Due Dates

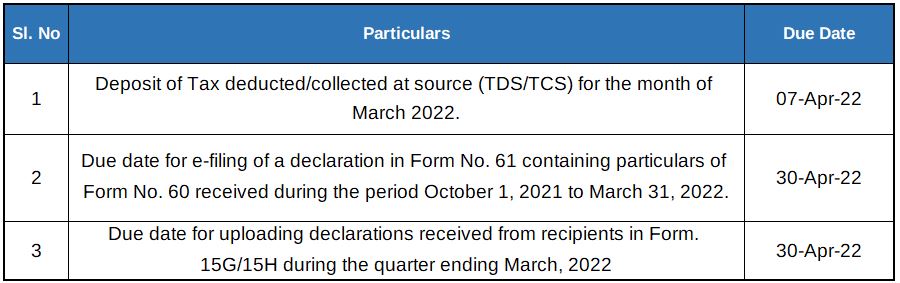

Important Due Dates April 2022

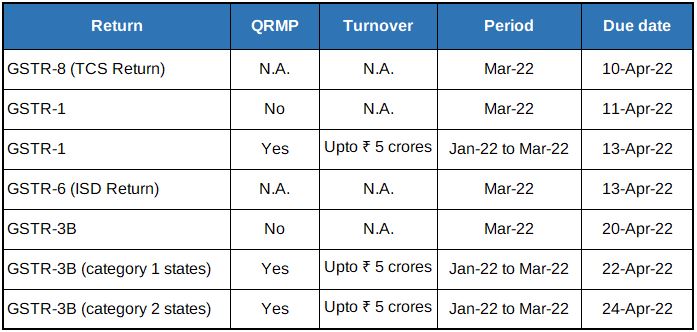

GST Compliance calendar for due dates falling in the month of April 2022

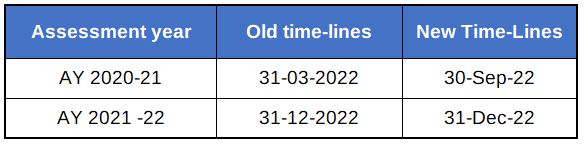

Due date extension for completion of assessment

DIRECT TAX

Circulars / Notifications / Press Release

Notification No. 16, 2022

- The CBDT has further extended the due date for passing of any order under the Benami Act to 30 Sep 2022

Circular no 6/2022

- CBDT has issued directions that the delay in filing of Form 10-IC for Assessment Year 2020-21 is condoned if the domestic companies satisfy certain conditions.

CBDT notifies ITR Forms for AY 2022-23

- The CBDT has notified all the Income tax return forms for Assessment Year 2022-23

Notification No. 20/2022/F. No.370142/9/2022-TPL

- Central Government has notified that Provisions of TCS u/s 206C(1G) will not applicable be to a non-resident Individual visiting India

Circular no. 7/2022

- The CBDT has clarified that all the consequences provided under the Income-tax Act for not furnishing, intimating or quoting PAN shall come into effect from 01 Apr 2023 if PAN becomes inoperative due to non-linking of it with Aadhaar. However, the taxpayer is liable to pay fee of INR. 500 or INR. 1000, as the case may be, if PAN is linked with Aadhar from 01 Apr 2022 to 31 Mar 2023

Case Laws

Hindustan Aeronautics Ltd

- In the referred case, assessee paid flight testing fee to French company without withholding tax. Assessing officer was of the opinion that such fee was in the nature of ‘Fee for technical service’ subject to withholding and thus disallowed the expenditure.

- CIT(A) upheld the order of the Assessing officer. Aggrieved by this, assessee filed appeal before ITAT.

- ITAT held that assesse was not liable to deduct TDS on flight test fee as no technology was made available.

FCC Co Ltd

- In the referred case, assessee company being a foreign company entered into Joint venture with a domestic company. Assessee earned royalty income which was duly offered to tax. . However, income from supply of raw materials, components & capital goods were not offered to tax in India in the absence of a PE (Permanent Establishment) under India-Japan DTAA.

- Assessing officer held that Assessee has a business connection in India and Fixed PE as well as Supervisory PE under Article 5 of India-Japan DTAA.

- ITAT held that merely providing access to the premises for the purpose of providing agreed services would not amount to the place being at the disposal of the Assessee, and therefore does not constitute a PE.

- ITAT also held that supervisory activity of employees were not in nature and also, not in connection with building site, construction project, installation project or assembly project as per Article 5 of DTAA. Hence there is no supervisory PE of the assessee.

- ITAT therefore ruled in favour of assessee.

Rajat Dhara

- In the referred case, Assessee was resident and Ordinary resident in India. Assessee has earned salary from US Employer Company and has claimed the benefit of DTAA, Article 16.

- Assessing officer held that salary received from US employer is taxable in India and also that the Assessee could not take benefit of the DTAA provisions.

- ITAT observed that, assessee has an option to either pay taxes as Income tax laws or DTAA, whichever is beneficial. Assessee claimed that his stay was for 165 days only and thus on perusal of Article 16 of the India-US DTAA held that salary income earned was taxable in the US and not in India.

Joison Kundu KulamJohny

- In the referred case, the assessee received demand notice due to Tax Consultant’s (TC) malpractices, who made bogus claims in IT returns filed by him and claimed refund of tax from the department.

- Assessee approached another Tax consultant and realised that the old Tax Consultant was not a certified Chartered Accountant and income tax return filed was incorrect.

- Assessee then revised the return and paid the demand. Assessing officer-initiated penalty proceedings that assessee had wilfully furnished inaccurate particulars.

- Upon appeal, ITAT remanded back the case to CIT(A) to relook the genuineness of the Assessee’s claims and whether he was guilty or not for claiming excess refund.

Daujee Abhushan Bhandar Pvt. Ltd

- In the referred case, High Court held that re-assessment proceeding Notice under Section 148 is invalid if the notice is digitally signed on last day limitation period but emailed on later date.

Perizad Zorabian Iran

- In the referred case, Assessee was deriving income from acting profession as well as partner’s remuneration.

- Remuneration from partnership firm exceeded threshold of INR 50 lakh under section 44AB and assessee failed to get books of accounts audited. Revenue passed an order treating invalid return.

- Upon appeal, High Court notes that the term “Profession” as defined under Section 2(36) includes vocation, thus observes that the income earned by Assessee as partners’ remuneration cannot be construed as carrying on profession as well as business simultaneously in different field. Thus, ruled in favour of assessee.

Vidya Bharati Society for Educational & Scientific Advancement

- In the referred case, Calcutta HC held that CIT(A) cannot cancel trust’s registration merely relying upon statement of trustee of another trust.

Tractors and Farm Equipment Ltd

- In the referred case, Chennai ITAT held that Cost reimbursed to overseas distributors for warranty, provided under

sale agreement to buyers, is not Fee for Technical Service.

corporate laws

Form MSME for the period 1 October 2021 to 31 March 2022 to be filed on or before 30 April 2022

Ministry of Corporate Affairs vide Notification dated 4 March 2022 have notified LLP (Second Amendment) Rules, 2022 with a view of ease of doing business through digital transformation. Key amendments which were notified are listed below:

1. Application for PAN and TAN needs to be made along with the LLP incorporation form and the same shall be allotted and mentioned in the certificate of Incorporation of LLP

2. Five DPINs may be applied for through the LLP incorporation form. Prior to this amendment application for only two DIPINs were permitted.

3. All forms for LLP which need to be filed with Ministry are now changed to web based forms with the intention of faster processing.

Indirect taxes

Customs and FTP Update

Government extends validity of Foreign Trade Policy by six months

Foreign Trade Policy 2015-2020 was originally valid for five years up to 31 March 2020 and, was subsequently extended up to 31 March 2022. Now, the Government has further extended the validity of Foreign Trade Policy 2015-2020 and the Handbook of Procedures by another six months till 30 September 2022. FTP inter alia provides various export promotion/incentive schemes such as EPCG, Advance Authorization, EOU, STP etc. Such schemes now would continue to operate in their present form up to 30 September 2022.

IGST exemption on imports available to EPCG, Advance Authorization holders, EOUs/STP units extended up to 30 June 2022

IGST and compensation cess exemption on imports available to EPCG, Advance Authorization holders, EOUs/STP units has been extended by the Government for another three months up to 30 June 2022

Goods and Service Tax

Show Cause Notice is must for recovery of interest– Jharkhand High Court

The Jharkhand High Court in the case of M/s Narsingh Ispat Limited has held that when the taxpayer disputes calculation or levy of interest, adjudication of interest liability must be done by issuing a show cause notice, and recovery of interest without proper adjudication would amount to violation of principles of natural justice. In this case, though the interest liability was intimated in DRC-01A, the petitioner contested the liability on the ground of levy. However, without issue of show cause notice, the Department proceeded to issue a summary of demand order in Form GST DRC-07 on the petitioner. Thus, High Court allowed the writ petition on failure to follow the principles of natural justice with a liberty to the Department to issue proper show cause notice for recovery of interest.

Service of Notice and other communication through registered post or speed post or courier is must till all technical problems of GST portal are resolved – Madras High Court

As per GST law, any order, decision, summons, notice or other communication can be served by any one of the prescribed methods which includes making communication available on the GST portal. However, the Madras High Court in the case of Pushpam Realty has held that till all technical glitches of GST portal are resolved, the Department must serve the notice of assessment and other communication under the GST law through registered post or speed post or courier with an acknowledgement to the Assessee at their last known place of business and simultaneously upload the communication on the GST portal. The Assessee in this case challenged the demand order on the ground that order has been passed without proper service of show cause notice. However, the Department contended that the show cause notice was uploaded on the GST portal which is in compliance with Section 169 of the Central GST Act. Considering that even as on date, there are problems arising out of intercommunication between the State GST and Central GST and the web portal which has to be resolved, Department must serve notice and other communication by other modes of service as prescribed under Section 169 of the Central GST Act.

Recipient of supply cannot obtain a ruling on the taxability of his inward supply – Gujarat Appellate AAR

The Gujarat Appellate AAR in the case of M/s Surat Municipal Corporation has held that the Appellant being a recipient cannot obtain a ruling on the taxability of his inward supply. Advance Ruling is binding only on the person who seeks advance ruling. In case recipient obtains an advance ruling on taxability of his inward supply, then the supplier is not bound by that ruling and he may determine taxability of transaction on the basis of his own understanding of law. Thus, the ruling will lose its relevance and applicability. Thus, Appellate AAR upheld the order of AAR, which rejected the recipient-applicant’s application seeking Advance Ruling.

Cybersecurity / IS AUDIT

The Ever-Evolving Role of CTO / CISO

The role of Chief Technology Officer / Chief Information Security Officer is becoming more complex and critical than ever before – especially post-pandemic, when cloud solutions have become a way of life. The role shoulders the responsibility of not only shielding external threats, but also protection from insiders (i.e., employees, vendors, business partners) from data privacy, data breach, attacks, regulatory compliance at respective nations. In this brief write up, our team endeavours to ponder over some simple topics to keep you abreast of what is happening in this field.

We do not know what we do not know

Practically, every organization has internet connectivity and IT infrastructure of some kind which means virtually all organizations are prone to cyber-attacks. So considered, are there solutions available to CTOs / CISOs to counter such attacks?

The first step to a solution is the ability to identify and understand the risk associated within an organization and to be able to manage it. It is essential that organizations complete a cyber security risk assessment process to identify valuable and vulnerable assets to mitigate the risks.

There should be a realistic perspective on the nature of security as we should understand that 100% security and an impenetrable firewall is not possible. No system or environment can be made a 100% secure and there will be some residual risk left over even after securing all systems. This, unfortunately is the nature of the game.

We know what we don’t know

Identifying risks starts with identifying your assets. You cannot protect if you do not know what you need to protect. All organizations have crown jewels among their assets and these critical assets vary with from organisation-to-organisation The more valuable it is, the more probable it will become a target and thus comes the need to protect it better.

The next step is to identify the threats; tactics, techniques, and methods used by threat actors that could cause potential hazard to the organizational assets. Exceptional knowledge base is required to identify potential threats to each asset.

Thereafter one must ascertain the consequences of the identified threats by exploiting the vulnerabilities discovered. This is where an in-scope vulnerability test can be put to skillful use; where vulnerabilities are discovered, exploited and consequences are comprehended. Expert consultation could help minimize the security loopholes and understand the overall security architecture for the future.

We know what we know

Determining and prioritizing risks is the next step in the risk assessment. As mentioned earlier, it is not possible to close all risks. However, it should be made sure that the residual risk should be within the risk tolerance level of the organization. There are three ways to get to the agreed upon tolerance level.

- Avoid: If the risk outweighs the benefit, the best course of action to reduce the exposure is to discontinue the activity or service (to the possible extend).

- Transfer: There could be a model where shared risk with third parties could be introduced through cyber insurance or outsourcing operations.

- Mitigate: Deploy security controls and other measures to reduce the probability or impact and hence the risk level as well.

We need to know what we need to know - Tools to mitigate

There are many platforms available in the market that can be deployed to resolve such issues. At the end of the day, knowing your risk and a mitigation plan is what will keeps confident.

Risk management allows us to see the risks, understand the worst-case scenario and help us build a backup plan to mitigate the issue and deploy the business continuity plan at the point of breach and making sure our critical assets are all secure.

Depending on the needs, a Security Operation Center can be created with capabilities of Security Information and Event Management (SIEM) and / Security Orchestration, Automation and Response (SOAR) Systems. This is another security-oriented system to be created for a secure organization.

Another set of tools useful would-be Data Leak Prevention software to ensure that sensitive data is not lost misused or accessed by unauthorized users. DLP software helps you to classify regulated, confidential, and business critical data and determine any policy violations set by the organization. Some of the commercial providers in the market are CoSoSys, Kaspersky, McAfee etc.,

What makes a good night sleep (every night) of every CTO / CISO

To remain on top of the top CISO challenges in 2022 and get a good night’s sleep (every night) it is vital to draw in with peers, keep up with group strength, and follow all the latest and relevant trends. Moreover, understanding your industry’s administrative and structural necessities and a knowledge of meeting required benchmarks is crucial. There is no one-size-fits-all solutions especially in cyber security assurance. Therefore, organizations should assess the exact requirements and implement only needed solutions to ensure round the clock security.

SINGAPORE UPDATES

Monetary Authority of Singapore and Inland Revenue Authority of Singapore Updates

1) MAS issues notice on capital requirements for recognised market operators formed or incorporated in Singapore

The Monetary Authority of Singapore has issued the notice on capital requirements for recognised market operators that are formed or incorporated in Singapore. The notice establishes the liquidity and solvency requirements for recognised market operators formed or incorporated in Singapore

General requirements for liquid assets and eligible capital

A Specified RMO must not cause or permit its liquid assets to fall below its liquidity requirement or cause or permit its eligible capital to fall below its solvency requirement. A Specified RMO must immediately notify MAS if its liquid assets or eligible capital fall below 120% of the liquidity requirement or solvency requirement respectively. A Specified RMO must calculate its liquid assets and eligible capital for each business day no later than the end of the following business day.

Liquidity requirement

The Notice introduces a liquidity requirement which requires a Specified RMO to hold liquid assets of at least 25% of its annual operating expenses as stated in the latest audited financial statements of the Specified RMO. A Specified RMO must calculate its liquid assets as the sum of the following items in its latest available accounts: (a) cash and cash equivalents, (b) debentures of the Government, (c) negotiable certificates of deposit, and (d) money market funds.

MAS has considered the feedback from respondents and has excluded depreciation and amortisation (“D&A”) expenses from the calculation of annual operating expenses. MAS has also clarified in its response that it does not intend to require that cash and cash equivalents be kept in an operating account or segregated in a separate bank account. MAS has also stated that it does not view intercompany receivables as liquid assets.

Solvency requirement

MAS has recalibrated the solvency requirements for Specified RMOs and removed the exclusion of illiquid assets from the computation. The revised solvency requirement under the Notice requires a Specified RMO to hold eligible capital of at least 25% of its annual operating expenses or S$250,000, whichever is higher.

A Specified RMO must calculate its eligible capital as the sum of the following items in its latest available accounts:

- base capital;

- paid-up irredeemable and cumulative preference share capital;

- paid-up redeemable preference share capital provided that the redeemable preference share has a redemption period of not less than two years from when the preference share is issued and paid-up;

- revaluation reserves;

- other reserves; and

- interim unappropriated profit.

The following items are to be excluded from the calculation of eligible capital:

- intangible assets;

- future income tax benefits;

- pre-paid expenses;

- charged assets, except to the extent that the Specified RMO has not drawn down on the credit facility if the charge is created to secure a credit facility; and

- treasury shares, if they are not already excluded from the base capital of the Specified RMO.

MAS explained in its response that, unlike the treatment of D&A expenses for the liquidity requirement, MAS has not excluded D&A from annual operating costs for calculating the solvency requirement. MAS views the solvency requirement as a reflection of financial viability, and as such, Specified RMOs should hold adequate capital to replenish depreciating assets.

2) MAS issues new AML/CFT notice for precious stones and precious metals activities and updates existing AML/CFT notices

On 1 March, 2022, the Monetary Authority of Singapore has issued a new anti- money laundering and countering the financing of terrorism notice for financial institutions in the conduct of their operations and business activities in precious stones, precious metals and precious products and received the existing AML/CFT notices for FIs and Variable Capital Companies.

MAS proposed to issue a new notice for FIs dealing in precious stones, precious metals and precious products to ensure consistency in the AML/CFT requirements across all FIs dealing in precious stones, precious metals and precious products, instead of expanding the requirements in the existing AML/CFT notices to apply to the FIs precious stones, precious metals and precious products activities.

The new PSM AML/CFT Notice applies to FIs that carry on the business of “regulated dealing” in PSM or as an intermediary for “regulated dealing” in PSM. “Regulated dealing” is defined in line with the Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act 2019 (“PSPM Act”), and refers to any of the following activities:

- manufacturing any PSM;

- importing or possessing for sale any PSM;

- selling or offering for sale any PSM;

- selling or redeeming any asset-backed tokens (excluding securities, derivatives, commodity contracts and digital payment tokens (“DPTs”));

- purchasing any PSM for the purposes of resale.

Amendments to existing AML/CFT notices:

1. New Requirements Relating to Digital Token Services

MAS sought views on aligning the existing AML/CFT requirements for banks, merchant banks, finance companies, credit card or charge card licensees and capital market services licensees in relation to digital token transactions they conduct, with that for digital payment token service providers.

2. No minimum threshold for application of CDD requirements for occasional transactions involving DPTs or digital capital market product tokens (DCMPTs)

MAS clarified that the proposed CDD requirements apply when the FI establishes business relations or undertakes transactions for a customer who has not otherwise established business relations with the FI, in relation to digital token services and transactions that the FI is providing to or conducting on behalf of the customer.

3. Imposition of value transfer requirements for DPT or DCMPT services

All FIs engaged in digital token services will be required to comply with the value transfer requirements. In addition, FIs that receive or initiate value transfers will be required to screen both the value transfer originator and the value transfer beneficiary.

3) IRAS introduces two new frameworks to help companies improve tax compliance

The Inland Revenue Authority of Singapore (IRAS) has introduced two new tax frameworks to help companies manage corporate tax and Goods and Services Tax (GST) matters.

The new frameworks are the Tax Governance Framework (TGF) and the Tax Risk Management and Control Framework for Corporate Income Tax (CTRM).

The TGF and CTRM complement the existing Goods and Services Tax Assisted Compliance Assurance Programme (GST ACAP). Together, they provide a suite of voluntary compliance tools that companies can adopt holistically or as independent programmes, depending on their readiness and business needs.

The TGF focuses on strengthening the tax governance standards in a company and elevating them to the Board level. It features a set of broad principles and practices around three main building blocks of good tax governance: compliance with tax laws, governance structure for managing tax risks and relationship with tax authorities. The framework is applicable to both Corporate Income Tax (CIT) and Goods and Services Tax (GST) and can be adopted by any company willing to commit to good tax governance. Companies that attain the TGF status can enjoy a longer grace period for voluntary disclosure of tax errors:

(i) A one-time extended grace period of two years for voluntary disclosure

(ii) For a GST-registered business accorded ACAP status, a one-time extended grace period of three years for voluntary disclosure of GST errors made within two years from the date of award of TGF status; or for a GST-registered business without ACAP status, a one-time extended grace period of two years for voluntary disclosure of GST errors made within two years from the award of TGF status.

IRAS- Due Dates

- Estimated Chargeable Income (ECI) June year-end: 30-September-2022

- GST Return: January 2022 – March 2022: 30-April-2022

- Form C-S/C: 30 November 2022