Due Dates

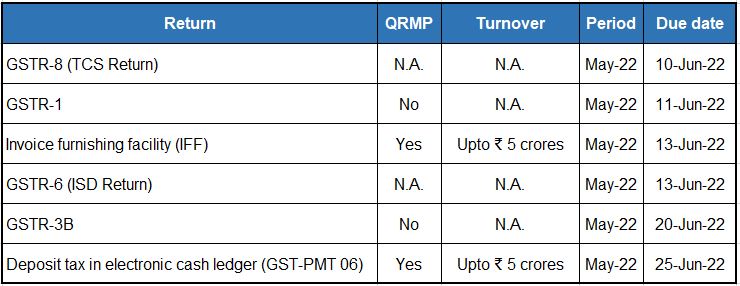

GST : Due dates in June 2022

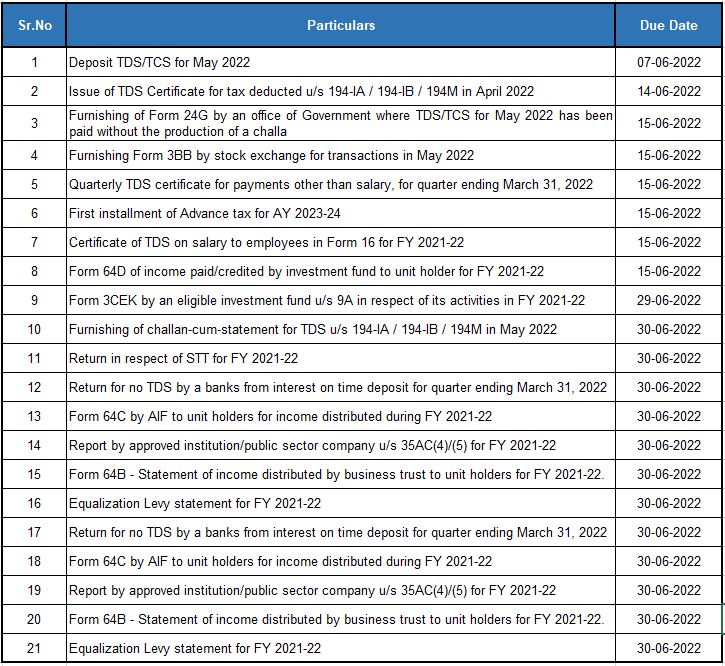

Income Tax: Due Dates in June 2022

DIRECT TAX

Circulars / Notifications / Press Release

Notification No. 49, 2022

New forms for advance ruling

- Forms no. 34C, 34D, 34DA, 34E, 34EA have been notified by CBDT for advance ruling applications

- Allows signing of applications digitally if the applicant is required to furnish the return of income under digital signature

- Communicating about the application through a registered email address

Notification No. 50, 2022

Rules for compliance, computation of minimum investment and exempt income

- Various compliance requirements to be fulfilled by alternative investment fund, domestic company and NBFCs receiving funds from specified companies

Notification No. 53, 2022

Mandatory requirement of PAN before entering into the following transactions:

- Cash depositing/withdrawing ₹ 20 Lakhs or more in one or more account

- Opening of current account or cash credit account

Notification No. 54, 2022

New Faceless Penalty (Amendment) Scheme 2022 and its Revised Directions has been notified by CBDT, the highlights are:

- Personal hearing now allowed if requested

- Regional Faceless Penalty Centre Omitted

- Authentication in electronic record by National Faceless Penalty Centre

- Reference of Penalty Units and Penalty Review Unit now defined

Circular No. 10, 2022

- The Finance Act, 2021 has inserted two new sections 206AB and 206CCA for higher rate of TDS and TCS for specified persons.

- The Finance Act 2022 has made certain amendments to the said sections thereby excluding higher rate of TDS for sections 194-IA, 194-IB, and 194M

Case Laws

Ashish Agarwal – Supreme Court : Strikes balance between Revenue's & Assessees' rights to settle reassessment controversy; Modifies High Court rulings by invoking Article 142

- In the referred case, the Supreme Court modifies High Court judgement and held that the reassessment notices issued under section 148 of the old law shall be deemed to be the show cause notices under section 148A(b) of the new law and directs that the revenue shall within thirty days provide the assessee with all the material information relied upon, so as to enable the assessee to file their reply to the notices within two weeks thereafter.

- This Supreme Court Judgement shall apply to all the writs pending in different High courts.

ESPN India - Chennai ITAT: Holds ESPN India not liable for TDS on payment under reseller agreement for advertisement space on ESPN UK’s website

- In the referred case, Chennai ITAT held that payment made for purchase of advertisement space is not taxable as royalty. Unilateral retrospective amendments to section 9(1)(vi) of the Act to the definition of ‘royalty’ cannot override the more beneficial definition under Article 13(3) of the UK-India Tax Treaty.

R N Fashion – Calcutta High Court: Notice due on a holiday not a valid opportunity of being heard

- Any opportunity provided by any notice due on a public holiday or weekend was not considered to be a meaningful opportunity by Calcutta High Court.

Ascent Hydro Projects Pvt Ltd– Mumbai ITAT: Income from carbon credits are capital receipts and not business receipts

- In the referred case, Mumbai ITAT dismisses revenue’s appeal and held that receipts from carbon credits are non-taxable capital receipts.

- Carbon credit generated out of environmental concern and not having character of trading activity are in the nature of a capital receipt and not in the nature of business income; ITAT thus dismisses Revenue’s appeal on this aspect

Oripol Industries Ltd – Orissa High court: Excess Commission paid to directors and relatives is disallowed u/s 37

- High Court observes that supply of Iron Ore Fines (IOF) was not in the line of business and the excess commission paid is to be disallowed as the Assessee failed to demonstrate the special expertise of directors and their relatives in procuring IOF from markets in India

Bluebay Mauritius Investment Ltd – Mumbai ITAT: Adjustment of brought forward capital losses against tax exempt capital gain as unsustainable

- In the referred case, Mumbai ITAT held that brought forward capital losses cannot be adjusted with exempted short term capital gains under article 13 of India Mauritius DTAA

Milestone Brandcom (P.) Ltd – Mumbai ITAT: Assessment order passed without application of mind is to be remanded back.

- An assessment order passed without considering the assessee’s response to the show cause notice, not provided opportunity of being heard and without application of mind has to be quashed and remanded back. Further, the assessing officer is directed to pay sum of ₹ 10,000/- as donation to PM cares fund from his personal account.

Blackstone FP Capital Partners Mauritius V Ltd – Mumbai ITAT: Revenue to decide if beneficial ownership inbuilt in Article 13 of India Mauritius DTAA

- In the absence of specific provisions dealing with beneficial ownership clause in Article 13 of India – Mauritius DTAA unlike Article 10 & 11, the ITAT has remanded back the case wherein to examine the admissibility of exemption provided under Article 13 of India – Mauritius DTAA in cases where the Assessee is not beneficial owner.

Apurva Goswami – Delhi ITAT : Overseas remittances for business promotion not FTS but business income, not liable for TDS where no Permanent Establishment (PE) in India

- In the referred case, Delhi ITAT held that any remittances to a non-resident carrying out business outside India in the absence of PE for Global Business Affiliates (GBA)/Business Development Associates (BDA) is not liable to deduct TDS u/s 195. Regarding the assessee’s contention of non-fulfilment of the condition of “make available” in Article 13 of the DTAAs with USA in his case, the Assessing Officer observed that the assessee is deriving an enduring benefit in the shape of clients which would continue to be associated with it once they have been introduced by the consultants.

Indirect Taxes

Government defers implementation of Electronic Cash Ledger under the Customs Act till 30 November 2022

As per Section 51A of the Customs Act, the Government has notified that the payment of duty, interest, penalty, fee or any other amount under Customs Act needs to be made through Electronic Cash Ledger (ECL). Earlier, the Government had notified 1 June 2022 for implementation of the provisions of ECL, Now the same has been postponed till 30 November 2022.

This deferral has been notified by way of exemption to the deposits pertaining to all class of persons and all categories of goods for the period from 1 June 2022 up to 29 November 2022.

Goods and Service Tax

IGST not leviable on ocean freight in CIF import contract – Supreme Court of India

The Supreme Court of India in the case of M/s Mohit Minerals Pvt Ltd has held that in CIF (Cost, Insurance and Freight) import contract, levy of IGST under reverse charge mechanism (RCM) on ocean freight component is contrary to concept of ‘composite supply’ in Section 8 of Central GST Act.

In CIF contract, foreign exporter contracts with shipping line, without the involvement of importer, for transportation of goods from foreign port to the destination port of importer’s country. Entry 9(ii) of Notification number 8/2017 of Integrated Tax (Rate) read with Entry 10 of Notification number 10/2017 of Integrated Tax (Rate) seeks to levy IGST at the rate of 5% on ocean freight value in CIF contract and ‘Importer’ in India was categorized as ‘recipient of service’ liable to pay this tax under RCM, though he is not a party to the subject contract. Further, when ocean freight value is not ascertainable, a deeming fiction was created to assume freight value at 10% of CIF import price for the purpose of computation of IGST.

Earlier, the Gujarat High Court had struck down this IGST levy on multiple counts viz. (i) importer is not service recipient in this case, (ii) levy of IGST on ocean freight amounts to double taxation as IGST is already paid on import of goods, (iii) the subject transaction does not have territorial nexus with India. The High Court, on these grounds, had held that the Entry 10 of Notification number 10 is ultra vires to the scheme of GST law.

The Government had filed an appeal before Supreme Court of India challenging the decision of Gujarat High Court. The Supreme Court dismissed the appeal filed by the Government and in para 148 of its decision, among other points, it concluded that the IGST levy imposed on the ‘service’ aspect of the transaction is in violation of the principle of ‘composite supply’.

Incentive received from a person other than supplier cannot be considered as trade discount and the same constitutes consideration for provision of marketing service – Maharashtra AAR

The Maharashtra AAR in the case of M/s. MEK Peripherals India Private Limited has held that:

- The incentive received from Intel Inside US LLC (hereinafter referred to as “IIUL) as a percentage of the quarterly target achieved cannot be considered as trade discount. The Applicant in this case is a reseller of Intel products, which they purchase from various distributors of IIUL. Since there is no supply of goods directly from IIUL to the Applicant, the AAR held that, the ‘incentives’ received from IIUL cannot be considered as trade discount in terms of the provisions of Section 15(3) of the CGST Act and the incentives represent consideration flowing from IIUL to the Applicant for marketing services.

- As regards the question of ‘export of services’, the AAR held that the marketing services are provided in respect of goods which are made physically available by the recipient (IIUL, through its distributors) to the Applicant-supplier and hence, the place of supply in this case is in India, and therefore, the supply of marketing services does not qualify as ‘export of services’.

GST is not payable under RCM on services of foreign ‘intermediary’ – Gujarat AAR

The Gujarat AAR in the case of M/s. Adani Green Energy Ltd has held that the Applicant is not liable to pay GST under reverse charge mechanism in respect of the services received from the ‘Manager’ located in non-taxable territory, where the ‘Manager’ has arranged the subscription of ‘Senior Secured Notes’ between the Applicant and actual investors. The AAR noted that, in whole subscription process, the Manager has undertaken many activities like scheduling a meeting between the Applicant and investors, initiating the process of book building for offer of Notes to the potential investors, soliciting counter offers from the interested investors, collecting the proceeds of subscription, etc. Hence, the Manager has the characteristics of an agent and a broker, performing subsidiary role in arranging the main supply and thus, satisfying the definition of ‘intermediary’. Thus, the AAR held that the place of supply in this case is the location of Manager, that is, non-taxable territory. Consequently, the present transaction is not an ‘import of service’ as the place of supply is outside India and therefore, GST is not payable under reverse charge mechanism.

GST is not payable on recovery of canteen charges from employee - Gujarat AAR

The Gujarat AAR in the case of M/s Cadila Healthcare Limited has held that the canteen service facility provided by the Applicant to its employees is not an activity made in the course or furtherance of business and hence, GST is not leviable on the recovery of canteen charges. AAR noted that, as per the arrangement, part of the canteen charges is borne by the Applicant whereas the remaining part is borne by the employees. Applicant does not retain any profit margin in the activity of collecting employees’ portion of canteen charges.

Recoveries from employees for providing canteen facility, and FOC supply of bus transport facility not taxable under the CGST Act; ITC is not eligible on canteen services, GST paid on hiring of buses eligible for ITC – Gujarat AAR

The Gujarat AAR in the case of M/s Emcure Pharmaceuticals Limited has held that:

- The recoveries made by the Applicant from its employees for providing canteen services is not taxable under the GST law. Further, transport facilities provided to employees free of cost is not taxable under the GST law.

- The AAR also held that even after the amendment in Section 17(5) of the CGST Act, input tax credit of GST charged by canteen vendor is not eligible, though it is mandatory under the Factories Act to provide canteen facility to the employees.

- In respect of hiring of buses used for transportation of employees, the AAR held that input tax credit on GST paid on hiring of buses, having approved seating capacity of more than 13 persons, is admissible to the Applicant.

Service Tax is payable on secondment of employees – Supreme Court of India

The Supreme Court of India in the case of M/s Northern Operating Systems Pvt. Ltd. has held that secondment of employees by foreign entity qualifies as ‘manpower supply service’ and thus, leviable to service tax under reverse charge in the hands of Indian entity.

The issue in this case was that whether the reimbursement of salary of seconded employees by Indian entity to foreign entity is liable to service tax under reverse charge mechanism.

In the present case, there were primarily two agreements entered between Indian entity and foreign entity. One agreement was for provision of back-office support services by Indian entity to foreign entity on a cost-plus mark-up basis (“Service Agreement”). In the other agreement viz. ‘secondment agreement’, it was agreed between the parties that Indian entity would request its foreign entity for secondment of its employees in India. The secondment arrangement was for a limited duration and the seconded employees were under the supervision and control of the Indian entity during the period of secondment. However, due to social security laws of the home country of the secondees and other business considerations, the seconded employees were retained on the payroll of the foreign entity and their salary was also paid by the foreign entity which was then claimed as reimbursement from Indian entity.

The department contended before Supreme Court that the real purpose of secondment of employees by foreign entity to Indian entity was to ensure that the expertise of seconded employees is available to the Indian entity for performance of agreed tasks and to ensure the quality under the Service Agreement. It was also argued that though the seconded employees were operationally under the control of the Indian entity the fact remains that they were on the payroll of the foreign entity and the employees would return to their original position in the foreign entity after upon cessation of the assignment. Thus, the arrangement was one of a contract for service which was provided by foreign entity to India entity through seconded employees.

The respondent-assessee in this case primally argued that the seconded personnel are contractually hired as employees of the Indian entity and their remuneration is also fixed by it. Further, the process of disbursal of salaries and allowance is solely for the sake of convenience and continuation of the social security benefits in the home country. Since, there exists employer-employee relationship in this case, the reimbursement is in the nature of salary payment and hence, not liable to service tax.

Supreme Court of India on analyzing the entire arrangement between foreign entity and Indian entity noted that:

- In order to decide whether an ‘employer-employee’ relationship exists in a given case, the ‘Supervision and control’ test is not necessarily determinative to discern the real employer;

- The test of ‘substance over form’ has been consistently applied by the Supreme Court which require a close look at the terms of contract or the agreements;

- In the present case, the secondment is for a specific duration and in relation to performance of the specific tasks given by foreign entity to Indian entity. In this context, the foreign entity deploys its employees possessing the specific required skill on a secondment basis with an Indian entity. But, the seconded employees continue to be on the payroll of foreign entity and they would return to their original position after the completion of secondment.

Having regard to this, the Supreme Court held that the Indian entity is recipient of manpower supply service in the present case in relation to secondment of employees by foreign entity to it. However, Supreme Court held that invocation of extended period of limitation is not tenable in this case as the view held by the assessee was neither mala fide nor untenable.

Cybersecurity / IS AUDIT

VAPT: An Action You Cannot Ignore

The rapid adoption of technology in the last two decades has fuelled the exponential growth of connected devices, custom applications and IoT. The penetration of digital technology has not only entered our daily life but also in the day-to-day activities in every organization. With ordinary eyes, all our software and network would look organized and performing in ways that it meant to be. However, to a person with the right skill set, vulnerabilities caused by rapid adoption, intrinsically connected software of different generations and poor configuration can be easily identified.

The safety of IT assets depends on the person ethically acting upon it and not exploiting it for personal gains. Our advice is to not to wait for someone else’s moral compass to protect an organization and perform Vulnerability Assessment and Penetration Testing (VAPT) to strengthen the security and bring about the necessary fixes.

All industries invest a fair amount of money on their system security to ensure reliability and security of their applications. VAPT is one such investment that protects your network and applications and make them immune to threats. It helps one identify pre-existing flaws in the network and gives a clear picture on the consequences that may occur due to these flaws.

The necessity of VAPT is usually by organizations. On the contrary, companies should understand that each one of them are potential targets for hackers. This can be seen by looking at the increase in the ransomware attacks on organisations ranging from schools, hospitals, food outlets to large corporates.

Significant Causes for Vulnerabilities

The major causes of vulnerabilities in an organization network can be attributed to the following reasons:

- Poorly configured system

- Poor password combinations

- System connected to unsecured network

- Poor design of hardware and software

- Complex software or hardware

- Negligible awareness of best cyber security practices among employees

Benefits of VAPT

The security environment of an organization gains excessive benefits from a periodic (at least on annual basis) VAPT. A few of them as mentioned below:

- Provides a comprehensive view on potential threats faced by an organization. It could be caused by a specific application, outdated security patches, or services running on ports which may not be required.

- Helps organization identify software errors that could lead to cyber-attacks.

- Provide risk management.

- Protects your organization from financial loss and reputation damage.

- Secures your services from internal or external threats.

- Protects organizational data from malicious actors.

Necessity of Penetration Testing

- To keep the financial data secure while transferring it between systems or over networks.

- To protect user data

- To identify security vulnerabilities within an application.

- To find out loopholes within the system.

- To assess the tolerance of business in cyber-attacks.

- To implement effective security strategy and business continuation plan in the organization.

Securing our assets can be an intimidating task. Every organization invests in security, but is your data safe?

Protecting your assets before the attack is the way to go. Performing VAPT and safeguarding your assets should be the goal of every organization

SINGAPORE UPDATES

Accounting and Corporate Regulatory Authority (ACRA)

1) Timelines for updating Registers

With effect from 30 May 2022, companies should enter into their Register of Nominee Directors (ROND) information received from nominee directors (including any updates) within 7 days after receiving the information.

Foreign companies need to update their Register of Members within 30 days following any changes.

2) Public Consultation on Proposed Legislative Amendments Relating to Singapore’s Regulatory Regime for Corporate Service Providers

The Accounting and Corporate Regulatory Authority (ACRA) is proposing amendments to the Companies Act, ACRA Act and a new Corporate Service Providers Bill (CSP Bill).

Following are the proposals for ACRA’s key legislative:

(a) Enact a new CSP Bill requiring all entities or persons providing corporate secretarial services in and from Singapore to register with ACRA as CSPs, regardless of whether they need to transact with ACRA.

(b) Increase financial penalties on RFAs/CSPs/RQIs [2] for breaches of terms and conditions of their registration and introduce a fine [3] for breaches of anti-money laundering/ countering the financing of terrorism obligations (AML/CFT obligations) committed with the connivance of, or through the neglect by individuals like directors, owners or partners of CSPs.

(c) Introduce a requirement for CSPs to ensure that individuals they appoint to act as nominee directors are fit and proper, and satisfy prescribed training requirements, if they hold more than a legally prescribed number of nominee directorships by way of business (unless they are qualified persons); and

(d) Introduce a new requirement for nominee directors and shareholders to disclose their nominee status and the identity of their nominator to ACRA, and for ACRA to maintain such information. The nominee status of these directors and shareholders will be made publicly available.

Monetary Authority of Singapore and Inland Revenue Authority of Singapore Updates

1) MAS paper on strengthening AML/CFT name screening practices

The Monetary Authority of Singapore (“MAS”) has released an information paper after conducting a thematic review on financial institutions in relation to Anti-Money Laundering/Countering of Financing of Terrorism (“AML/CFT”) name screening practices.

By selecting a number of financial institutions, mainly banks, merchant banks, and finance companies, MAS determined gaps in the name screening frameworks adopted by the financial institutions.

The summarized key findings are as follows:

- Inadequate Senior Management Oversight

Whilst senior management had adequate access to information to oversee, monitor and deliberate follow-up actions for money laundering/terrorism financing/proliferation financing (ML/TF/PF) risks, there was insufficient oversight on AML/CFT processes, including name screening processes to ensure they were operating well. MAS recommends senior management prevent these lapses which result in true hits being erroneously dismissed.

- Framework, Policies and Procedures

It was noted by MAS that some financial institutions failed to:

- implement tools to perform batch ongoing screening of customers and relevant parties to mitigate human error and to ensure checks are carried out in a timely manner

- screen former names of customers

- systematically identify and track the parties that were subject to name screening requirements.

MAS recommends subscribing to a system solution to enable robust and timely screening. MAS also recommends that AML/CFT policies adequately cover the need to screen former names of customers and entities that require screening.

- Screening Parameters and Databases

MAS noted that financial institutions did not adequately understand, evaluate and regularly review the appropriateness of name screening methodology including parameters. MAS also noted that financial institutions did not enquire and document the information/resources used by screening vendors and did not include certain information sources, relevant to ML/TF/PF related matters in their screening databases. MAS has given some suggestions on optimising name screening permutations and has suggested excluding titles, legal entity statuses such as Pte. Ltd., punctuations and symbols and common words such as &, bin, s/o.

MAS recommends that staff responsible for setting policies for screening parameters are familiar with the systems and how to conduct effective screening. Appropriate training and regular review of the AML screening providers should be undertaken by financial institutions.

- Alert Resolution

MAS noted that financial institutions have used inappropriate criteria to determine relevance of news and did not establish clear documentation standards on name screening. Financial institutions are recommended to establish proper records of assessment of alerts especially for dismissing any alerts. Appropriate second line of defence checks and balances should be regularly conducted to detect possible oversight on handling of alerts.

Although the thematic review was conducted by MAS on banks and finance companies, recommendations provided in the report are useful for all financial institutions. Name screening is an essential part of the AML/CFT process and in the risk rating of customers. Inadequate practices, lack of robustness in terms of name screening procedures will lead to inaccurate risk rating of customers and prevent financial institutions from taking appropriate steps to mitigate ML/TF/PF risks.

2) MAS issues Prohibition Order Against Ms Nancy Tan Following Conviction for Dealing in Securities Without a Licence

The Monetary Authority of Singapore (MAS) has issued an eight-year prohibition order (PO) against Ms Nancy Tan Mee Khim, following her conviction for consenting to Noble Consulting Group Pte Ltd (Noble) carrying on a business of dealing in securities without holding a capital markets services licence under the Securities and Futures Act 2001 (SFA).

Under the PO, which took effect on 18 May 2022, Ms Tan is prohibited from performing any regulated activity or from taking part in the management of, acting as a director of, or becoming a substantial shareholder of a holder of a capital markets services firm under the SFA.

Between July 2013 and December 2015, Ms Tan was the managing director of Noble, a company in the business of helping small and medium enterprises raise funds from the public. Noble organised multiple seminars, participated in investment exhibitions, created and disseminated marketing materials to potential investors and raised a total of $15,355,000 from 145 members of the public. The Investment or Loan Agreements that the investors entered into with Noble’s client companies were found by the State Courts to be debentures, a form of securities.

On 3 June 2020, Ms Tan was convicted under section 82(1) read with section 331(1) of the SFA for consenting to Noble carrying on a business of dealing in securities without holding a capital markets services licence. She was sentenced to 8 months’ imprisonment.

Timeline for Updating Registers

With effect from 30 May 2022, companies should enter into their Register of Nominee Directors (ROND) information received from nominee directors (including any updates) within 7 days after receiving the information.

For more information, please visit the following links:

IRAS- Due Dates

- Estimated Chargeable Income (ECI) June year-end: 30-September-2022

- GST Return: Apr 2022 – Jun 2022: 31-July-2022

- Form C-S/C: 30 Nov 2022