Due Dates

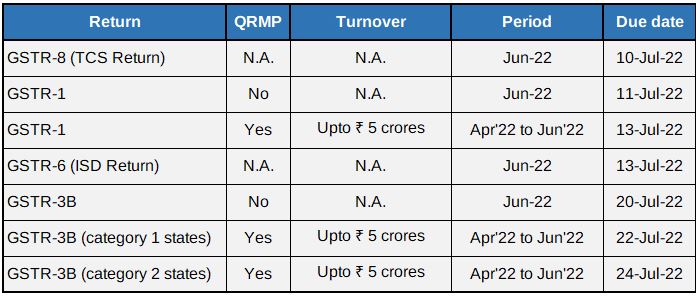

GST: Due dates in July 2022

Corporate Laws Due Dates

Return on Foreign Liabilities and Assets (FLA Return) needs to be filed with the Reserve Bank of India on or before 15 July 2022

ECB 2 return for the month June 2022 need to be filed on or before 7 July 2022.

Form 11 for LLP for FY 2021-22 need to be filed on or before 15 July 2022 as per the extension of time granted by MCA.

MCA vide notification dated 30 May 2022 has amended the Companies (Appointment and Qualification of Directors) Amendment Rules, 2022. In terms of the amendment rules, any compromise or an arrangement or merger or demerger between an Indian Company and a Company incorporated outside India in a country which shares land border with India, it is made mandatory to submit a declaration regarding requirement of obtaining a prior approval under the Foreign Exchange Management (Non-Debt Instruments) Rules, 2019. In case a prior approval is required then approval from Ministry of Home affairs needs to be obtained before initiating the process for compromise or arrangements or merger or demerger.

MCA vide notification dated 1 June 2022 has amended the Companies (Appointment and Qualification of Directors) Amendment Rules, 2022. In terms of the Amendment Rules, in case any national of a country which shares the border with India is proposed to be appointed as a Director, then necessary clearance from the Ministry of Home Affairs, Government of India shall be obtained and attached along with Form DIR-2. Similar clearance needs to be obtained prior to making an application for Directors’ Identification Number (DIN) and the same needs to be attached with the DIN application.

DIRECT TAX

Circulars / Notifications / Press Release

Notification No. 01, 2022

- Notification No. 01 of 2021 dated 22 June 2021 which was to facilitate Tax Deductors and Collectors in identification of Specified Persons as defined in sections 206AB and 206CCA has been modified to provide a detailed procedure to identify the specified person

Notification No. 69, 2022

- The Central Government, has notified that the “Seventy Second Investment Company LLC (PAN: ABICS2676N)” as specified person for Sovereign Wealth Fund. They can now claim tax exemption of income in nature of dividend, interest or long-term capital gain as per section 10 of income tax act.

Notification No. 70, 2022

- CBDT retains the tolerance range of Arm’s Length Price in International transaction for AY 22-23.

Notification No. 62, 2022

- CBDT notifies the Cost inflation Index (CII) to compute Capital gain for the year 2022-23 to be 331.

Notification No. 66, 2022

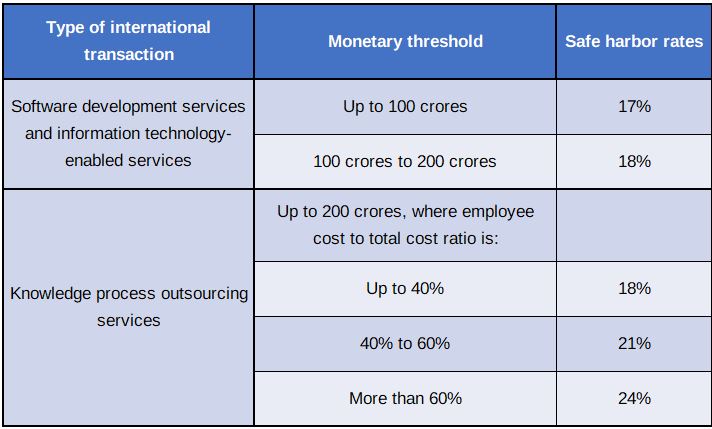

- Safe Harbour has been extended for assessment 2022-2023.

Notification No. 67, 2022

- CBDT amended Income Tax Rule 30 and 31A,

Inserted: - New Form No. 16E – Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source,

- Form No. 26QE – Challan-cum-statement of deduction of tax under section 194S by specified persons.

Amended: - Form No. 26QB – Challan-cum-statement of deduction of tax under section 194-IA,

- Form No. 26QC – Challan-cum-statement of deduction of tax under section 194-IB,

- Form No. 26Q, Form No. 26QC – Challan-cum-statement of deduction of tax under section 194-IB

- Form No.26QD – Challan-cum-statement of deduction of tax under section 194M.

Circular No. 13 & 14, 2022

- The CBDT has given clarification regarding how taxes will be deducted on various issues with respect to 194S – TDS on transaction of Virtual Digital Asset. Such clarification are in respect of

- TDS on Peer-to-Peer transactions.

- TDS when exchange, brokers are involved.

- TDS when consideration paid is in kind.

- TDS u/s 194S and 194Q etc.

Case Laws

S K Srivastava – High Court :

- In the referred case, Assessee has contended that NaFAC (National Faceless Assessment Centre) does not fall within the authority of law as provided under Article 265 of the Constitution. NaFAC is not an income tax authority as defined in the Income Tax Act and therefore it cannot pass an order.

- High Court said that there is no illegality in the Faceless Scheme as provided in the Section 144B. The disposal of the objections and framing of the assessment has actually been done by the Assessing Officer. The only difference is that unlike earlier, the orders have been conveyed by NAFAC instead of Assessing Officer directly.

Credit Suisse (Singapore) Ltd

- In the referred case, Assessee was distributing Mutual Fund scheme outside India and claimed offshore distribution commission exempt under section 10. However, department taxed such income as it constituted business connection in India.

- Mumbai ITAT held that for taxing the income as deemed to accrue or arise in India, the income should be ‘reasonably attributable’ to operations carried out in India whereas in the instant case, all the operations were carried out outside India;

- Thus, holds that offshore distribution income cannot be taxed in India.

Virtusa Consulting Services Pvt Ltd

- Madras HC allowed Assessee’s writ appeal and holds that reference made to TPO beyond the period of 21 months is time-barred and if such reference to TPO is bad, then all further proceedings, in furtherance of the same are also bad. Therefore, it quashes the assessment order passed by the AO.

Swati Bajaj – Calcutta High Court

- The HC ruled in favour of the revenue stating that the penny stock’s unreasonable rise over a short period was done by a group of promoters of the company, operators, share brokers and money launderers.

- The creditworthiness of the company whose stock rose exponentially was also very poor and the shares of such company are closely held as the general public is not interested in these stocks due to the poor financials of the listed companies.

- Therefore, unless and until the Assessee discharges such burden of proof, the addition made u/s 68 by the assessing officer cannot be faulted.

Sanjay Sadashiv Navale – Pune ITAT

- In the referred case, Pune ITAT held that revenue’s contention of income escaping assessment merely because the Assessee deposited money in his bank account was a fallacious assumption as the bank deposits need not necessarily constitute undisclosed income.

- The reasons recorded by the Assessing Officer were not sufficient reasons for reopening the assessment proceedings and reassessment was quashed.

Aker Powergas Power Gas Pvt Ltd – Mumbai ITAT

- Mumbai ITAT quashes a draft assessment order which is passed along with demand and penalty notice and called it as void ab initio as it is not in line with the procedures laid down u/s 144C.

Goods and Service Tax

Renting of residential dwelling to business entities for the use of their employee is exempt from GST – Maharashtra AAR

The Maharashtra AAR in the case of M/s Kasturi & Sons Ltd has held that renting of residential dwelling to M/s. LIC of India for residential purpose of their staff members is eligible for the exemption from payment of GST. Renting of residential dwelling for use as residence is a service, which is exempted from levy of GST under the Notification 12/2017-CT(Rate) dated 28June 2017. The apartments were taken on lease by LIC of India for use as residence by staff members. AAR has noted that it is the purpose for which the property is used that is relevant for the purpose of determining eligibility to exemption and the status of the recipient as business entity has no bearing on deciding claim of exemption. Thus, Applicant is exempt from payment of GST on receipt of monthly license fee.

It may be noted that, GST Council in its 47th meeting held in the last week of June has proposed to withdraw exemption on renting of residential dwelling to business entities (registered person).

CENVATenvat Credit of service tax paid on Corporate Social Responsibility expenses is not eligible – CESTAT New Delhi

CESTAT New Delhi in the case of M/s Power Finance Corporation Ltd has held that the Appellant being a non-banking finance corporation engaged in financing projects was not entitled to CENVAT Credit on the services used for Corporate Social Responsibility (CSR). The Tribunal noted that as per Rule 2(l) of CENVAT Credit Rules, 2004, not all services used by provider of output services in running its business qualify as ‘input services’, but only such services which are used by such provider for providing an output service qualify as input services. Expenditure on CSR is discharge of a statutory liability imposed as per the Companies Act, 2013, and such expenses are incurred from the profits earned by the Company from its business activities. Thus, the Tribunal noted that CSR expenses are incurred post rendering of output service and cannot be said to be incurred for providing an output service. In view of the specific definition of ‘input services’ as per CCR, 2004, the Tribunal held that the Appellant was not eligible to avail CENVAT Credit on expense incurred on CSR.

Receipt of gratuitous payment by the Cooperative Housing Societies from an outgoing member is taxable – Maharashtra AAR

The Maharashtra AAR in the case of M/s Monalisa Co-operative Housing Society Limited has held that Applicant is liable to pay GST on receipt of voluntary payment from an outgoing member. The AAR noted that, as per the Model Bye laws No.7 (e) and 38(e) (ix) of the Cooperative Housing Societies, the society cannot accept voluntary donations from a transferor or transferee. Therefore, the amount received by the society from the transferor cannot be considered as voluntary donations. Payment from an outgoing member to a society appears to be a payment made for the services rendered by society to the outgoing member during his stay as a member in a society. Further, the AAR referred to the decision of Bombay High Court in case of Alankar Sahkari and noted that in case of transfer of flat by a member, different ways are being invented by societies to collect higher transfer fees than what is legally permissible. Societies are in a dominating position and the members also want smooth transaction, so the members agree to pay voluntary donations to the society in such case. Thus, the consideration is received by the society for the supply of services and hence the same is liable to GST.

The activity undertaken by Liaison Office for Head Office is a taxable activity – Maharashtra Appellate AAR

The Maharashtra Appellate AAR has held that the activities undertaken by Liaison Office for the Dubai Head office, where it has been set up to play a key role in the growing trade and diplomatic relations between India and UAE constitutes supply.

The Maharashtra Appellate AAR has modified the AAR by holding that the activities undertaken by the Appellant on behalf of Dubai Head Office cannot be construed as supply of intermediary service, as Liaison Office is merely acting as a link for communication between the Indian businesses and the Dubai businesses, without undertaking any arrangement or facilitation of supply of any goods or services between business entities of the two countries.

The activities performed by the Appellant at the behest of their Delhi Head Office will come under the ambit of ‘Supply’. The activities pertaining to the organization of the various events, the place of supply in such cases will be the place where such events are held. Since the events are organized in India, the place of supply will be in India, and it will attract GST at the rate of 18% having SAC “998596”. The other supply of services which are not in the nature of organization of events, the place of supply will be outside India and hence, such supply will not be liable to GST.

Further it was also held that, the activity which is not business as per the mandate of RBI can still be construed as a business under the GST law. The Liaison Office and the Head Office are two different persons as per the GST Law.

IGST exemption on imports available to EPCG, Advance Authorization holders, EOUs/STP units

Government had earlier extended IGST and compensation cess exemption on imports to EPCG, Advance Authorization holders, EOUs/STP units till 30 June 2022. Now, the Government has further extended the IGST and compensation cess exemption on imports to EPCG, Advance Authorization holders, EOUs/STP unit without any time limit.

Cybersecurity / IS AUDIT

How to Lower Your Cyber Security Insurance

No business is immune to the risks present in the cyber security space. The average cost of the impact of data breach is increasing steadily. The prospect of loss motivates us to reduce the impact of an incident that we might encounter. Hence, we can see a steadily increasing popularity of cybersecurity insurance. Here, we will help you to understand the important things you need to know about this insurance.

What Does Cyber Security Insurance Cover?

Cyber Insurance covers a lot of costs that might incur at the time of a security incident. The most common one on people’s mind would be of the burden of the ransom from a ransomware attack. As a matter of fact, your insurance covers the ransom and cover other additional expenses as well. It includes:

- Financial losses suffered due to the business shut down.

- Forensic investigation necessary to comprehend the impact of the breach

- Cost of notifying your customers of the breach.

- Crisis Management Consulting

- Legal Fees

- Putting your network back online and running services post-incident

The market of cyber insurance has grown exponentially over the past few years. High value financial damage has made companies rethink their position on the insurance. However, the insurers are seeing the same trends, and the cost of cyber insurance premium has been rising accordingly as well. Clearly, the insurers are also looking for profit and they don’t want to lose money, so they are doing their due diligence and thoroughly analyze the cyber security practices before insuring them.

To have lower premiums, you must do all the things that you should be doing to avoid a breach. Ultimately, your goal and your insurer’s goal coincide as both doesn’t want you to experience a cyber security incident. Therefore, they will reward you for following the best industry practices in your organization.

Here are some steps to reduce your cyber insurance costs.

- An Incident Response Roadmap

A well thought out incidence response plan is the best for exuding confidence in front of your insurance team. Identification and protection of the most sensitive data and business network, cyber security decision making capability, preparation to counter modern day threats and compliance with data regulations are some factors that determine the reduction in the insurance premium.

- Effective Security Training

As your organization grows, so do the opportunities to attack your company. The more employees you have, the more vulnerable your company as it increases the probability of phishing attacks. Whatever advanced data management, security tools and practices you employ, it would be redundant if your employees are oblivious to them. A continuous awareness for cyber security and data management processes should be imparted to the employees at regular intervals to address this concern.

- Focus on Security Behaviours

Cyber security is a continuous process and require real time data monitoring and analysis combined with advanced industry knowledge. An external penetration testing and risk assessment from a third-party organization and a confident overall risk rating can be key factors in the process. Conducting penetration testing during required intervals, providing adequate access, limited stored data and restricted network access would prove to be useful to you in minimizing your insurance premium.

- Encouraging the Best in the Industry Standard Cyber Security Practices

A systematic integration of the cyber security policies in your day-to-day practices can serve a long way in impressing your carriers. Strong Password policy. Multi-factor authentication for using important services, effective third-party management, regularly installing the patch updates and a workforce well versed in cybersecurity practices could help you capture the best deal.

Evolving Market

With increasing risk and loss ratios, it is becoming more difficult to obtain reasonably priced cover. Thus, organizations will be compelled to better manage their cyber security risks to obtain lower premiums. In the recent past, businesses were able to select a competing provider with low security requirements but that’s no longer the case with insurers having greater influence over cyber security practices.

Insurance providers carry a certain level of risk, and each provider needs to carefully manage it. As a strategy, an increasing number of insurers are providing pre-breach security support. By offering preventative cybersecurity support, insurers are reducing the chances of a breach. This allows the insurers to add value to their customers while reducing their own risk.

Data is the key as insurers are trying to quantify the risks through building partnerships to get it. This data provides a more accurate and dynamic view of immediate threat landscape which in turn helps the company to create a checklist helping the businesses in tackling these immediate threats. Although helpful, organizations shouldn’t fully fall back on the guidance of the insurance company and ensure the 360°’ protection of their infrastructure. Insurance would be helpful in case of large-scale security breach and help organization with a quick transition and recovery from a major attack. That being said, insurance should only be a part of wide strategy that prioritize detection and prevention ahead of response and mitigation.

SINGAPORE UPDATES

Accounting and Corporate Regulatory Authority (ACRA)

1) ACRA and SGX RegCo establish committee to advise on Sustainability Reporting roadmap for Singapore incorporated Companies

On 21 June 2022, the Accounting and Corporate Regulatory Authority (ACRA) and Singapore Exchange Regulation (SGX RegCo) announced that they have established a Sustainability Reporting Advisory Committee (SRAC) to advise on a sustainability reporting roadmap for Singapore-incorporated companies.

As part of its work, the Committee will provide inputs on the suitability of international sustainability reporting standards for implementation in Singapore. The SRAC comprises industry leaders and sustainability champions with diverse experience including chief sustainability officers, representatives of financial institutions, institutional and retail investors, sustainability reporting professionals and academia.

ACRA and SGX RegCo said that they are developing a roadmap for wider implementation of sustainability reporting for Singapore-incorporated companies, beyond SGX-listed companies. SGX RegCo has been progressively enhancing sustainability reporting for listed companies, including mandatory reporting since 2016 and the introduction of climate reporting from FY2022.

2) ACRA consultation on proposed amendments to Singapore’s regulatory regime for corporate service providers and nominee directors and shareholders

The Accounting and Corporate Regulatory Authority (ACRA) is conducting a public consultation on proposed amendments to the Companies Act 1967 and the Accounting and Corporate Regulatory Authority Act 2004 and the introduction of new Corporate Service Providers Bill (CSP Bill).

The key legislative proposals are:

- To enact a new CSP Bill requiring all entities or persons providing corporate secretarial services in and from Singapore to register with ACRA as CSPs, regardless of whether they need to transact with ACRA;

- To increase financial penalties on registered filing agents, CSPs and registered qualified individuals for breaches of terms and conditions of their registration, and introduce a fine for breaches of anti-money laundering/ countering the financing of terrorism obligations (AML/CFT obligations) committed with the connivance of, or through the neglect by individuals like directors, owners or partners of CSPs;

- To introduce a requirement for CSPs to ensure that individuals they appoint to act as nominee directors are fit and proper, and satisfy prescribed training requirements, if they hold more than a legally prescribed number of nominee directorships by way of business (unless they are qualified persons); and

- To introduce a new requirement for nominee directors and shareholders to disclose their nominee status and the identity of their nominator to ACRA, and for ACRA to maintain such information. The nominee status of these directors and shareholders will be made publicly available.

Monetary Authority of Singapore and Other Updates

1) MAS issues revised Business Continuity Management guidelines to Financial Institutions

On 6 June 2022, the Monetary Authority of Singapore (MAS) issued a revised version of the Business Continuity Management Guidelines (BCM) for financial institutions (FIs), to help FIs strengthen their resilience against service disruptions arising from IT outages, pandemic outbreaks, cyber-attacks and physical threats. The revisions take into account learnings from the handling of the COVID-19 pandemic and increased digitalisation in the financial sector.

To enable the continuous delivery of services to customers, FIs should adopt a service centric approach through timely recovery of critical business services facing customers, identify end-to-end dependencies that support critical business services and address any gaps that could hinder recovery of such services, and enhance threat monitoring and environmental scanning and conduct regular audits, tests and industrial exercises.

The revised Guidelines provide new insights on measures that FIs can take to better manage the increasingly complex operating environment and threat landscape to enable the continuous delivery of services to their customers. Under the revised Guidelines, FIs should:

- Adopt a service-centric approach through timely recovery of critical business services facing customers

- Identify end-to-end dependencies that support critical business services, and address any gaps that could hinder the effective recovery of such services; and

- Enhance threat monitoring and environmental scanning, and conduct regular audits, tests, and industry exercises.

2) Singapore Green Bond Framework Introduced for Issuance of Sovereign Green Bonds

On 9 June 2022, the Singapore Government published the Singapore Green Bond Framework. The framework lays foundation for the issuance of green bonds by the Singapore Government under the Significant Infrastructure Government Loan Act 2021 and serves as a reference for statutory board’s respective green bond framework. The framework details the Singapore Government’s intended use of green bonds proceeds, governance structure to evaluate and select eligible projects, operational approach to manage green bond proceeds and commitment to post issuance allocation and impact reporting.

Key Features of the Framework

- Alignment with internationally recognised market principles and standards: The Framework is developed and structured in alignment with the core components and key recommendations of the International Capital Market Association (ICMA) Green Bond Principles 2021 and the ASEAN Capital Markets Forum ASEAN Green Bond Standards 2018.

- Stringent governance and oversight of project selection and allocation of proceeds: The Second Minister for Finance chairs the Green Bond Steering Committee, which assumes overall responsibility for proper governance and implementation of the Framework. The Singapore Government commits to annual post-issuance allocation reporting and impact reporting on environmental benefits and, where possible, social co-benefits of the Eligible Green Expenditures. This provides transparency and accountability for investors and other interested parties.

- Technical screening to evaluate and identify green projects: The eligibility criteria for the Green Categories have been developed with reference to internationally recognised market principles and standards such as the ICMA Green Bond Principles and the Climate Bond Initiative (CBI) Taxonomy and Sector Criteria.

3) SGX RegCo to require live engagement and voting at all AGMs for FYs ending 30 June 2022 or after

Singapore Exchange Regulations has announced that it would require live engagement and voting for issuers holding their Annual General Meetings for financial years ending 30 June 2022 or after.

Physical general meetings allow shareholders to directly and immediately engage with the Board and vote thereafter. SGX RegCo said that it similarly expects issuers to accord shareholders with the same full rights should they choose to hold virtual meetings. These rights include the right to attend, ask questions and communicate their views, and to appoint proxies or to vote at General Meetings. Issuers that choose to conduct fully virtual general meetings must utilize both real time electronic voting and real time electronic communication at their general meetings.

Therefore, all issuers holding their annual general meetings for financial years ending 30 June 2022 or after must conform to these expectations. Issuers holding any other general meeting on or after 1 October 2022 to seek shareholder approval for corporate transactions must also take into account the expectations set out in the column.

IRAS- Due Dates

- Estimated Chargeable Income (ECI) June year-end: 30-Sept-2022

- GST Return: For the Quarter ending Jun 2022: 31-Jul-2022

- Form C-S/C for the FYE 2021: 30 Nov 2022