court submitting that there was violation of section 144C(1) whereby no draft order was passed before passing the final assessment order.

Conclusion:

- The High Court allowed the assessee’s writ petition stating that assessee was deprived of his legislative rights by not giving a reasonable opportunity to appeal before DRP. HC held that the AO had committed breach of the provisions as stated u/s 144C(1).

- Further, The High Court distinguished revenue’s reliance on the Supreme Court’s ruling that no right was available to assessee in this case.

- Accordingly, the final assessment order passed by AO was declared void ab intio and thereby quashed and set aside the demand and penalty notice

Other Updates

15% Global Minimum Tax will halt race to bottom: US President

- US President Joe Biden commends the signatories of Paris OECD Statement comprising 130 countries;

- He stated that 15% global minimum tax rate endorsed by nations making up 90% of the world’s economy “… puts us in striking distance of full agreement to halt the race to the bottom for corporate taxes.”

ITD conducts searches on PAN-India basis in a prominent group having diversified businesses

- Income Tax Department (ITD) carried out search operations on 22 July 2021 on a business group, involved in businesses in various sectors, including Media and Real Estate. The group has over 100 companies with an annual group turnover of over ₹ 60 Billion.

- During the search, it was found that they have been operating companies in the names of their employees which have been used for multiple purposes namely, booking bogus expenses and siphoning off the profits from listed companies by routing such funds into their closely held companies to make investments, making of circular transactions etc.

- Several employees have admitted that they were not aware of such companies and had given their Aadhaar card and digital signature to the employer in good faith whereas some were relatives who had signed willingly but had no control on the activities carried on by those companies.

- Quantum of income saved using this group detected so far amounts to ₹7 Billion in 6 years.

- Cyclical trading and transfer of funds among group companies were ₹2.2 Billion. Evidence that these have been fictitious transactions without any actual movement of goods has been obtained.

- The real estate entity of the group had been sanctioned a loan of ₹6 Billion out of which major part has been diverted to a sister concern as loan at lower interest rate of 1%. Here, the real estate company is reducing its taxable profit by paying interests whereas the funds are used as investment in the sister company.

- The listed media company does barter deals for advertisement revenues, where immovable properties are received in lieu of actual payments.

- A total of 26 operational lockers have been found in the residential premises of the promoters and key employees of the group.

OECD reports on Revenue Statistics in Asia-Pacific; Endorses domestic resource mobilization for recovery from COVID-19

- OECD in its report, “Revenue Statistics in Asia and the Pacific 2021 – Emerging Challenges for the Asia-Pacific Region in the COVID19 Era” compared the tax revenues for 24 Asian and Pacific countries.

- According to the report, the average tax to GDP ratio was 21% which was way below OECD and Latin American countries average of 33.8% and 22.9%

- The revenue from tax on goods and services & that from income tax was 49.8% and 17% respectively for the Asia-Pacific region in 2019.

- The report also states domestic resource mobilization and fiscal policy will play a huge role in recovery post COVID-19 era for developing countries

Other Updates

- 161st Income Tax Day was observed by CBDT on 24 July 2021

- CBDT signs a 9 year Bilateral Advance Pricing Agreement with US for software development and marketing support activities

- The Ministry of Finance, State confirmed that on 1 July 2021, India has backed the Global Minimum Tax with minimum rate @15% along with 129 of 139 other member nations of OECD/G20

- The Ministry of Finance announced that the net direct tax collection in the 1st quarter of FY 2021-22 has almost doubled to 1,17,783.87 crore during the same period last year)

- CBDT orders transfers/postings of 58 Top level officers and appoints 32 Additional Charges

- Systematic measures of the Government under the Black Money Act has detected undisclosed income of ₹ 39,799 crore (approx.) and already raised ₹9,510 crore in taxes

- National Faceless Assessment Center issues SOP for handling writ petitions challenging faceless assessments and penalty orders.

Centre mulls Ordinance for past tax assessments as litigation mounts

News dated 21 July 2021

- As Litigation mounts, the Government of India is exploring authorized choices including bringing an ordinance to deal with the issue of Income Tax Litigation on reassessment notices under outdated, time-based norms.The validity of the notices issued by the tax department between 1 April 021 and 30 June 2021 and under old norms was challenged in recent weeks by writ petitions filed by companies and individuals.

- Assessees (Companies and individuals) mentioned that Income Tax Department’s action was void and arbitrary as it could not extend old provisions of the Income Tax Act.

Goods and Services Tax

Government notifies self-certification of reconciliation statement in Form GSTR-9C, mandatory audit by CA/CMA done away with

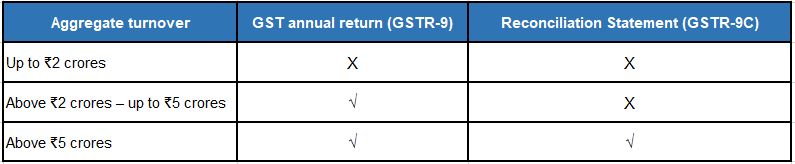

The Union Budget 2021 had proposed self-certification of Form GSTR-9C (GST audit report) instead of compulsory audit by CA/CMA hitherto. Now the Government has notified the said amendment proposed in Budget 2021. From the financial year 2020-21, businesses having their aggregate turnover above ₹5 crores can now self-certify reconciliation statement in Form GSTR-9C.

Further to ease compliance burden, Government has exempted small taxpayers having an aggregate turnover up to ₹2 crores from filing annual return in Form GSTR-9. For ease of understanding, applicability of GST annual return and reconciliation statement is explained in table below:

Reversal of input tax credit not warranted for normal loss of inputs during manufacturing process

The Madras High Court recently had an occasion to determine whether reversal of Input Tax Credit (ITC) is mandated in terms of Section 17(5)(h) of the CGST Act, 2017, towards normal loss arising out of consumption of inputs during the course of the manufacturing process.

The appellant M/s. ARS Steels & Alloy International Private Limited had been engaged in the manufacture of iron and steel products. The Hon’ble Madras High Court observed that the manufacturing process essentially entails a normal loss of small proportion of inputs. Being occasioned out of the actual consumption of inputs, such unquantifiable loss is inherent to the manufacturing process. Further, such loss is beyond appellant’s control as it entirely depends on external factors.

In pre-GST era, in similar case of Rupa & Co. Ltd. V. CESTAT, Chennai [2015 (324) ELT 295], the Division Bench of the Hon’ble Madras High Court had allowed CENVAT Credit on the total amount of inputs used notwithstanding that the entire amount of inputs did not figure out in the finished product. When there is no dispute that each manufacturing process would automatically result in some kind of normal loss such as evaporation, creation of by-products, etc., the total quantity of inputs that goes into the making of the finished product would represent the inputs of such products in entirety. Relying on this decision, the Hon’ble Madras High Court held that normal loss arising out of consumption of inputs during the process of manufacture is not subject to the rigors of Section 17(5), and thus proportionate reversal of ITC in such cases in uncalled for.

Taxability of cross border ‘intermediary’ services

In this month’s newsletter, we bring you few judgements on the topic of ‘intermediary’ services. As you may be aware, not all services rendered to foreign customers qualify as ‘export’ under GST law to enjoy zero-rated benefits. One of the conditions to claim zero-rated benefit is that the ‘place of supply’ of services must be outside India. If the place of supply is in India, then it is not export and GST is payable even if the customer is located outside India and payment is received in foreign exchange. GST is a destination-based consumption tax. The situs of ‘place of supply’ achieves this destination-based principle. Constitution of India authorizes the Parliament to formulate the principles for determining the ‘place of supply’. So, the ‘place of supply’ is a legal prescription and in order to determine what constitutes ‘export’, one must unmistakably identify ‘place of supply’ rather than solely relying on location of customer and currency of transaction. In this backdrop, here is a synopsis of a few judgements on taxability of cross border ‘intermediary’ services.

Constitutional validity intermediary services - difference of opinion among division bench of the Bombay High Court

In a recent judgement, divergent views have emerged among the division of the Hon’ble Bombay High Court in the case of Mr. Dharmendra M Jani wherein the constitutional validity of Section 13(8)(b) read with Section 8(2) of the IGST Act, 2017 has been challenged.

The appellant in this case is engaged in providing marketing and promotion services to its overseas principals, whereby it finds customers in India for the goods manufactured by appellant’s overseas principals. Subsequently, all the legs of goods supply transactions, viz. PO, Sale Invoice, Payment and Delivery of goods take place between the overseas principal and Indian customer. Towards such marketing and promotion services, the appellant raises its commission invoice and receives the same from its overseas customer in convertible foreign exchange. The appellant claimed that such arrangement amounts to ‘export of service’ in terms of Section 2(6) and challenged the levy of GST on such services as “intermediary services’ under Section 13(8)(b) read with Section 8(2) of the IGST Act, 2017.

Justice Ujjal Bhuyan of the Hon’ble Bombay High Court upheld the appellant’s challenge to the constitutional validity of 13(8)(b) read with Section 8(2) of the IGST Act, 2017 where he observed that the said provisions do not confirm with the overall scheme of the CGST and IGST Acts, as well as with the provisions of the Article 245, 246A, 269A and 286(2) of the Constitution of India. While the said provisions ought to uphold the fundamental principle that GST is a destination-based consumption tax, they completely run opposite when they subscribe to the principle of origin-based taxation. The extra-territorial impact of Section 13(8)(b) of the IGST Act, 2017 is in no way connected with the GST regime in India, and thus, the same is ultra vires the GST regime and unconstitutional.

On the contrary, Justice Abhay Ahuja took a divergent view and observed that neither Section 13(8)(b) nor Section 8(2) of the IGST Act, 2017 are unconstitutional, nor these provisions are ultra-vires the IGST Act, 2017. When the Constitution itself empowers the Parliament to formulate the principles determining the ‘place of supply’, Section 13(8)(b) of the IGST Act, 2017 cannot be said to be ultra vires the charging section of GST law.

In view of such difference in opinion, the matter is likely to be placed by the Chief Justice before the larger bench of the High Court to decide constitutional validity of ‘intermediary services’.

Facilitating sale of goods for overseas suppliers - not ‘Export of Service’

The West Bengal Authority for Advance Rulings (AAR) in the case of M/s Teretex Trading Private Limited services has held that arranging / facilitating sale of goods shall be classified as ‘intermediary service’ and cannot qualify as ‘export of service’ as defined under Section 2(6) of the IGST Act, 2017.

Facts of the case are that the applicant is engaged in supplying facilitation services by way of: (a) locating prospective overseas/Indian buyers; (b) understanding buyers’ requirement of goods; and (b) arranging sale of goods from foreign manufacturers/ traders to the prospective buyers. The applicant does not play any role in actual delivery of goods to buyers. Towards such facilitation services, the applicant receives consideration in the form of commission in convertible foreign exchange from the overseas suppliers.

The AAR observed that although the applicant does not actually supply goods on his own account, the supply of aforesaid facilitation services by the applicant is inextricably linked with the supply of goods by the overseas supplier. The applicant can neither change the nature and value of supply of goods, nor does he hold the title of the goods at any point of time. Thus, the AAR observed that the applicant squarely satisfies all the conditions laid down under Section 2(13) of the IGST Act, 2017 and ruled that the applicant qualifies as an ‘intermediary’. Further the AAR has held that since the place of supply in this case lies within India, such supply of services would be treated as an intra-state supply in terms of Section 8(2) of the IGST Act, 2017. Consequently, the facilitation services provided by the applicant do not qualify as ‘export of service’ in terms of the provisions of Section 2(6) of the IGST Act, 2017.

Manner of calculation of consideration not relevant to determine ‘intermediary’ services

The Karnataka AAR recently had an opportunity to decide taxability of intermediary services in the case of M/s Airbus Group India Private Limited. The applicant in this case is involved in identifying the local capabilities in India to source the raw materials, parts, assemblies, systems, equipment and services for Airbus group. Further, the applicant also provides various support services in connection with onsite assessment and performance review of the suppliers under the global supplier development program. The applicant contended that services rendered by them do not qualify as ‘intermediary’ services on two main grounds. First, the applicant renders the services to Airbus group entities on a principal-to-principal basis and they are not an agent or broker of such entities. Second, their remuneration is fixed on a cost plus mark-up basis and is not linked to the purchase prices. Therefore, the applicant claimed that they do not fit into the definition of ‘intermediary’, and the services provided by them would qualify as ‘export of service’ under GST law. However, the Karnataka AAR noted that it is not necessary that commission payment is always involved in ‘intermediary’ services and cost plus mark-up arrangement can also be the basis for payment. So long as the applicant is involved in arranging or facilitating the supply, the applicant would qualify under the ‘intermediary’ definition. As regards the argument of the applicant that they are independent contractor and not agent or broker, the AAR noted that, there can be difference between agent, broker and an intermediary. In the case of an agent or broker, activity is undertaken on another’s behalf which is not necessary in the case of an intermediary. Therefore, the reliance on principal-to-principal relationship or calling oneself as an independent contractor is not relevant for the purpose of determining an ‘intermediary’ as per the definition. Finally, the AAR held that since the place of supply in case of intermediary services is in India in terms of Section 13(8) of the IGST Act, 2017, the services rendered by the applicant do not qualify as ‘export of services’ and would be liable to GST at 18% under HSN 998599 ‘other support services nowhere else classified’.

Services exported by India branch to customers of US Head Office liable to GST up to 26 July 2018, exempt thereafter

The Kerala AAR in the case of India Branch of M/s. Sutherland Mortgage Services Inc. (“SMSI”) USA has held that the services exported by India Branch office do not qualify for ‘export’ and are liable to GST up to 26 July 2018. However, due to specific exemption introduced under the IGST Act, the applicant is eligible for GST exemption from 27 July 2018.

The applicant in this case is primarily engaged in the business of providing information technology enabled services such as mortgage orientation and related services. The applicant was established as a branch of SMSI, USA as the mortgage laws of United States of America prevented its Head Office from outsourcing of its work to any other third party. The applicant and its USA Head Office entered into Inter-Company Agreement for providing aforesaid services. According to the applicant, the Agreement is entered only for the purpose of transfer pricing regulation as the branch has no separate legal entity. USA Head Office reimburses the applicant on cost plus mark up to comply with the transfer pricing regulations.

The applicant pointed out that the scope of work (SOW) between their USA Head Office and the customers specifically provides the India branch office locations as service providing locations and the invoice raised by USA Head Office to the customers clearly show the bifurcation of the services provided by the on-site location (Head Office) and the off-site location (the applicant).Thus, the applicant contended that they provide services directly to the customers of Head Office located outside India and not to their USA Head Office. Therefore, according to applicant, services provided by them would qualify as export of services.

The AAR noted that the explanations to Section 8 of the IGST Act creates a legal fiction that the establishment of a person in India and any other establishment of the same person outside India are two separate legal persons for the purpose of GST law. Thus, even though the applicant and its USA Head Office cannot be treated as distinct persons under the law of contracts or in commercial or accounting parlance, they are separate legal persons / distinct persons as far as the applicability of GST law is concerned. Therefore, the recipient of services as per the agreement ought to be determined in the light of this legal fiction.

On a perusal of the various clauses of the Inter-Company Agreement, the AAR observed that the services are provided by the applicant to its USA Head Office and not to the customers of Head Office. The AAR further noted that in view of the aforesaid deeming fiction, the contract entered by the customers with USA Head Office and the payment made by them to Head Office cannot be considered as contract executed with or payment made to the applicant. Thus, the AAR rejected the contention of the applicant that the service recipient in this case is customers of its USA Head Office. Finally, AAR concluded that the services rendered by the Applicant to its USA Head Office are liable to GST up to 26 July 2018 and exempt thereafter in view of the specific exemption introduced in the IGST Act.

Contribution to Residential Welfare Association (RWA) – GST leviable on monthly contribution only in excess of ₹7,500 – Madras High Court

Well, the story goes like this. GST is exempt on contributions collected by RWAs for an amount up to ₹7,500 per month per member. The bone of contention is if let’s say the monthly contribution is ₹9,000 then whether GST is payable on entire ₹9,000 or only on the contribution in excess of ₹7,500, that is, ₹1,500 in this case. In the early days of GST, CBIC had issued a clarification that only excess contribution would be liable to GST in such case and not the entire contribution. However, in 2019 Tamil Nadu Advance Ruling Authority in one case issued an adverse ruling that RWAs must pay GST on the entire contribution if the monthly contribution exceeds ₹7,500. Taking a cue from this Ruling, department took a U-turn and quickly issued a clarification on the lines of this advance ruling. Against this backdrop, the Madras High Court in a batch of writ petitions has recently held that contributions to RWA only in excess of ₹7,500 would be taxable under GST law. In arriving at its conclusion, Hon’ble High Court perused various exemption entries under erstwhile service tax law, central excise law, even under GST law and observed that the term “up to” connotes an upper limit and is interchangeable with the words “till” and thus in this case it means that any amount till the ceiling of ₹7,500 would be exempt for the purposes of GST.

No GST on warranty supplies

The Kerala AAR in the case of M/s South Indian Federation of Fishermen Societies has held that supply of goods or services during warranty period without consideration is not liable to GST. The applicant in this case posed several questions before AAR with respect to classification and rate of GST on marine engines and spare parts of fishing vessels and repairs and maintenance of fishing vessels. One of the questions raised by the applicant was with respect to the supplies during warranty period.

In this connection, the AAR noted that the warranty is a promise or guarantee made by a seller of the goods or a provider of services as a part of the contract of sale or service. The consideration received for the original supply includes the consideration for promise to repair or replace during the promised warranty period. Hence, a separate consideration is not charged for warranty repairs / replacement. Therefore, the AAR ruled that the supply of goods or services during warranty period without consideration in discharge of the warranty obligation is not liable to GST. This a welcome ruling not just because it is favourable to the taxpayers but the facts of the case and industry practices appear to have been objectively considered by the AAR.

Damages for breach of contract not taxable

Liquidated damages are a predetermined sum of money agreed by the contracting parties that must be paid as damages for failure to perform under a contract. Failure to perform covers non-performance, late-performance, inadequate performance. Both under erstwhile service tax law and GST law, ‘agreeing to tolerate an act’ is a declared service. Whenever there is a recovery of any sum by the aggrieved party towards damages for breach of contract by the other party, department invoked this declared service of ‘agreeing to tolerate an act’ to levy tax on such liquidated damages. On this very issue, last month the service tax tribunal delivered three judgements all in favour of taxpayers. The facts in each case and the analysis of these judgments

M/s Ruchi Soya Industries Ltd

The appellant in this case has set up a project of generating electricity using wind energy and has installed wind turbine generators (WTG). For operation and maintenance (O&M) of WTG, the appellant has given a contract to O&M service provider. In terms of the machine availability clause under the contract, in case of machine downtime below a specified limit, O&M service provider is under an obligation to compensate a predetermined amount to the appellant from the O&M service charges already recovered. The department demanded service tax under the category ‘agreeing to tolerate an act’ on the compensation amount received by the appellant under machine availability clause. The Tribunal on a perusal of various provisions of the service tax law observed that the service tax liability is on the gross amount charged for the services provided and thus there must be a nexus between the amount charged and taxable service rendered. In the instance case, the credit note issued for the compensation amount by the O&M service provider is towards refund of excess amount paid by the appellant to O&M service provider. There is no service which has been rendered by the appellant to O&M service provider so as to attract service tax. Machine availability clause cannot be in the nature of an act of tolerance by the appellant even from the perspective of dictionary meaning of word ‘tolerance’. Amount received by the appellant under machine availability clause is merely an amount to safeguard the loss of the appellant and the said amount cannot be called as consideration for the tolerance of service provided. Basis these reasons, the Tribunal set aside the service tax demand on the compensation amount received under machine availability clause.

M/s Neyveli Lignite Corporation Ltd

The appellant in this case has awarded turnkey contract to M/s BHEL and considering that the time is the essence of the contract, liquidated damages were agreed upon in case BHEL fails to adhere to the stipulated timelines under the contract. Considering the delay in performance, the appellant recovered liquidated damages from BHEL for non-adherence to agreed time schedule. The department demanded service tax from the appellant on the said liquidated damages under the category ‘agreeing to tolerate an act’.

M/s Steel Authority of India Ltd

In this case also, the appellant recovered liquidated damages under the contract for failure to adhere to various timelines stipulated under the contract. The damages were towards failure to deliver consignments within the delivery schedule, forfeiture of Earnest Money Deposit for failure to make full payment within the date specified in the sale order. The department demanded service tax on the liquidate damages so recovered by alleging that the appellant has tolerated an act and liquidated damages are consideration towards such act of tolerance.

In both the above judgements (M/s Neyveli Lignite Corporation Ltd and M/s Steel Authority of India Ltd) the Chennai CESTAT set aside the service tax demand on liquidated damages. The CESTAT in both the cases relied upon the judgement of CESTAT Delhi in the case of M/s South Eastern Coalfields Ltd., in arriving at its decision. It appears that, the courts are giving due importance to intention of the parties in determining taxability of amounts received as liquidated damages. In case of breach of contract, the parties to contract do not intend to flout the terms of the contract so as to attract penal clauses. Thus, the courts seem to be in favour of the view that damages are not in the nature of consideration for any services rendered. Further there also appears to be consensus among courts on this issue that the declared service of ‘agreeing to do an act or to refrain from an act or to tolerate an act’ is attracted only when there is a dominant intention of the parties to do so like in case of non-compete agreements etc.

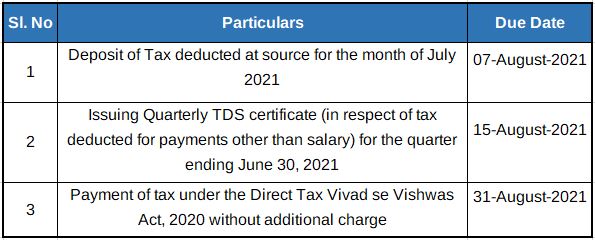

Due Dates

Important Due Dates July 2021

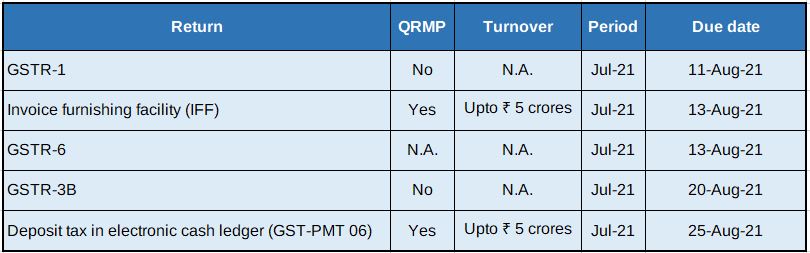

GST Compliance Calendar for August 2021

Monetary Authority of Singapore and Inland Revenue Authority of Singapore Updates

SINGAPORE UPDATES

1) MAS (Monetary Authority of Singapore) lifts dividend caps on Singapore banks and financial firms

The Monetary Authority of Singapore (MAS) has lifted dividend restrictions on local banks and finance companies, noting that they have maintained strong capital adequacy ratios and the economic recovery is progressing well.

Last year, the authority asked banks and finance companies to cap their financial year (FY) 2020 dividends per share at 60 per cent of the previous year’s and offer shareholders the option of receiving the remaining dividends to be paid for FY2020 in shares in lieu of cash.

The global economic outlook has since improved. While some uncertainties remain, Singapore’s economy is expected to continue on its recovery path, given strengthening global demand and progress in our vaccination programme. Local Banks and Finance Companies have maintained strong capital adequacy ratios and continued to meet the credit needs of individuals and businesses, despite higher levels of provisioning made during the pandemic. Under MAS’ latest stress tests, these ratios are projected to remain resilient even under an adverse macroeconomic scenario of a stalled global recovery associated with delays in vaccine deployment and a global resurgence in the pandemic due to mutated virus strains, leading to the Singapore economy slipping again into recession in 2021.

Ms Ho Hern Shin, Deputy Managing Director, MAS said, “Local Banks and Finance Companies have weathered the pandemic well and are in a strong position to support the economic recovery. As downside risks remain, Local Banks and Finance Companies should exercise continued prudence in their discretionary distributions, whilst prioritising support to customers. Particularly when COVID-19 is not yet endemic, businesses may face added liquidity strains when COVID-19 measures are tightened from time to time. Banks and Finance Companies will do well to proactively work with customers to navigate these challenges.”

2) BIS Innovation Hub and Monetary Authority of Singapore publish proposal for enhancing global real-time retail payments network connectivity

The Bank for International Settlements Innovation Hub in Singapore has published a proposed blueprint for enhancing global payments network connectivity.

The blueprint, also supported by the Monetary Authority of Singapore (MAS), aims to improve network connectivity via multilateral linkages of countries’ national retail payment systems.

Titled Project Nexus, the proposal outlines how countries can fully integrate their retail payment systems onto a single cross-border network, allowing customers to make cross-border transfers instantly and securely via their mobile phones or internet devices.

The Nexus blueprint comprises two main elements:

- Nexus Gateways, to be developed and implemented by the operators of participating countries’ national payment systems, will serve to coordinate compliance, foreign exchange conversion, message translation and the sequencing of payments among all participants. These gateways will be predicated on a common set of technical standards, functionalities and operational guidelines set out within the proposal.

- An overarching Nexus Scheme that sets out the governance framework and rulebook for participating retail payment systems, banks and payment service providers to coordinate and effect cross-border payments through the network.

Under the Nexus blueprint, participating countries will only need to adopt the Nexus protocols once to gain access to the broader cross-border payments network. This removes the need for countries to negotiate payment linkages with each jurisdiction on a bilateral basis.

The Nexus blueprint was developed through extensive consultation with multiple central banks and financial institutions across the globe. It builds on the pioneering bilateral linkage between Singapore’s PayNow and Thailand’s PromptPay launched in April 2021, and benefits from the experience of the National Payments Corporation of India’s (NPCI) development and operation of the Unified Payments Interface (UPI) system. The blueprint can be built upon through continued research and engagement with regulators, payment operators, banks, and other industry participants collaborating towards a technical proof-of-concept.

Sopnendu Mohanty, Chief FinTech Officer, MAS, said “To achieve significant cost-reduction in cross-border payment transfers, enhancements must be made on two fronts: direct connectivity between domestic faster payment systems, and frictionless foreign exchange on shared common wholesale settlement infrastructures. The BIS Innovation Hub Singapore Centre is working on both. The Nexus project maps out a much-needed set of standards to achieve seamless cross-border payment systems connectivity.”

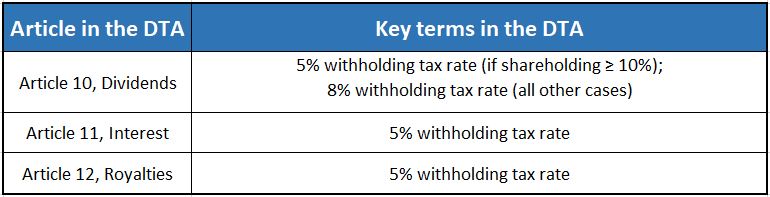

3) Singapore and Jordan Sign Avoidance of Double Taxation Agreement

On 14 July 2021, an agreement was signed between the Government of the Republic of Singapore and the Government of the Hashemite Kingdom of Jordan, for the Elimination of Double Taxation with respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance (“DTA”).

The summary of the key terms in the Singapore-Jordan DTA is as follows:

4) SGX Enhances SGX RegCo's Enforcement Powers and Disclosures on Whistleblowing Practices

With effect from 1 August 2021, Singapore Exchange Regulation (“SGX RegCo”) will have a wider range of enforcement and administrative powers, including the power to require a director or executive officer to resign from an existing position with an issuer listed on the Singapore Exchange Securities Trading Limited (“SGX-ST”). With effect from 1 January 2022, issuers listed on the SGX-ST Mainboard and Catalist (“listed issuers”) will be required to state in their annual reports that they have put in place a whistleblowing policy, starting with their annual reports relating to financial years commencing from 1 January 2021.

Starting from 1 August 2021, SGX RegCo will have the power to, amongst others:

- issuing a public reprimand against an issuer, its directors, executive officers, and issue managers;

- in the case of a listed issuer:

• issuing an order for the denial of facilities of the market, and prohibiting a listed issuer from accessing the facilities of the market for a specified period; and

• requiring a listed issuer to comply with conditions on its activities; and - in the case of a director or executive officer of a listed issuer:

• Requiring the resignation of the director or executive officer from an existing position with a listed issuer; and

• prohibiting any issuer for a period not exceeding three years from appointing or reappointing the director or executive officer, as a director or executive officer, or both.

IRAS- Due dates

Form C-S/C for the FY 2020 -30-November-2021

Estimated Chargeable Income (ECI) (June year-end)- 30-Sep-2021

GST Return: July 2021 – September 2021- 31 October 2021