Due Dates

Important Due Dates in May 2022

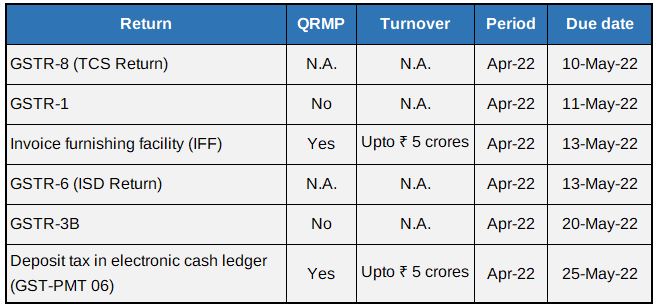

GST Compliance calendar

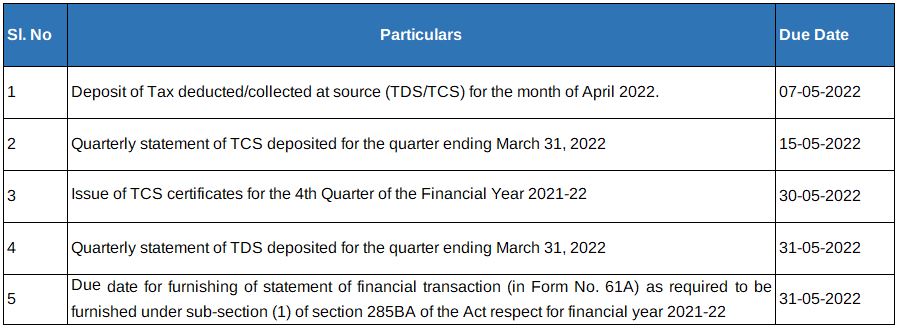

Income Tax Compliance calendar

DIRECT TAX

Circulars / Notifications / Press Release

Notification No. 21, 2022

Key Changes in Income Tax Return Forms for the Assessment Year 2022-23

- Information on Income from Retirement Benefit Funds in the countries notified under section 89A.

- Schedule for partners deriving only profits from the firm

- Schedule for Tax deferred in ESOPs

- Non-residents to disclose significant economic presence and provide details of aggregate payments and number of users in India

- Companies to disclose investments in unincorporated entities under schedule IF

- Requires bifurcation of corpus donation into donation made for renovation of repairs of places notified under section 80G and other donations

Notification No. 24, 2022

- CBDT notifies rules for taxation of income from Retirement Benefit Account maintained in a notified country.

- Where a specified person has accrued income in a specified account for AY 2022-23 or later, such income shall, at the option of the specified person, be included in his total for AY in which income from the said specified account is taxed at the time of withdrawal or redemption in the country notified under section 89A in which the Retirement Benefit Account is maintained.

Circular No. 95, 2022

- Employee Provident Fund Organization (EPFO) clarifies on calculation and deduction of tax on taxable interest relating to contributions to Provident Fund.

- EPFO clarifies that the effective date for TDS shall be 1 April 2022 or final settlement/ transfer, whichever is later in case of final claim settlement and in all other cases.

- TDS rate shall be 10% if PF account is linked with valid PAN, failing which the TDS rate 20%; further states that in case of non-resident, TDS rate would be 30% under Section 195 subject to provisions of DTAA.

Notification No. 29, 2022

- Donation to The Somnath Temple now eligible for deduction under section 80G

Notification No. 37, 2022

CBDT extends the scope of filing ITR and includes following persons whose:

- Total sales, turnover or gross receipts in the business exceeds ₹60 Lakh; or

- Total gross receipts in profession exceeds ₹10 Lakh; or

- Aggregate of TDS and TCS is ₹25,000/- or more, and ₹50,000/- or more for an individual resident aged 60 years or more; or

- Aggregate of deposit in one or more savings bank account is ₹50 Lakh or more

E-filing of ITR 1, 2 and 4 for AY 2022-23 enabled and offline utility for the same is also made available

CBDT has extended the timeline to update UDIN till 31May 2022

Case Laws

SRC Aviation P. Ltd - Delhi HC: Upholds disallowance of bonus paid to directors in lieu of dividend; Reiterates settled legal position

- In the referred case, the High Court disallows the payment of Bonus to shareholders-directors observing that it was paid to avoid payment of dividend distribution tax (DDT) and the bonus was not in nature of the employment or service contract.

Deloitte Touche Tohmastu - Delhi ITAT: Holds Deloitte's subscription fees received from member firms as exempt since governed by principles of mutuality

- In the referred case, Delhi ITAT held that subscription fees received from members was in the nature of reimbursement and being governed by the principle of mutuality, for the lack of a profit motive, the excess of income over the expenditure or the “surplus” remaining in the hands of such a venture cannot be regarded as “income” taxable under the Act.

Strides Pharma Science Ltd - Mumbai ITAT deletes interest adjustment on share application money and Considers LIBOR plus 300 basis point on advances recoverable

- In the referred case, assessee company has contested addition of notional interest on share application money pending allotment and interest imputed on advance recoverable.

- ITAT deletes interest adjustment on share application money the funds remitted to AEs (Associated Enterprises) for share application money was for obtaining shares only, not intended to be a loan and the repayment of part of share application money by the AEs was part of the process relating to share allotment

- Assessee stated that payment of advances was only incidental to normal course of business and thus not a separate transaction;

- ITAT directs AO/ TPO to consider LIBOR plus 300 basis point to compute the interest on advances recoverable from the AEs and further directs that while computing the interest, the credit period allowed by the AEs to be considered and only on net credit period interest needed to be charged.

Vivimed Labs Limited – Hyderabad ITAT invalidated 153A proceedings due to lack of incriminating evidence from search

- In the referred case, Hyderabad ITAT quashes assessments under section 153A due to lack of incriminating material found or seized during the course of search and held that the material forming part of assessee’ s books, not to be considered as incriminating material.

Kalpesh Synthesis Pvt Ltd – Mumbai ITAT holds tax audit report cannot override HC judgement

- In the referred case, Mumbai ITAT rules that legal position of the HC judgement shall override the position taken by the auditor in tax audit report and the tax audit report cannot be a reason alone for disregarding any HC judgement.

Toyota Boshoku Automotive India Pvt. Ltd – Bangalore ITAT rejects taxability as FTS & Sec.195 liability on reimbursement of seconded employees' salary to Toyota Corp

- In the referred case, Bangalore ITAT holds that Toyota Boshoku Automotive India Pvt. Ltd. is not liable for TDS on Fees for technical services under section 195 on reimbursement of salary of seconded employees, if already subjected to TDS under Section 192.

Australia agrees to amend law for not taxing Indian firms offshore income

- India and Australia sign the Economic Cooperation and Trade Agreement wherein Australia agrees to amend its domestic tax law so as to not tax offshore income of Indian entities providing technical services to Australia.

corporate laws

• Form CSR 2 for the financial year end 31 March 2021 to be filed on or before 31 May 2022.

• Form FC 4 (Annual Return of Foreign Companies) for financial year end 31 March 2022 to be filed on or before 29 May 2022.

• ECB 2 for the month of April 2022 to be filed on or before 7 May 2022.

MCA has via notification dated 6 April 2022, amended Companies (Management and Administration) Amendment Rules, 2022. Vide these amendment rules, certain particulars of Registers and Index of Members are not available any more for inspection and taking extracts.

MCA has via notification dated 5 April 2022, introduced various changes to streamline and fast track the voluntary liquidation process. Gist of the same is given below:

1. Time limit for giving intimation regarding the appointment of Insolvency Professional as a Liquidator to IBBI is increased to seven days.

2. Time frame for completion of voluntary liquidation and submission of final report is reduced from twelve months to 270 days / 90 days subject to other conditions from date of commencement of voluntary liquidation.

3. Insolvency Professional who has been appointed as a Voluntary Liquidator is now required to submit a Compliance Certificate in the prescribed format along with the final report and application to Tribunal.

Goods and Service Tax

GST registration not required in the State of import, even if goods are directly sold from the port of importation – Telangana AAR

The Telangana AAR in the case of M/s. Euroflex Transmissions (India) Private Limited has held that GST registration is not required in the State in which the goods are imported if the goods are directly sold from the port of importation to the customers located across different states in India. The applicant in this case is registered under GST law in the Telangana State and imports goods at a port of import in a different State. The AAR held that, the applicant can raise tax invoice from his place of business registered in the State of Telangana and the applicant is not required to obtain GST registration in the State in which the goods are imported. The AAR also held that applicant is eligible to avail ITC of IGST paid on import of goods even though they are directly dispatching the goods from the port of import to the customer’s place, without bringing the goods at their place of business in Telangana.

GST is applicable on liquidated damages/penalties received due to breach of conditions of contract – Telangana AAR

The Telangana AAR in the case of M/s. Singareni Collieries Company Limited has held that liquidated damages/ penalties received due to delay in performance of the contract, beyond the date prescribed in contract, is taxable under GST. The liquidated damages/penalties are consideration for tolerating the act or a situation arising out of the contractual obligation and such toleration constitutes supply of service. Further, as per GST law, consideration in relation to supply includes the monetary value of an act or forbearance. The AAR also relied on the provisions of the Indian Contract Act, 1872, which states that a failure to perform the contract at the agreed time renders it voidable at the option of the opposite party and alternatively, such party can recover compensation for loss occasioned by non-performance.

Canteen services provided to the employee at subsidized price, not liable to GST and ITC is not eligible on canteen and business promotion expenses - Haryana Appellate AAR

The Haryana Appellate AAR in the case of M/s. Musashi Auto Parts India Private Limited has held the following:

- The canteen services provided to the employees at subsidized price as mandated under the Factories Act is not a taxable activity. The AAR noted that, these services are uniformly available to all the employees as a facility in the course of their employment and, employer is under legal obligation to provide such services.

- The AAR has also held that, even after the amendment in Section 17(5) of the CGST Act, input tax credit of GST charged by canteen vendor is not eligible, though it is mandatory under the Factories Act to provide canteen facilities to the employee.

- As regards eligibility to input tax credit of GST paid on purchase of sweets, dry fruits, electronics, gold & silver coins/articles for free supply to the customers/agents, the AAR has held that input tax credit on such inward supplies is not eligible to the Appellant as these are meant for personal consumption.

Transportation facility provided by the employer to the employee is taxable – Haryana Appellate AAR

The Haryana Appellate AAR in the case of M/s. Beumer India Private Limited has held that transportation facility provided by the employer to the employee is taxable and the same would be liable to GST on a value that exceeds the total gift value of ₹50,000/- given by the Appellant to an employee availing this facility. In arriving at its conclusion, the AAR noted that, the transport facility is optional to the employees and thus, it is not part of the contractual obligation of the Appellant under the employment contract. In terms of the clause 2 of Schedule-I of the CGST Act, a supply between related persons, even if made without consideration, is taxable under the GST law. Thus, the AAR held that transport facility provided to the employees is liable to GST.

Preferential Location Services is a separately identifiable service from the construction service taxable @ 18%– Haryana Appellate AAR

The Haryana Appellate AAR in the case of DLF Ltd holds that Preferential Location Service Charges (PLS) collected will attract GST at 18%, where such charges are collected along with the consideration for sale of properties before the issuance of completion/occupation certificate (thereby 1/3rd Abatement of Transaction Value will not be available on charges collected as PLS). The appellant AAR held that amount charged for Preferential Location is for the premium in the location which attracts the buyer to pay the consideration over and above the normal value for a property. Hence, such PLS is an exclusive service capable of being provided even by a dealer in immovable property, after issuance of completion/occupation certificate. Thus, PLS is a separate service attracting GST rate at 18% which can be provided before or after the issuance of completion/occupation.

Cybersecurity / IS AUDIT

Metaverse & the Universe of Cybersecurity Risks

Imagine you are discussing a confidential client issue with your reporting manager. Soon after the end of meeting, in the virtual office, you come to know that (in real life) your boss has absolutely no idea about the meeting just had in the virtual space. Isn’t that terrifying?

Can you comprehend what’s going on? Read on.

In the Metaverse Universe, you can just become a victim of a “hacked avatar” or a “deepfake” scam. Deepfake refers to the manipulated digital figures that looks and sound like someone else.

Metaverse is a trending topic cropping up in most conversation these days in some advanced nations (including India). Although, the concept has been there, the push of this version into the new digital world has created great excitement and popularity even as the idea of what a Metaverse remains hazy.

The concept of Metaverse represents a new virtual world with an added pleasure of Augmented reality promising an immersive digital environment. While the idea of revolutionized digital world sounds all exciting, it is essential that we prepare for the plethora of cybersecurity concerns that will come along with this revolution.

While keeping the current cyber security issues in mind, we can predict some of the upcoming scenarios that may arise in the Metaverse. The possibilities include risks like:

- NFT Scams: Non-Fungible Tokens would be the epicenter of the Metaverse economy and even in the current situations we can see fake NFT sale scams online, it wouldn’t be wise to think such scenarios won’t occur in the Metaverse.

- Malicious Smart Contracts: These could be deployed to dupe people and used for gaining access to their cryptocurrency wallets or personal information.

- Malware Attacks: The AR/VR devices are prone and would be a new entryway for malware invasions and data invasions. A problem that may increase with mass people adoption of the technology

- Blockchain scams: We can expect blockchain scams occurring through seemingly legitimate financial institution.

An analysis of the present security situation of the virtual world till 2022 and taking in account of the statistical data, it is safe to predict that the existing cybersecurity issues such as phishing and other social engineering attacks would also be prevalent within the Metaverse as well.

With the social engineering attacks and other fraudster scams involved, we still cannot ignore the largest looming concern that surrounds the Metaverse and that is data privacy and security concerns that will mostly be under threat due to various reasons.

Embedded technology with Hardware risk:

Metaverse is bound to leave a lot of data, as AR/VR devices themselves collect large volumes of user data including, biometric information thus creating a potential for hack attacks. Moreover, demand for user data would also rise with the Metaverse and it could help provide leverage to collect more user data which is bound to rob people of their personal information.

Lack of legal helm for Metaverse

Metaverse is prominently using blockchain technology, which is secure, however, the technology is not immune to vulnerabilities. Moreover, the decentralized system with no designated administrator or moderator to keep charge or control is also concerning. The absence of authority may give rise to issues while retrieving stolen or illegally obtained assets.

While the metaverse provides a huge new frontier for consumers and corporations to engage, it will also be another space for cybercrimes to thrive as we have seen in the dark web. There are several factors that makes Metaverse potentially lucrative for cyber criminals such as regulation being virtually non-existent, ransomware and extortion tactics. Legal recourse for attacks is also low despite the protections in place provided by blockchain and cryptocurrency.

From our decades of knowledge of the digital revolution, we can see that with many emerging technologies, security was given secondary importance and mostly after a disruptive security incident. Therefore, instead of playing catch up with security, businesses creating this digital playground must ensure effective and efficient investment in cybersecurity. While Metaverse isn’t mainstream now, proper integration of cybersecurity operations from ground up would put business in better position to combat an ever-evolving threat landscape that’s fast becoming more complicated.

SINGAPORE UPDATES

Monetary Authority of Singapore and Inland Revenue Authority of Singapore Updates

1) Singapore Parliament Passes the Financial Services and Markets Bill to Address Key Risks Through a Financial-Sector Wide Regulatory Approach

The Financial Services and Markets Bill (“FSM Bill”) was read for the second time on 4 April 2022 and subsequently passed by the Singapore Parliament on 5 April 2022. Once it comes into force, the FSM Bill will allow MAS to adopt a financial sector-wide regulatory approach to address key financial sector risks, including money laundering and terrorism financing (“ML/TF”) risks, financial misconduct risks and technology risks.

This update outlines the key aspects of the FSM Bill.

I. Harmonised and expanded powers to issue prohibition orders (“POs”)

Under the FSM Bill, MAS’ powers to issue POs will be consolidated to apply to all MAS-regulated financial services. The FSM Bill will also empower MAS to issue POs against any person (whether located within or outside Singapore), with the fit and proper criteria being the sole ground upon which MAS will decide whether to issue a PO. Additionally, the scope of prohibition will be broadened to not only include taking up key positions such as directorship, management, or substantial shareholding, but also performing essential functions such as handling of funds, risk-taking, risk management and control, and critical system administration. FIs who use the services of prohibited persons in contravention of the PO will also be guilty of an offence unless they have taken reasonable steps to ensure compliance with the PO and believed on reasonable grounds that they would not be breaching the PO by indirectly engaging a prohibited person.

II. Enhanced regulation of DT service providers for ML/TF risks

FSM Bill will establish a separate licensing regime for persons who provide DT services outside Singapore from within Singapore. Thus, a person who carries on from a place of business in Singapore the business of providing a DT service outside Singapore will be required to be licensed under Part 9 (when the FSM Bill passes into law and becomes the FSM Act), unless that person is already regulated under some other existing regulatory framework (for instance, as a DPT service provider under the PSA).

The FSM Bill will primarily impose ML/TF-related requirements on DT service providers, and these requirements will be similar to those imposed on DPT service providers under the PSA. This means that DT service providers will have to comply with the ML/TF requirements under the FSM Bill, in addition to any other legal requirements applicable under the law of the country in which they offer DT services.

III. Harmonised power to impose requirements on technology risk management

The FSM Bill will also consolidate MAS’ powers to impose requirements relating to technology risk management on all FIs. Further, the maximum penalty for breaches of technology risk management related regulations will be pegged at S$1 million. This quantum takes into consideration the existing penalty regimes of other Singapore agencies such as the Personal Data Protection Commission.

IV. Statutory protection from liability for mediators, adjudicators and employees of operator of approved dispute resolution scheme

Prior to the FSM Bill, the regime for approval of dispute resolution schemes was provided for under the Monetary Authority of Singapore Act (“MAS Act”) and the Monetary Authority of Singapore (Dispute Resolution Schemes) Regulations 2007. This approval regime will now be migrated to the FSM Bill, along with the introduction of a new provision conferring statutory protection for mediators, adjudicators, and employees of an operator of an approved dispute resolution scheme against liability or claims by a complainant or FI. This statutory protection will apply where these persons carry out their duties with reasonable care and in good faith, but will not apply in cases of wilful misconduct, negligence, fraud or corruption.

V. Migration of certain MAS Act provisions to the FSM Bill

Apart from the above key changes, various other provisions within the MAS Act will also be migrated to the FSM Bill once it comes into force. Firstly, MAS’ general power to issue directions to FIs where necessary in the public interest will be migrated to the FSM Bill. This will be supplemented by a new power to approve the carrying on of business in Singapore by FIs which are not otherwise regulated by MAS, where the operations of such FIs would affect the monetary stability and credit conditions in Singapore, or the development of Singapore as a financial centre, or the financial situation of Singapore generally.

Secondly, MAS’ powers of control and resolution of FIs as well as its powers to assist foreign and domestic authorities to support their ML/TF supervisory actions, will be migrated from the MAS Act to the FSM Bill in substantially the same form. MAS’ powers of inspections will also be migrated from the MAS Act to the FSM Bill, with amendments to include inspections for the purpose of determining the extent of compliance by an FI with technology risk management requirements, and the extent of compliance by DT service providers with the new DT services regime.

To supplement its powers, the FSM Bill will also contain a new provision obliging FIs to take reasonable care not to provide false or misleading information to MAS.

2) Australia and Singapore to deepen collaboration in FinTech

On 13 April 2022, Australia Treasury and the Monetary Authority of Singapore (MAS) have signed the Australia-Singapore FinTech Bridge Agreement to strengthen cooperation between the FinTech ecosystems of both countries.

The commencement of discussions to develop the FinTech Bridge was announced in June 2021, when Australian Prime Minister Scott Morrison met with Singapore Prime Minister Lee Hsien Loong. The FinTech Bridge aims to build on the overarching framework for digital economy cooperation under the Australia-Singapore Digital Economy Agreement (DEA) to deepen collaboration between the FinTech ecosystems of both countries.

The FinTech Bridge will support both FinTech ecosystems now and in the future, with both the Australia Treasury and the MAS committed to ensuring that it will be a living agreement.

The Australia-Singapore FinTech Bridge sets out a framework for both authorities to:

- Deepen bilateral and multilateral cooperation on FinTech, to facilitate trade, investment and ecosystem development in the FinTech sector;

- Support the mutual establishment of FinTechs looking to expand in each other’s markets, and to encourage FinTechs to use the facilities and assistance available to explore new business opportunities and reduce barriers to entry;

- Build on current engagements[1] to strengthen linkages between Australia and Singapore for policy officials, regulators, and industry groups; and to work together to share FinTech expertise and encourage the development of new opportunities; and

- Explore joint innovation projects on emerging issues in FinTech to help the industry navigate through a constantly evolving space, to share information on emerging market trends, and to learn from the experiences in each jurisdiction. This includes collaboration in areas such as blockchain and distributed ledger technology, digital identities, cross-border data connectivity, data portability, and the application of FinTech to promote sustainable finance.

3) MAS Takes Civil Penalty Action and Issues Prohibition Orders against Two Former Trading Representatives for False Trading

Om 25 April 2022, the Monetary Authority of Singapore (MAS) has imposed civil penalties on, and issued prohibition orders (POs) against two former trading representatives, Ms Ngin Kim Choo and Mr Yeo Jin Lui, for false trading. Both executed a client’s instructions to purchase KS Energy Ltd (KSE) shares for the purpose of creating a false or misleading appearance with respect to the price of KSE shares.

Ms Ngin and Mr Yeo, who were trading representatives employed by CIMB Securities (Singapore) Pte Ltd (CIMB), admitted to contravening section 197(1)(b) of the Securities and Futures Act (SFA), and have paid MAS civil penalties of $100,000 and $50,000 respectively without court action.

MAS has issued five-year and four-year POs against Ms Ngin and Mr Yeo respectively, prohibiting them from:

(a) performing any regulated activity or from taking part in the management of, acting as a director of, or becoming a substantial shareholder of a holder of any capital markets services firm under the SFA; and

(b) providing any financial advisory service or taking part in the management of, acting as a director of, or becoming a substantial shareholder of any financial advisory firm under the Financial Advisers Act.

IRAS- Due Dates

- Estimated Chargeable Income (ECI) June year-end: 30-September-2022

- GST Return: For the period Jan – Mar 2022: 31-July-2022

- Form C-S/C: 30 Nov 2022