DIRECT TAX

Circulars/Notifications/Press Release

CBDT notifies computation mechanism for incomes attributable to investment division of an offshore banking unit

- With effect from 01 April 2022, CBDT has notified a set of rules and a form, giving computation mechanism for calculating the exempt Income under section 10(4D) and income determination under section 115AD(1B) of the Income Tax Act 1961.

CBDT notifies e-Advance Rulings Scheme, 2022

Key Points

- Applies to the applications for advance rulings made or transferred before the Board for Advance Rulings (BAR).

- Application should be made electronically in forms mentioned in 44EE of the rules to the secretary of BAR.

- All communication between the BAR, applicant, PCIT/CIT shall be through electronic mode and no personal appearance may be required by the Applicant either personally or through an authorized representative under the Scheme, although a request may be made by the Applicant for a hearing which ‘may’ be provided through video conferencing

Guidelines under clause (10D) section 10 of the Income-tax Act

- CBDT issues guidelines u/s 10(10D) for computation of exempt income from one or more ULIPs issued on or after 01 Feb 2021.

- Guidelines explains with examples, the applicability of provisions under two situations.

i. Situation (a): No consideration is received on any eligible ULIPs during any previous year preceding the current previous year or consideration has been received on such eligible ULIPs but has not been claimed to be exempt and,

ii. Situation (b): Consideration is received under any one or more eligible ULIPs during any previous year preceding the current previous year and has been claimed to be exempt u/s 10(10D).

Case Laws

Kerala State Beverages Manufacturing & Marketing Corporation Ltd

- In the referred case, ACIT has disallowed Rs.811.90 Cr. u/s 40(a)(iib) on account of gallonage fee, license fee, shop rental (kist) and surcharge on sales tax/turnover tax. On appeal by assessee, SC held that gallonage fee, license fee, shop rental (kist) is not an exclusive levy on the assessee and therefore cannot be disallowed.

- For surcharge on sales tax and turnover tax levied, SC held that surcharge is enhancement of sales tax and when the sales tax levied under the KGST Act is allowed, “there is no reason not to allow deduction of surcharge on sales Tax.

Barclays Bank PLC

- In this case, Assessing Officer passed an order in accordance with the TPO’s directions which was challenged by assessee in the Dispute Resolution Panel (DRP). CIT later opened the same case as revisionary proceedings u/s 263 against this assessee filed appeal before Mumbai ITAT.

- Mumbai ITAT held that an order passed pursuant to DRP directions u/s. 144C is excluded from such revisionary proceedings. Mumbai ITAT passed an order stating that, 3 member Dispute Resolution Panel (DRP) is superior to single person CIT and quashes revisionary proceedings initiated in this case.

Rashesh Shrish Sanjanwala

- In the referred case, to save capital gain tax, assessee has deposited an amount in Capital Gain scheme account for making investment. Later, he exceeded the maximum time allowed to invest as per income tax act.

- However, assessee has paid the full tax liability on capital gain and therefore requested the income tax authority (ACIT) for issuance of the No Objection Certificate to enable the withdrawal of money from the bank’s Capital gain scheme account.

- ACIT has rejected withdrawal application on ground that income tax return was not filed.

- Assessee filed appeal before high court. High court ruled in favour of assessee directing ACIT to allow withdrawal from Capital Gain scheme account.

Jetha Properties Private Limited

- In this case, Bombay High Court has held that expenses incurred for raising floor height of warehouse to secure goods from rainwater is revenue in nature as the said expenditure has been incurred in order to preserve and maintain an already existing asset and it is integral part of the profit-making process and thus revenue in nature.

Oracle Financial Services Software Limited

- In this case, Bombay HC held that existence of the ‘reason to believe’ that income chargeable to tax has escaped assessment is a jurisdictional condition for invoking the power u/s 147. The AO is required to record reasons before a notice to reopen the assessment u/s 148 of the Act is to be issued. It was further held that the reasons should be based on tangible material.

Yash Suneja

- In the referred case, the assessee earned a LTCG from sale of shares and claimed an exemption u/s 54F of the Income Tax Act by investing an amount in a residential property.

- Assessee owned two properties one of which was residential House Property and other property was used by the assessee for business purpose.

- Revenue denied exemption on fact that assessee has two residential House Properties.

- Relying on the decision of the Karnataka HC in the case of Naveen Jolly, Delhi ITAT held that usage of the property has to be considered in determining whether it is a residential property or a commercial property and thereby assessee is entitled to claim exemption.

Niranjan Bhadang

- In the referred case, the Assessing Officer disallowed set-off of capital gain against one of the house property claimed by assessee stating that the flat was transferred when final instalment was received which was beyond the period of 1 year as per section 54F.

- Aggrieved by this, assessee filed appeal before ITAT. Mumbai ITAT stated that Assessee cannot be denied exemption because there is payment delay. ITAT concluded that for the claiming exemption, date of sale will be the date of agreement to sell and not the date on which final instalment is received.

Ketan Sureshchandra Shah

- In the referred case, assessee was receiving remuneration from Ideal Classes Pvt. Ltd. Assessing officer has disallowed the expenditure claimed against remuneration on the grounds that all the materials pertaining to teaching is provided by Ideal Classes Pvt Ltd and Assessee did not incur any expenses.

- Hearing the facts of the case, the ITAT ruled in favor of the Assessee and considered the income as business income and allowed 50% of the receipt as expenditure

Corporate laws

ECB 2 return for the month of January 2022 - To be filed on or before 7 February 2022.

- MCA has notified the Companies (Registration Offices and Fees) Amendment Rules, 2022, which shall be effective from 01 July 2022. As per these amendment rules, higher additional filing fees in case of delay in submission of certain forms to MCA shall be imposed. Further in case of repeated delays in filing of certain forms, higher additional fee shall be imposed.

- Ministry of MSME vide notification dated 19 January 2022, granted extension for validity of registration of existing MSMEs which were registered prior to 30 June 2020 till 31 March 2022.

Company Accounts

Mandatory Accounting Tool Requirements: A Software Perspective

Professionals’ attention is invited to the amendments in the Companies Act 2013. The companies are to adhere to the new amendments which are said to be coming in effect on 01 April 2022 vide notification of the Central Government dated 24 March 2021.

The notification, as follows,

“….Provided that for the financial year commencing on or after the 1st day of April, 2021, every company which uses accounting software for maintaining its books of account, shall use only such accounting software which has a feature of recording audit trail of each and every transaction, creating an edit log of each change made in books of account along with the date when such changes were made and ensuring that the audit trail cannot be disabled.”

Companies need to be geared up to meet the increased compliance in their accounting software and line up their Auditors to certify them. The ultimate objective of the government is to bring 100% transparency in the transactions made in the organization.

The New Features Required in Brief

Every company that is using a software for maintaining its books in electronics mode shall use the following features with effect from 01 April 2022:

- Record Audit trail of each and every transaction

- Creating an edit log of each change made in books of accounts and dates when such changes were made.

- The Audit trail function cannot be disabled.

Amendments to Adhere

The amendments made is contained in the sub rule (1) of Rule 3 which lays the complete instructions on how the books should be maintained by the organization. It requires all relevant books & papers relating to the accounts be maintained in digital form and continued be available in the Data Centres inside the country.

Moreover, it is also important to maintain the following directives as well:

- The information shared from the branch offices shouldn’t be altered.

- Original format of the books should be retained completely. That is, it should be in the format in which it was originally generated, received, sent or in a format that accurately represents the information at its origin.

- Information should be displayed in an easily decipherable format.

- There should be a system for the storage, display, retrieval, disposal or printout of the records/books and such records should not be rendered unusable. A backup of the records has to be maintained in electronic form.

In conclusion, the accounting software must have the capability mentioned above for maintaining the electric record, creating audit trails for each transaction and Edit logs that cannot be tampered.

How do these Changes Affect the Current situation?

- Where books are being maintained on Tally, QB or any other local software or ERP with local database, audit trail has to be enabled (if not enabled earlier) for bookkeeping and feature of disabling the same should be restricted for the bookkeeping personnel.

- Where books are maintained on an ERP like SAP, NetSuite, PeopleSoft etc., where the database is not in India, periodical back-ups (at least once a quarter) have to be maintained on servers located in India. The back-ups, so kept have to be in a secured environment, audit log for the accessing of the database has to be created or enabled.

- The records have to be stored in a secured database, audit log for the accessing of the documents/ information to be created or enabled.

Challenges & Concerns

Although at a conceptual and regulatory level an audit trail is significant and fitting, there are several concerns lodged by the Trade & Industry Associations.

While the audit trail intends to track all the info in the original form it is generated in, also looking to log all the changes made to original information, there is a chance for human error and change made to rectify the error would also be included in the Edit Logs.

There are also concerns on the burden it places on the smaller business firms. Additionally, the ambiguity of the execution is another concern among the software vendors on the implementation of the newer measures on their databases.

The Way Forward

As we can see that most of the larger organizations have already switched their software and ERPs to log the audit trails. These are bigger changes brought on by the institutions to bring in greater transparency. What it needs is strong and experienced leaders that could usher in the new financial year amendments and accommodate the changes it brings in your software as well as your organization.

Goods and Service Tax

No service tax on the notice pay recovery from employees – CESTAT Delhi

The CESTAT Delhi in case of M/s Rajasthan Rajya Vidhyut Prasaran Nigam Ltd has set aside the order of lower authorities demanding service tax on the notice pay recoveries by the appellant from his employees for premature resignation without serving the mandatory notice period. In this well-reasoned order, the CESTAT Delhi referred to the provisions of the Indian Contract Act, 1872 and made a distinction between consideration for a contract versus compensation under the contract. In this context the CESTAT Delhi observed that while a consideration is something received for performance under the contract, compensation is received for failure to perform the contract. Consideration is the object of the contract, but compensation is not. In this case, tolerance by the employer of not serving the mandatory notice period by the employee is not the object and essence of the employment agreement, and hence the CESTAT Delhi held that, notice pay recovered by the employer is in the nature of compensation and the same cannot be regarded as consideration for rendition of any service. Referring to decision of Madras High Court and other tribunals on this similar issue, the CESTAT Delhi set aside the demand of service tax on notice pay recoveries from the employees.

No GST on employee recoveries towards transportation, canteen, and notice pay – Maharashtra AAR

The Maharashtra AAR in the case of M/s Syngenta India Limited and M/s Emcure Pharmaceuticals Limited has held that GST is not leviable on amounts recovered by the applicant-employer from his employees towards transportation and canteen facility and notice pay. As regards recovery towards transportation and canteen facility, the AAR noted that these facilities are welfare measures, and the applicant cannot be said to be supplying these services to the employees. Further the GST is discharged on the value of bills raised by the third-party vendors and the amounts recovered from the employees are part of the amount paid to the third-party vendors on which GST is already paid. As regards notice pay recovery, the AAR noted that the applicant is compensated for the employees sudden exit and it cannot be said that the applicant has provided any service or has tolerated any act of the employee for premature exit.

One-to-one correlation is not required for utilisation of input tax credit – Gujrat Appellate AAR overrules AAR ruling

The Gujrat Appellate AAR in the case of M/s Aristo Bullion Pvt Ltd has allowed the appeal filed by the applicant and has held that, the applicant can use the input tax credit balance earned on inward supplies meant for bullion business for payment of output tax on outward supply of castor oil seed. Earlier the AAR has held that cross utilisation of input tax credit pertaining to bullion business is not allowed for output tax payment on castor oil seeds business and one-to-one correlation needs to be maintained by the applicant for availing and utilisation of input tax credit. The Appellate AAR rejected this observation of AAR and noted that, once a taxpayer validly avails input tax credit on inward supplies, the credit merges into a common pool of credit under the electronic credit ledger. Further, the appellate AAR observed that Section 16(1) of Central GST Act prescribes the eligibility and conditions for availing input tax credit, and it does not impose any restriction in the form of one-to-one correlation for utilisation of input tax credit.

Proportionate reversal of input tax credit not required on post supply discounts passed on by the supplier through commercial credit note – Madhya Pradesh AAR

The Madhya Pradesh AAR in case of M/s Mahaveer Prasad Mohanlal has held that the applicant is not required to reverse proportionate input tax credit in case of post supply discounts passed on by the supplier without adjustment of outward liability by the supplier. The applicant in this case received cash discount for early payment and other incentives through commercial credit note from the supplier. The applicant also submitted before AAR that both these discounts are in the nature of post supply discounts, as at the time of supply it is not known whether they are eligible for discount as well as quantum of discount, if they are eligible. The AAR on perusal of Section 15 of the Central GST Act, noted that these suppliers is eligible to adjust GST on discounts only if the fact of discount is known before or at the time of supply and recipient reverses the proportionate input tax credit. In the present case, considering that the cash discount for early payment and the other incentives passed on to the applicant are post supply discounts not known at the time of supply and the fact that the supplier has not adjusted his GST liability, the AAR held that the applicant is not required to reverse the proportionate input tax credit. On the second question of taxability of discount received, the AAR also held that with respect to these post supply discounts the applicant is not providing any service to the supplier and is only receiving the discount from the supplier, which is indirectly an adjustment to the purchase price, therefore no GST is leviable on the discount received from the supplier.

Due Dates

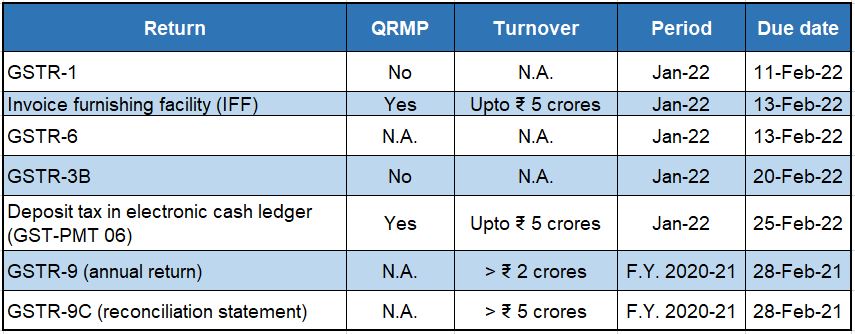

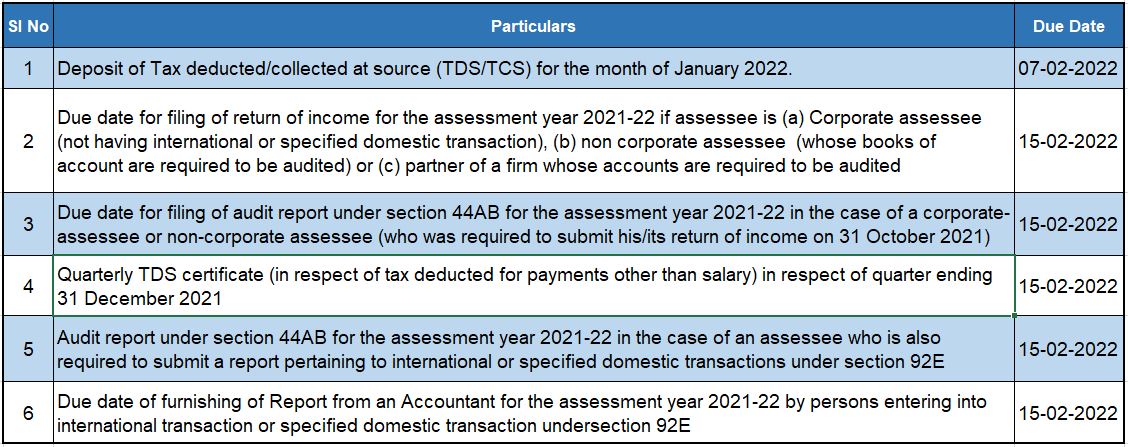

GST Compliance calendar for February 2022

Important Due Dates

SINGAPORE UPDATES

Monetary Authority of Singapore and Inland Revenue Authority of Singapore Updates

1) MAS Issues Guidelines to Discourage Cryptocurrency Trading by General Public

On 17 January 2022, Monetary Authority of Singapore (MAS) has issued the “Guidelines on Provision of Digital Payment Token Services to the Public” giving effect to MAS’ expectations in relation to the provision of digital payment tokens (“DPT”), more commonly known as cryptocurrency, to the general public in Singapore. The guidelines stress that the DPT service providers should conduct themselves with the understanding that trading of DPTs is not suitable for general public.

DPT service providers include payment institutions, banks and other financial institutions, as well as applicants under the Payment Services Act (PS Act). DPT services include the buying or selling of DPTs or facilitating the exchange of DPTs. The definition of DPT services will be expanded to include the transfer of DPTs, provision of custodian wallet services for DPTs, and facilitating the exchange of DPTs without possession of moneys or DPTs by the DPT service provider, when the amendments to the PS Act take effect.

MAS has consistently warned that trading DPTs is highly risky and not suitable for the general public, as the prices of DPTs are subject to sharp speculative swings. MAS has observed that some DPT service providers have been actively promoting their services through online and physical advertisements or through the provision of physical automated teller machines (ATM) in public areas. This could encourage consumers to trade DPTs on impulse, without fully understanding the attendant risks.

The new guidelines clarify MAS’ expectations that DPT service providers should not engage in marketing or advertising of DPT services:

- In public areas in Singapore such as through advertisements on public transport, public transport venues, public websites, social media platforms, broadcast and print media, or provision of physical ATMs; or

- Through the engagement of third parties, such as social media influencers, to promote DPT services to the general public in Singapore.

DPT service providers can only market or advertise on their own corporate websites, mobile applications or official social media accounts.

The guidelines also note that DPT service providers should not promote payment token derivatives contracts (“PTDs”) to the public as a convenient unregulated alternative to trading in DPTs. DPT service providers should not mislead the public that PTDs are less risky than DPTs.

2) CCCS Issues Guidance Note on Business Collaborations

The Competition and Consumer Commission of Singapore (“CCCS”) has issued a Business Collaboration Guidance Note (“Guidance Note”) to provide clarity to businesses and trade associations on the ways to collaborate without harming competition. This includes providing greater guidance on the assessment factors (such as market share and structure) that CCCS would generally consider in determining whether a collaboration complies with section 34 of the Competition Act (Cap. 50B) (the “Competition Act”), when specific types of collaborations may give rise to competition concerns, and the conditions under which competition concerns are unlikely.

The seven common types of business collaborations covered in the Guidance Note are:

(i) Information sharing – Exchange of both price and non-price information among businesses;

(ii) Joint production – Collaboration to jointly produce a product, share production capacity or subcontract production;

(iii) Joint commercialisation – Collaboration in the selling, tendering, distribution or promotion of a product;

(iv) Joint purchasing – Collaboration to jointly purchase from one or more suppliers;

(v) Joint research & development (“R&D”) – Collaboration on R&D activities, such as joint investment;

(vi) Standards development – Setting of industry or technical standards; and

(vii) Standard terms and conditions in contracts – Usage of terms shared amongst competitors establishing conditions of sale and purchase of goods and services between them and their customers.

The guidance note also includes a short section each on cross-border collaborations and information for trade associations regarding their role in supporting collaborations among their members.

3) SGX mandates climate and board diversity disclosures

Singapore Exchange (SGX) has unveiled its roadmap for issuers to provide climate-related disclosures based on recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

All issuers must provide climate reporting on a ‘comply or explain’ basis in their sustainability reports from the financial year (FY) commencing 2022. Climate reporting will subsequently be mandatory for issuers in the (i) financial, (ii) agriculture, food and forest products, and (iii) energy industries from FY 2023. The (iv) materials and buildings, and (v) transportation industries must do the same from FY 2024.

Other key changes effective 01 January 2022 include requiring:

- Issuers to subject sustainability reporting processes to internal review;

- All directors to undergo a one-time training on sustainability;

- Sustainability reports to be issued together with annual reports unless issuers have conducted external assurance; and

- Issuers to set a board diversity policy that addresses gender, skill and experience, and other relevant aspects of diversity. Issuers must also describe the board diversity policy and details such as diversity targets, plans, timelines and progress in their annual reports.

These requirements follow a public consultation on both sustainability reporting and board diversity disclosures which received broad support.

SGX expects the portal to house ESG information beyond the core ESG metrics. The information recorded in the portal may include material ESG factors, commentaries and explanations for reported metrics, and discussions on strategies, processes, board statements and targets relating to ESG matters.

https://www.sgx.com/media-centre/20211215-sgx-mandates-climate-and-board-diversity-disclosures

IRAS- Due Dates

- Estimated Chargeable Income (ECI) for December 2021 year-end: 31-Mar-2022

- GST Return: January 2022 – March 2022: 30-April-2022

- Form C-S/C: 30 November 2022